A workplace strategy for a changing environment

As a major office tenant in hundreds of cities around the world, EY has been developing its new system for office use and the launch of this happened as the COVID-19 crisis hit the world and its employees had to head home. Matthew Narracott, head of EY Nordics real estate, elaborates on the high degree of flexibility needed from EY’s perspective, and how this is now going to be solved in Oslo.

EY is taking a new approach to its office leases

The discussion about how to adapt the workplace in the ever-changing environment of stronger digital capacity and an increasingly mobile workforce, has been somewhat upended in the adaptations for the pandemic crisis. However, the movement towards more flexible use of office space will continue, although with some changes due to new knowledge gained during 2020. One prime example of this is EY, which had an ambitious program going already in 2019, and which has recently started implementing its new system for flexible office use in Oslo.

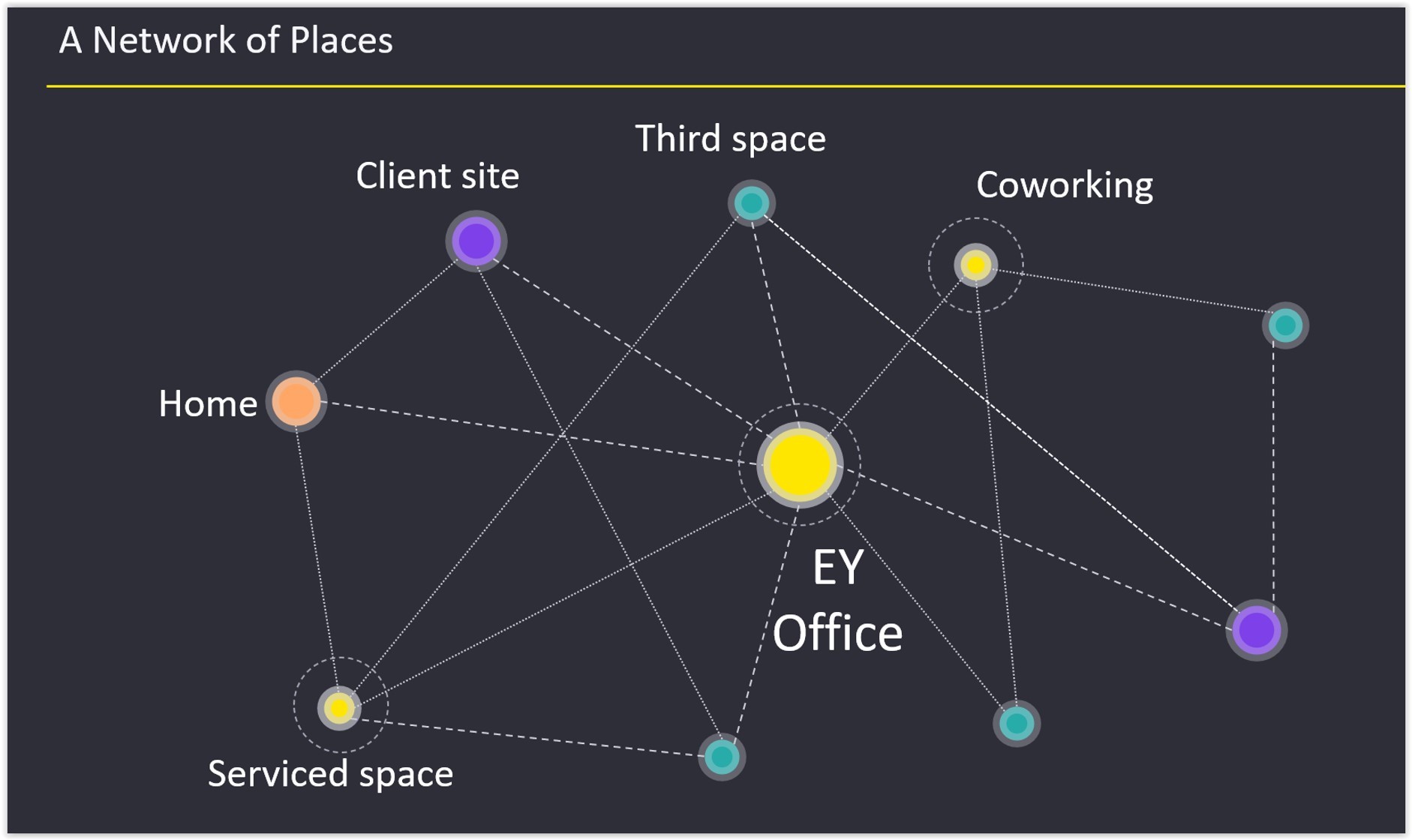

Matthew Narracott, Real Estate Leader for EY Nordics, explains how the company now thinks of its employees’ work situations as being distributed as never before, and that a “Network of Places” or “Hub & Spoke” model has been designed to enable cooperation and productivity in the new situation.

“Our Oslo “Hub” will be the new HQ office at Stortorget 7 in downtown Oslo. The hub office itself has a large component of flexibility, with around 35% of our occupancy spend shifting from traditional lease commitment to flexible use across desks, meeting room hours, and co-working-facility memberships. All via our flexible partner IWG” Narracott explains.

EY’s additional “Network of Places” within Oslo will consist of IWG’s 13 flex-office locations, where the EY employees can work from, or have meetings in, whenever they want to. These locations are spread around the city in two “circles”: inner city (within walking distance of Oslo S or Nationaltheatret subway/railway stations) and into the Oslo office clusters at Skøyen and around the Ring 3 road, at Lysaker, Nydalen and Helsfyr. These are all existing Regus or Spaces locations.

Alongside access to these more typical professional environments, EY continues to develop and roll-out digital tool enhancements for all employees that allow them to work from wherever is most convenient and efficient for each individual; a client’s office; a favorite coffee shop; a local park on a sunny day; or of course at home. To further facilitate the home-working side, EY recently offered all Nordic staff the opportunity to have an ergonomic chair installed at their homes (alongside workplace technology equipment as well), with a large share of employees in Norway signing up for this within the first 2 weeks.

A solution to changing needs

In Oslo, Akershus Eiendom has observed that among the largest tenants who have signed new leases in the last 5-10 years, quite a few have experienced sub-optimal results after moving into their new locations. Specifically, we see several examples of new office space built to a specification made by a sort of “optimization formula” which in theory was supposed to give a perfectly adapted space, but in reality gives the tenant no maneuvering room – literally and figuratively.

This has been visible as large tenants, both private corporations and government agencies, lease extra space in buildings nearby to handle either growth or a space that proved too small for the activities. The main mistake appears to be a lack of anticipation of changes in the business operation itself, or sometimes delay or a in a planned efficiency program – either for office space or for the number of employees. Some of the most recent lease processes, however, have taken measures to avoid this outcome. The EY lease at Stortorget 7 is a prime example of this.

Narracott elaborates on this, seen from a large tenant’s perspective: “If landlords are open in discussing tenant needs, there are some types of agreements where everyone can achieve what they need. If tenants can’t get the flexibility they need on parts of their space, then they will continue to strive for shorter and smaller leases than ever in order to be able to adapt to change in the future during volatile times like Covid. I believe many tenants would continue to accept longer lease terms, but only if flexibility is included and available”

An increasing level of environmental responsibility competence will also influence some tenants’ decisions: “The need to repeatedly re-fit and re-configure space also has a strongly negative environmental impact from the waste and emissions these frequent changes cause, and therefore a tenant will seek to make a longer-term responsible choice.” states Narracott. “The better choices being made and offered in this manner by landlords and also other responsible suppliers – architects; building contractors; furniture brokers; facility suppliers etc. – will have a great impact on how tenants score and appoint their landlords and other partners.“

From “office space” to “workplace experience”

For EY, Narracott expects this desire of optionality and flexibility to only continue to grow into the coming years.

“In the world of today, people are increasingly used to a “pay-as-you-go” service culture; they want their music streamed immediately; deliveries next or even same day; to review, edit, and sign documents on their laptop/monitor/tablet/phone based on whichever is nearest at the given time.

All of these things are possible and a part of modern life experience in a country like Norway; it seems silly that at the same time office workers haven’t been able to choose where or how they work, live, and commute or travel. The commercial real estate industry has started to realize this, but it must speed up to catch-up with other industries all around. The office is A place to work but doesn’t always have to be THE place to work” Narracott says.

New challenges

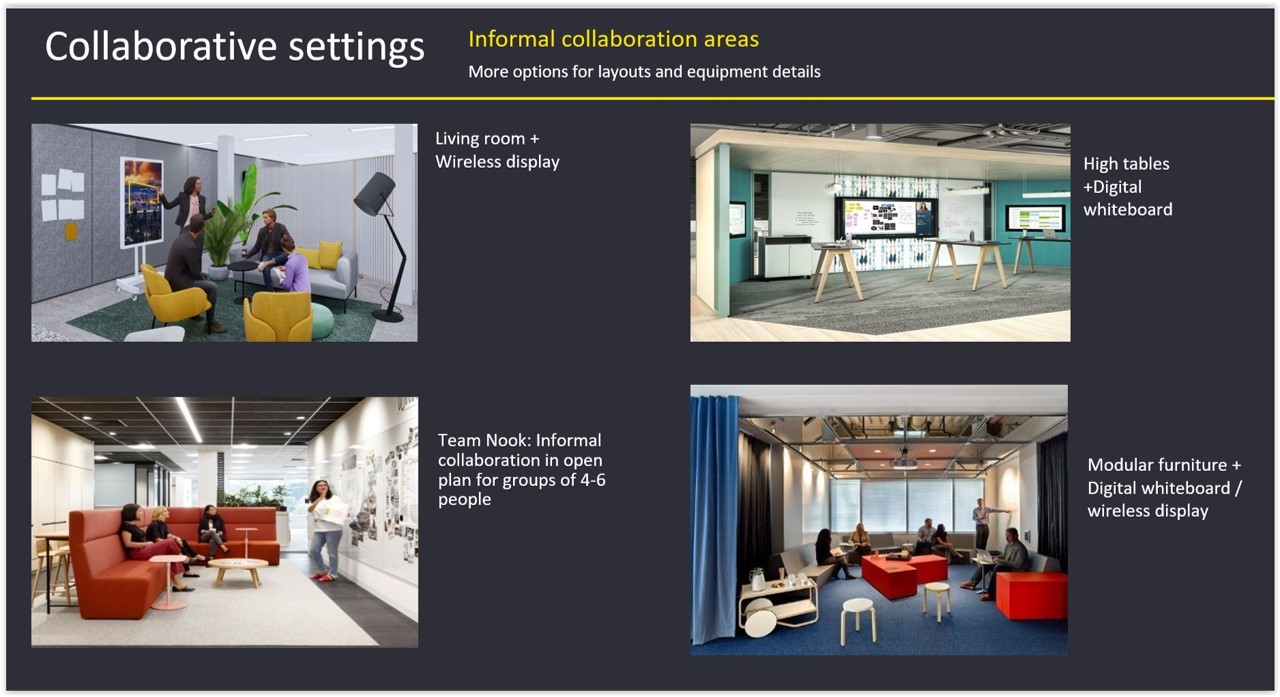

The digital and physical infrastructure of the new workplace architecture is, as a general rule, not very developed as of 2020 other than for a few select innovators like EY, and even for those, it is obvious that there is much learning and knowledge building to do. Some of the new competence is likely to be inspired by the hospitality or retail segments of commercial real estate. The physical architecture, division and technology of the “hub” office is also changing – see the video for a further explanation on this.

For EY, Narracott expects that the measuring of effects on productivity and employee satisfaction will be a large task for the coming months. Not just for home office solutions, but also for the multiple “spokes” or secondary locations where EY wants their employees to work, alone or in groups.

“Measuring and then adapting is more important than ever, to ensure that the distributed workspace location system works as desired. The longer-term effects both for employee happiness and for their subsequent output from all these different work situations is not clearly understood yet. We could realistically see in the near future, measurement of workplace quality by how healthy the people are, partly by counting the “beats-per-minute” of employees from their wearable technology. What we do know is that flexibility and optionality if valued, particularly by the younger generations. The pandemic situation has led to faster implementation to meet flexible needs, but the need for follow-up work has risen dramatically”, says Matthew Narracott.

He also states that the main operating cost will still be office rent, but that the home office user needs, and the associated costs, are coming more into focus. We will naturally see some costs shifting towards home office equipment and enablement.

How the market can adapt

The landlords may either choose to offer flexible lease solutions directly to the tenant, or they might need to team up with a flex-space vendor. One aspect of this is the outsourcing of the space operation side, but another is likely to be the multi-location presence, which is important for big tenants but which has also been observed for some medium-sized ones which might need a central location as an alternative to a fringe-located main office, or vice versa.

Large flex-space operators have an advantage in the development as described, as they can offer both practical systems adaptations and sizeable lease agreements covering many locations. Many smaller, local flex-office operators have excellent floor space and offer a very competitive product for smaller tenants; these are not always ready to handle a tenant with needs for coordination with multiple other locations both operated by themselves or other third parties.

- “The smaller operators should be looking for software or systems for cooperation and information sharing, to offer some of the same control for larger tenants. The flex-office industry is very diverse and has a many small local players, particularly outside of major cities, which creates challenges for tenants which may need dozens of locations in a single country. There’s also a general lack of these flexible operators outside of the largest cities currently”, says Narracott.