Rent and vacancy update Oslo Q3 2019

2019-Q3 was a strong quarter with rising rents and shrinking vacancy for the Oslo office market.

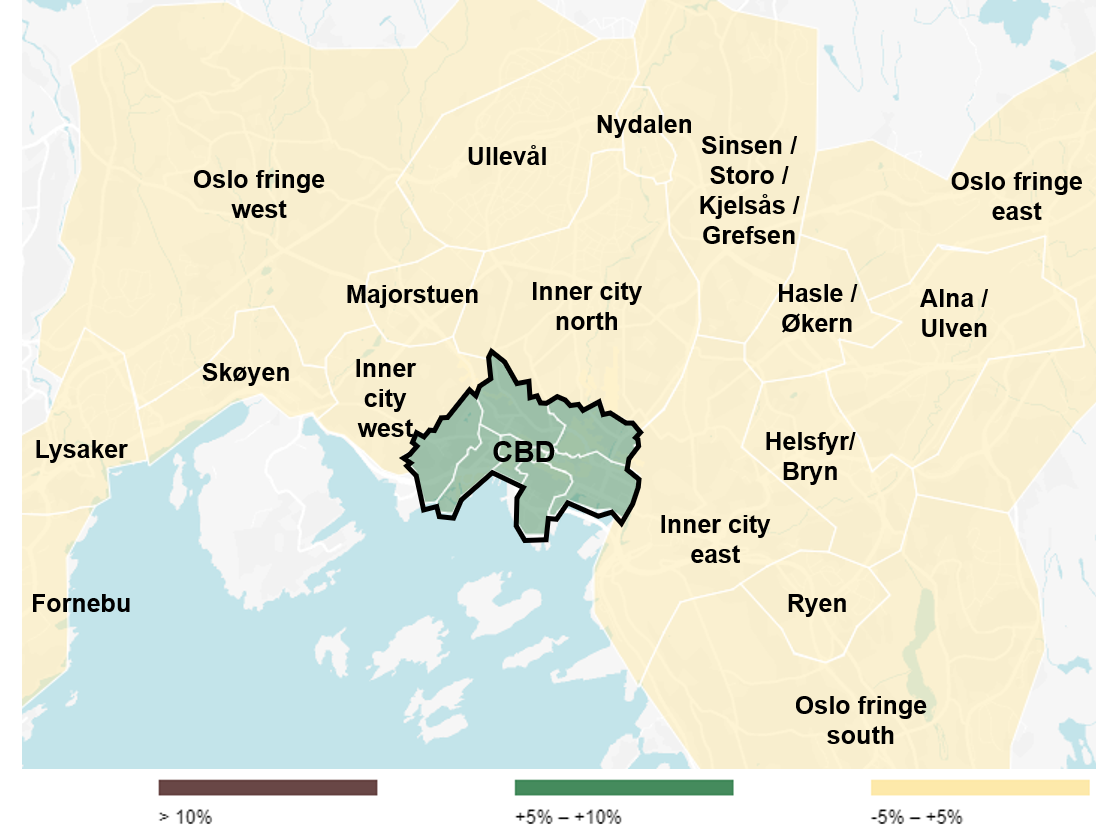

The trends from earlier this year continue, and the most interesting observation is upwards movement in rents also for eastern office clusters, where rental growth has been very weak for the last couple of years.

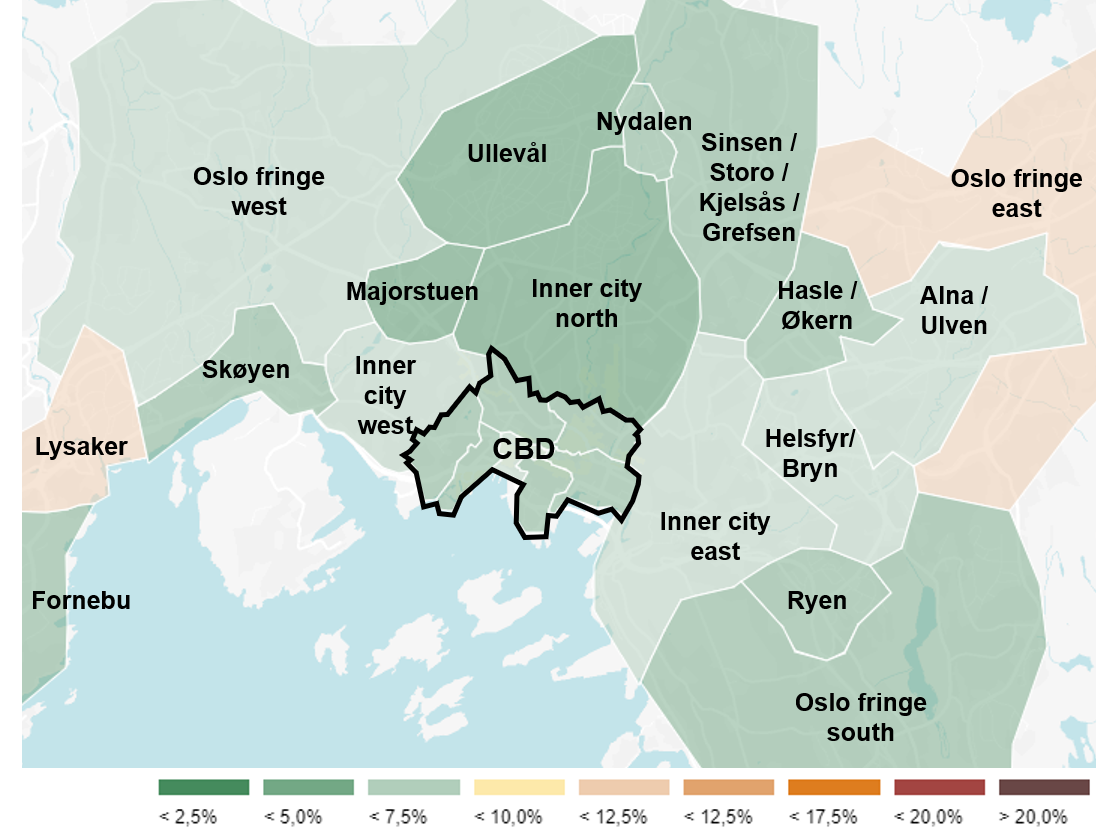

Vacancy

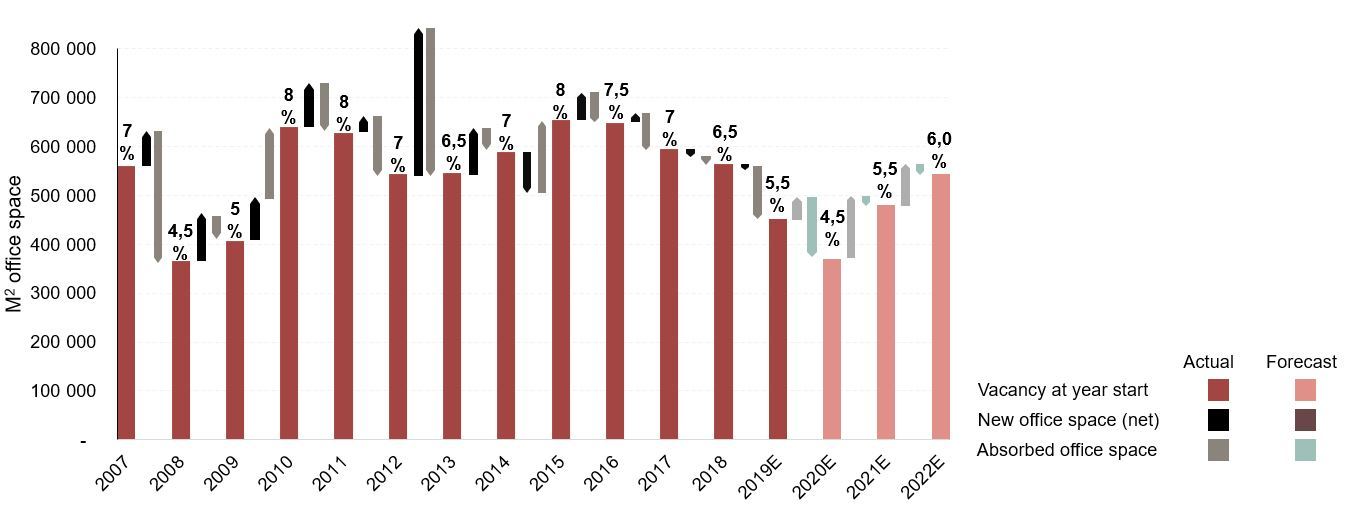

In 2019 we have recorded the lowest vacancy levels in Oslo since 2008. Oslo office vacancy (including Lysaker and Fornebu) per Q3 2019 was at 4.9%, equivalent to a y-o-y decrease of 0.9 percentage points. We see a continuing trend of tenants seeking highly central locations, making the CBD demand strong and resulting in lower office vacancy. Oslo CBD remains below 4% for the fifth consecutive quarter, standing at 3.7%.

Forecast

High demand for office space in combination with limited volume of new office supply have put downward pressure on vacancy levels. However, as construction of new office space is expected to pick up, the vacancy is anticipated to bottom out in early 2020 before slightly increasing over the following years. We estimate office vacancy in Oslo at ~6% by 2022.

For more information and data on vacancy levels in Oslo, click here.

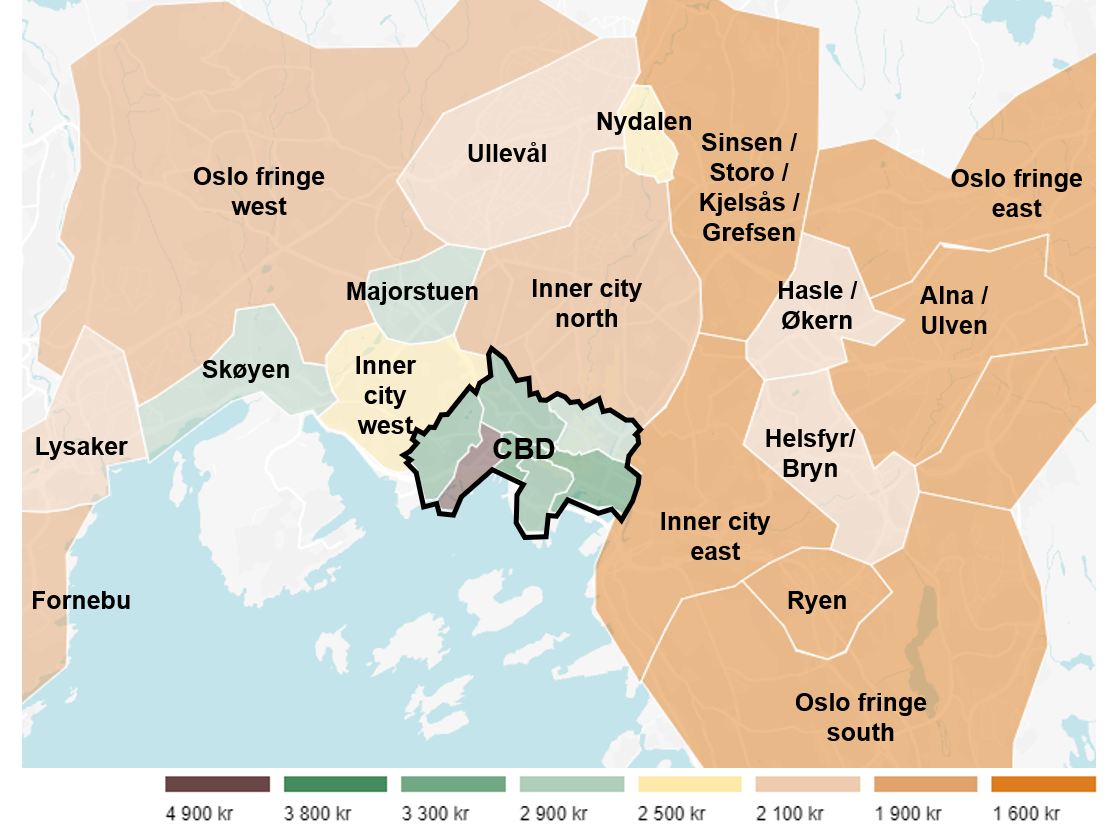

Rent levels

Office rents in central areas of Oslo have been increasing, and CBD is still characterized by low vacancy and above-average landlord advantage. Increasing demand and limited supply have continued to exert upward pressure on prices. Vika-Aker Brygge, Kvadraturen and Sentrum Nord, three sub-areas of CBD, have seen especially strong growth in the past 12 months, close to 10% nominally. Estimated prime rent per Q3 2019 is NOK 4,900 per sq.m pa. for high-standard locations, adjusted up from NOK 4,600 in Q2. Top floors have been noted as high as NOK 6,000 per sqm. The new leases at high-standard levels in Q3 have mostly been below 1,000 sqm in size. New solid rent levels, higher than any year since 2013, have also been signed both at Lysaker and Helsfyr.

Forecast

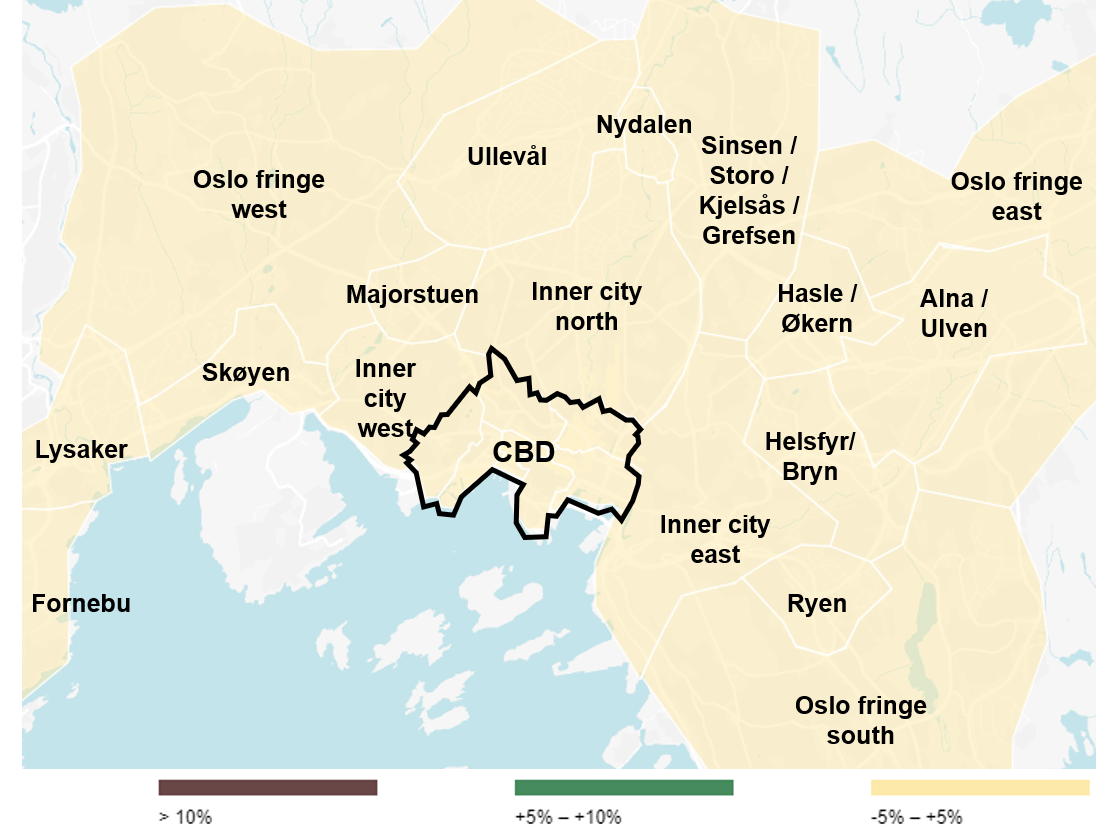

Our estimate for 10-15% nominal rental growth in the CBD for 2019 is maintained, and we expect further CBD rental growth of 5-10% in 2020. Our 2019 forecast for Lysaker, Skøyen and Nydalen is 5-10% rental growth, and as of October, we also raise or expectations for Helsfyr-Bryn to this level. We expect no significant change in the remaining areas of Oslo. For 2020, our expectations are for somewhat slower growth in rental levels due to the lower GDP growth forecasted. Low vacancy is still likely to enable rental growth above CPI.

For more information and data on Oslo office rents, click here.