2020 - The Roller-coaster Year

As 2021 is about to get started, we can look back on a very interesting and dramatic year for the commercial property market. The worst fears that emerged in mid-March were basically gone after only a month, and as the year progressed, most tenants and investors were more optimistic in the medium and long term. The main reasons are obviously both the government support programs and the belief that the crisis would be temporary and short-lived. The Norwegian investment market received a significant boost in addition to this, as the interest rates fell to a lower level and stayed there throughout the year.

The office rental market: Barely a bump in the road?

At the start of the pandemic situation in March, there was some uncertainty among the Oslo office landlords and brokers as to whether this would look like the oil price decline in 2014, where many tenants quickly revised their plans or postponed their relocating decisions, which caused a minor, but quick decline in rent levels. This did not happen in 2020, as the activity was back to a normal level after just a couple of weeks, although a bit slowed down due to lockdown issues. The most important number to follow is the volume of signed leases – and as counted by Arealstatistikk, the effect is very moderate. The 2020 volume of office m2 signed is close to the average for 2015-2018, which is impressive since it usually varies with the economic growth. This differs a lot from the 2014 situation and is good news for the leasing market and obviously also for the banks and investors.

Secondary, the rent levels have barely moved during the year 2020. A few of our indices were adjusted downwards from Q1 to Q2, but for the rest of the year, they stayed put. This obviously reflects the solid level of activity mentioned above, but also shows that landlords have kept their heads cool and not resorted to lowering their offers to make sure the leases are signed. In all office clusters around Oslo the story is the same: good demand and no movements in rent levels.

Two of the largest leases seen over the last decade for private companies in central Oslo have been signed in 2020 – with EY close to Oslo S, and the law firm Schjødt in Vika. Both are in properties undergoing thorough refurbishment. In fact, almost no contracts in new buildings for 2022-23 were signed at all in 2020, which contributes to a very meager volume of new office space in those years. For the medium-to-long-term balance in the office rental market in Oslo, this is good news for the existing landlords, as it may contribute to low vacancy (below 6%) if the economic activity picks up as most macro economists expect. For the coming year, there is so far no sign of a changing mood in the market.

Effects on the office demand: the jury is still out

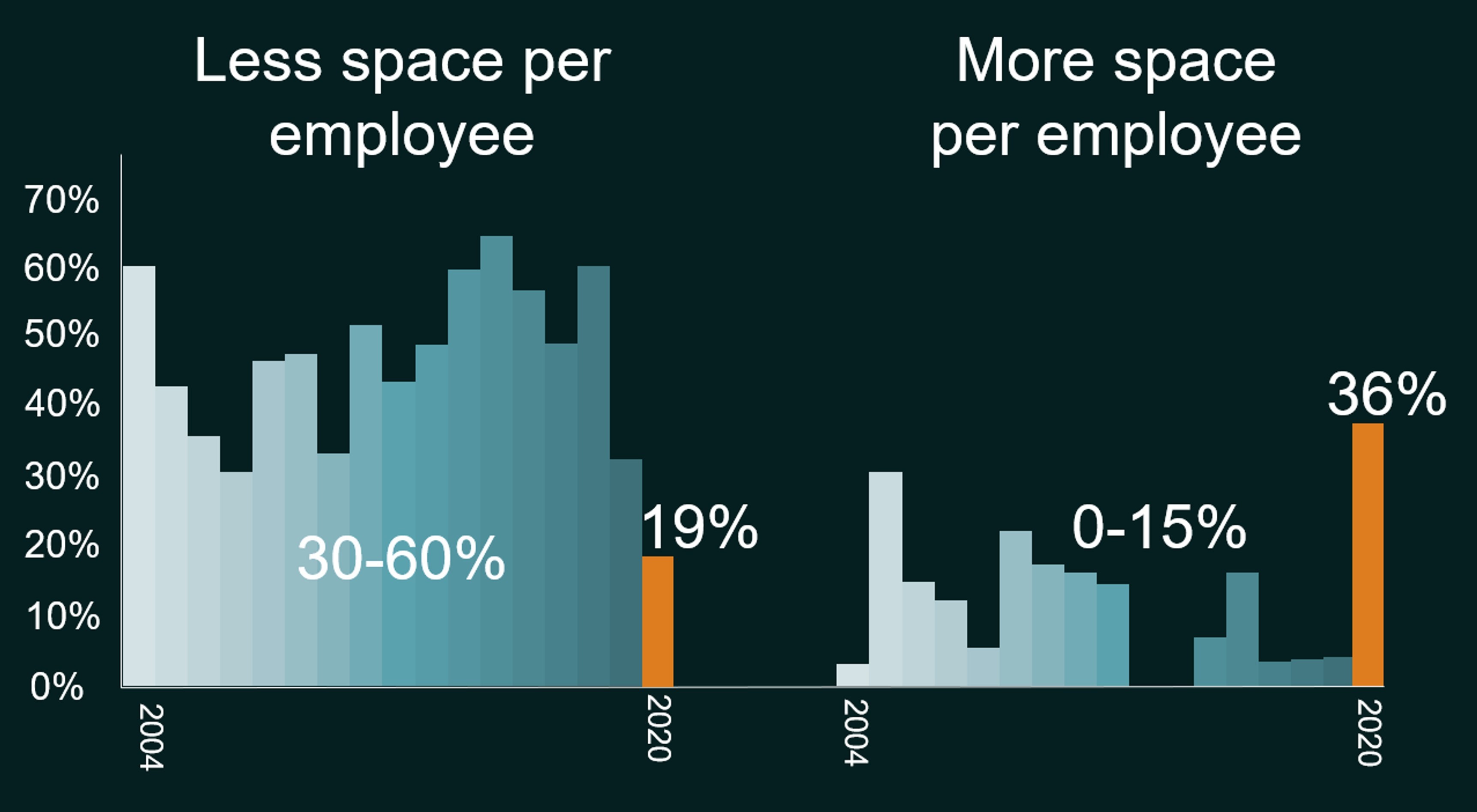

Many different theories, articles, thoughts and some surveys have been topis of discussions about the effects on the office demand from the larger adaptations to a larger degree of working from home. Some point to lower expected demand, others focus on the obvious value of the office as a meeting place for creative and collaborative work, and how it should be changed to serve this purpose. Akershus Eiendom performed our regular annual survey of office tenants’ need for space, which is focused only of tenants in process of moving, in September 2020. At that date, some change of office demand should have become visible for the majority of tenants. Surprisingly, we found very little effect of the Covid-19 pandemic; only a minority (40%) of tenants saw the pandemic as having an effect on their office needs, and only about half of these again reported that they would seek smaller office space as a consequence of this. However, we noted the largest share of tenants ever seen to report that they planned to seek larger space per employee in their new location, compared to their current office space, at 35% of all respondents.

One of the major advantages of home office solutions is the reduced commuting time. Compared to far bigger cities like London, the effect experienced by Oslo office users is actually not very strong; most employees have a half-hour commuting time or less. This might contribute to the lack of announced office space reductions from tenants. We do not expect any clear signals about the effects until after the office users have adjusted to a “post-pandemic” situation – which might take some time. The majority of tenants will, in our opinion, not make major moves until the forced home office period is over.

The retail market: In the middle of a rough ride

After many solid years for most kinds of retail property in Norway, 2020 showed the escalation of the e-commerce retail trend, which was already a rising issue for landlords and tenants. Restructuring and shop closures have happened for many chains and product categories.

The overall consumption was, however, the good news: Norwegians spent record volumes on goods, and when services were available, they also used those. Car-based shopping was a winner as shoppers avoided public transport and thus central shopping areas. As a consequence of the consumers’ foreign travel limitations, the spending on sports equipment and home improvement goods reached record volumes, while clothing suffered along with tourist-oriented retail.

Going forward, sustainability issues will come more into focus, and retail players need to keep changing their buildings to suit the new consumer needs; a bit simplified, the retail property needs to be either a popular destination with high traffic and a mixed offering of retail, dining, entertainment and leisure, or a last-mile-logistics hub.

The logistics market: Everyone onboard

As both supply chain issues and the e-commerce trend came into focus in 2020, demand for logistics rose, and new players in the e-commerce fulfilment industry are seeking new space. All the forces seen in 2018-19 which had propelled prime yields for logistics below that of shopping centers, received new energy. Many large and small objects for sale received massive interest. The last-mile logistics shortage might not be as pronounced in Norway as in most of the rest of Europe as we have relatively few densely built urban areas, but we also see demand for such space rising, and rents climbing. For logistics in the traditional areas outside the main cities, rents are still stable and land is available for new projects.

The transaction market: From full stop to full speed

As the pandemic situation started in March 2020, the loan margins quickly rose and the general uncertainty brought the transaction market to a standstill. Even though the market eased a bit in April, there was very little interest from property buyers at or above pre-Covid-pricing; i.e. there were mainly “bargain hunters” active, but many attribute this to the fact that investors were more focused on opportunities in the stock market where values had fallen with 20-30%. Any attempt to buy quality property at discounts was futile, as almost all property owners had a virtually unchanged – or even improved – cash flow situation. This was, obviously, helped by the generous government support programs launched to ease the pandemic crisis. As the stock market improved quickly and it became apparent that a “V-shaped recovery” was likely, the loan margins fell down to pre-pandemic levels during Q2. The record low interest rates, however, stayed low, and investors were back in force in June, driving the property transaction volume upwards at record speed. As the summer brought further stability and low infection rates, the fast pace in the market continued throughout the second half of the year, with the full 2020 volume at above 110 bNOK, surpassing the previous four years. There was a record 27 deals with a value of above 1bNOK. December 2020 was a solid spurt to the finish line, and the pace is unchanged as 2021 comes into focus; investors, in short, want more of the same.

Segment preferences

Modern buildings with long government leases – with most purposes and locations – was probably the segment with the most value growth in 2020, as investors now value the safety of a guaranteed revenue stream highly. Logistics property also had a very solid year with renewed interest; Funds received record capital, and several large investors with different motives shifted their focus even more towards logistics. The segment became something of a “safe haven investment” in 2020: As a simplified logic, the transportation of goods is surely needed in the future, so the property cannot be a bad bet. Office property in most major cities has also risen in value and seen a very high transaction volume.

Retail property had a slow year transaction-wise, but most owners had stable revenue throughout the year, and we expect some to trim and re-focus their portfolios during 2021. The willingness to sell, or necessity of selling, retail property at low prices is not present at the moment, as the market is waiting for the full fallout and the effects of a return to normal life. Hotel property is probably the hardest hit segment in 2020, and there was a very low transaction volume; 2021 might bring some more volume as owners re-focus their portfolios and divest some assets.

Notable transactions

Oslo office properties of all types were a major part of the transaction volume. Centrally located objects changed hands at a pace not seen for the past decade, with four of the top 20 deals in the city center and another two in other Oslo office clusters. All were set at record low yields for their type of property. Major investors of many types, notably also family offices such as Canica, have been active buyers.

The Coop logistics hub at Gardermoen was one of the major deals of 2020 with both a record size and a record low yield for logistics property. Many smaller transactions also attracted solid interest.

A record high share of the transaction volume, and 8 of the top 20 largest deals, consisted of development land or companies with their major value in land or projects. Most of this was residential, but some large commercial development land plots also changed hands. This happens both because investors look to increase their share in higher-return (and higher-risk) property projects, and because the value of centrally located land plots has risen to new levels per potential m2 of floor space. A major reason is also that certain investors such as Ferd have entered this market with two very large acquisitions, of both the old NRK site and a prime-located office land plot.

2021 expectations

The mood from late 2020 is mainly carried over in the new year, although the expectation that the economy will return to normal keeps being postponed somewhat, as vaccines are slowly rolled out and new setbacks occur. Retail and hotel property owners have the most anxiety about this, while owners of office and logistics mostly look to expanding or developing their portfolios. As the interest rates stay low, however, the cash flow and values for most property is very attractive to a broad range of investors; we have not yet seen the full effect of the hunt for return on savings and investments for everybody from pension funds, retail investors, traditional property companies and family offices in Norway and abroad.

As many countries including Norway are in partial lockdown again as of early February, but at the same time receiving and distributing vaccines at a promising but uneven pace, the mood is still somewhat uncertain and careful.

Looking back at the events and market ripples of the last year, we can conclude that 2020, however, turned out a lot better for commercial property than we could have imagined in March.