Hotel Market Update Q3 2019

The Norwegian hotel market is growing, due to both an expanding economy and a weak national currency, which causes vacation travel to be more attractive relative to foreign alternatives for both Norwegians and international guests. The major cities all see healthy growth, and especially Stavanger is now seeing the start of a recovery after tough years caused by the oil price decline in 2014.

A solid 2019 for hotels

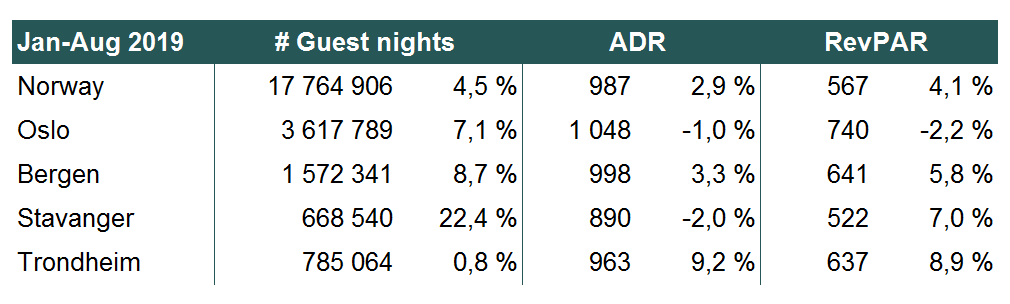

The national hotel market is still going strong and during the first 8 months of 2019 total guest nights sum up to 17,8 million. This is the highest number of guest nights ever and 4.5% higher than in the same period in 2018.

Foreign visitors accounted for almost 30% of the guest nights. Traditionally, Swedish, German, Danish and British guests have dominated the foreign guest nights, but during the last five-six years the number of American and Chinese guests have more than doubled. Only the last year, the number of American visitors has increased by 25% and they now make up the biggest group of foreign guests in Norwegian hotels. The increase in international guest nights is likely caused by the weak Norwegian Krone.

More than half of the stays are related to holiday and leisure, and it is also this group which has seen the largest growth so far in 2019, almost 6%. The course and conference sector have only seen a 0,3% growth in guest nights, and its share of the total market has seen a slight negative trend over the last years. Other business-related stays increased by 3,6% in the period.

The increase in guest nights has resulted in a record high revenue for the Norwegian hotels. So far in 2019, it is NOK 11,3 billion, which is 7,4% higher than last year. Revenue per available room (RevPAR) is NOK 567, an increase of 4,1%.

All cities take part in the growth

Oslo is the largest hotel market in Norway with 20% of all guest nights. The number of stays has increased by 6% so far this year, and average room rate is slightly above NOK 1,000 and RevPAR is NOK 717.

Stavanger and Bergen have seen the largest increase in guest nights, 22 % and 9 % increase respectively so far this year. Stavanger has seen the greatest increase in guest nights and has an average room rate of almost 900, but still has the lowest RevPAR of the largest Norwegian cities at NOK 522, having fallen from NOK 780 in 2013, illustrating the effect of the reduced oil investment activity. The average room rates in Bergen and Trondheim are NOK 998 and NOK 963, respectively, and both cities have RevPAR around NOK 640.

Property transactions are scarce

The transaction market for hotels has been very small both in 2018 and 2019 so far. Established, large players have large portfolios, and a number of smaller single-asset owners keep their hotels privately owned. Major operators such as Thon and Choice keep expanding rather through new development projects rather than acquisition. Very few entrants to the investor market have appeared, as most financial investors find the market as a non-operating owner unattractive as they are unlikely to have a negotiating power towards the hotel operators in any way similar to the major owners. We expect a few assets to come for sale during the fall, and the result is likely to be further consolidation of the ownership structure.