Overview of the Oslo office leasing market

A brief introduction to the office leasing market in Oslo

Brief introduction

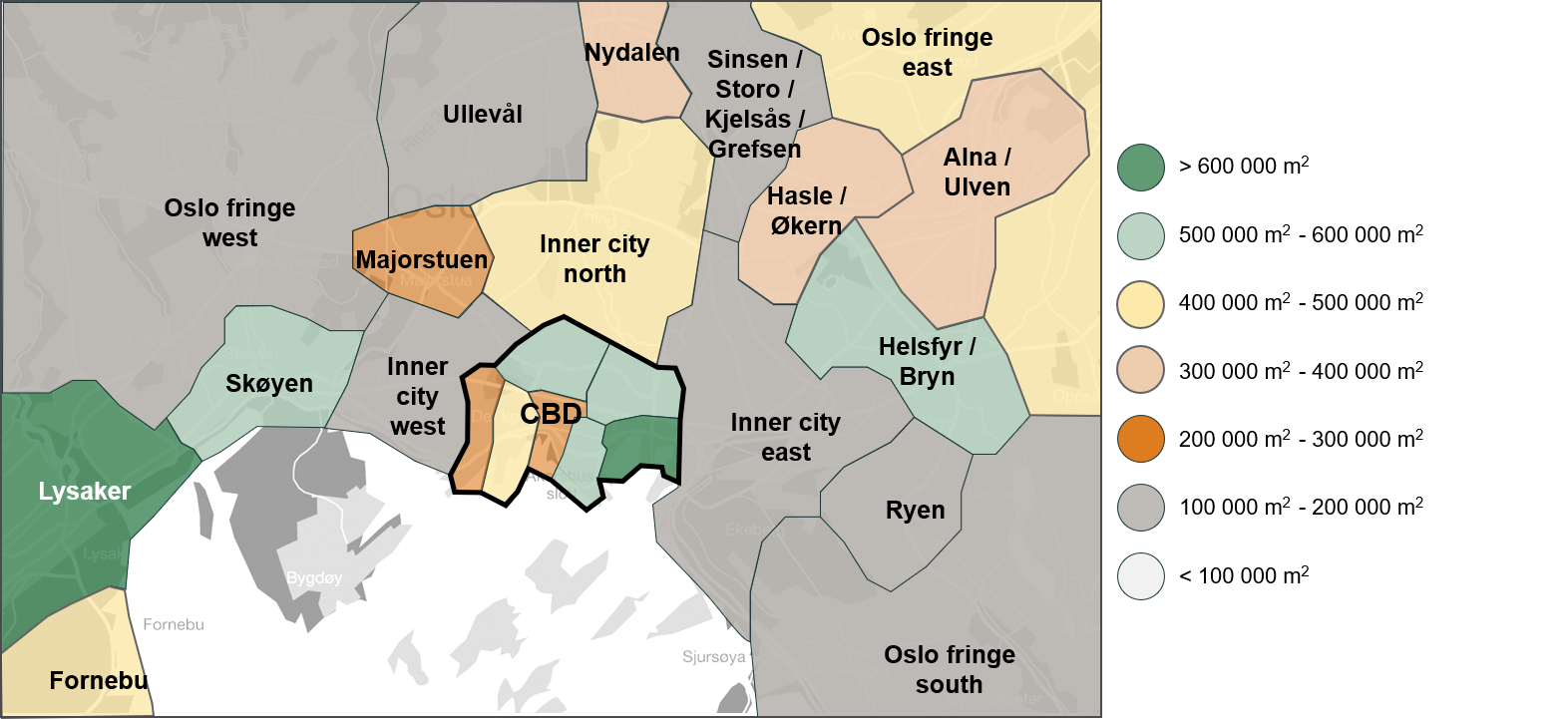

The Oslo office building stock, including Lysaker/Fornebu , today stands at around 8.6 million m2. Of the total volume, roughly 3.3 million m2 are situated within the city centre. The city centre office areas are marked in the map as seven areas/circles (CBD), from Solli Plass in the west to Bjørvika in the east.

Since 2007, the city centre has seen major urban redevelopment. Two new neighbourhoods at the waterfront, Tjuvholmen and Bjørvika, have been developed to become mixed residential and commercial areas. Bjørvika still has ongoing large development projects, and in the longer term, Filipstad just west of Tjuvholmen will be available for major commercial and residential development.

Generally, Oslo has a great deal of urban sprawl, and the built-up area covers significant land areas compared to its population size. Most of the office building stock is concentrated in densely built areas, and this is visible in the map. Office zones outside the Central Business District are generally found along the outer ring road from Lysaker through Nydalen, Hasle-Økern and Helsfyr-Bryn to Ryen. All areas have seen new development over the last 10 years, and Fornebu and Nydalen have seen the highest activity.

The area between the CBD and the outer ring road (in the map, seen as the Inner city West, North and East) is mostly in use for residential, education and retail purposes. The west of Oslo contains high-end residential areas with low density. The north-eastern corner of Oslo is the core area in all of Norway for logistical purposes, with many distribution centres for retail, wholesale and third-party logistics companies. Eastern and southern areas mainly consist of residential areas with varying degrees of density.

In most areas outside the major office hubs, we see slow but steady conversion of older office buildings into residential development projects, as these are generally more profitable than refurbishment for continued office use.

Oslo office rents

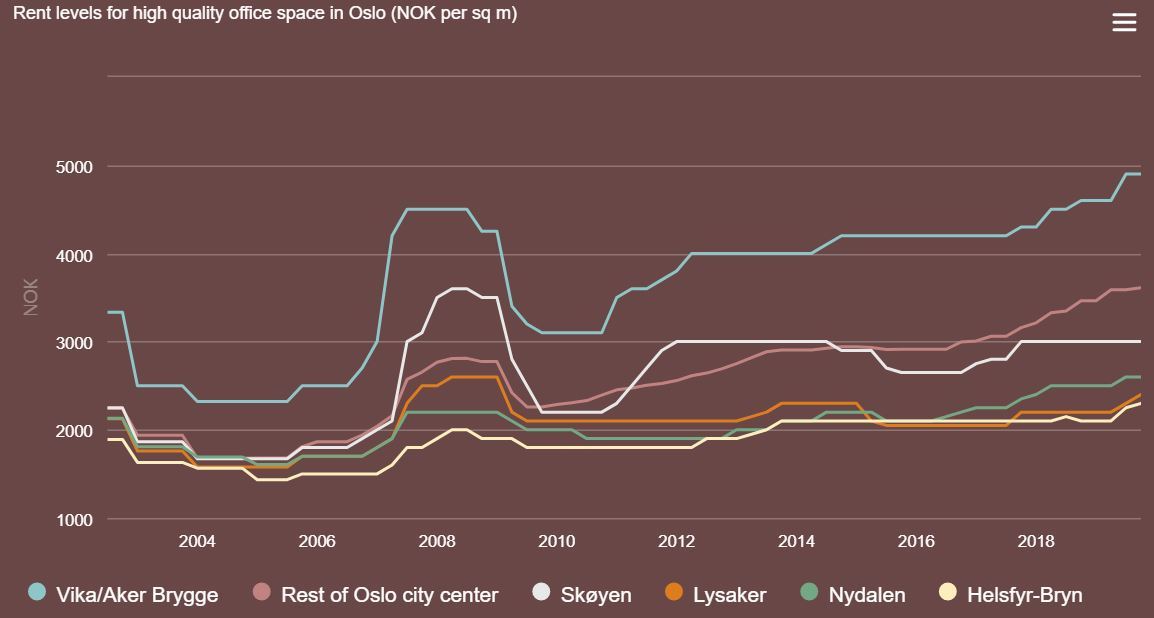

Real office rents in Oslo fell sharply in the wake of the financial crisis in 2008 and bottomed out during 2010. The rents increased until 2013-14, when the oil price decline became the main reason for a period of rental growth stagnation and even a slight decline in some submarkets, especially in the western fringe of Lysaker-Fornebu. However, since the start of 2017, rents have been on the rise, especially in the CBD. Due to low office supply and increased demand for office space close to public transportation, rent levels in the CBD and the office hubs Skøyen, Lysaker and Nydalen are expected to increase over the next two years, while the rents are expected to move sideways at Helsfyr, Bryn and Hasle-Økern where there are more new buildings being erected. Rent for high standard office space in the Prime CBD area is per Q3 2019 at NOK 4,900 per sq. m.

For more information and data on Oslo office rents, click here.

Vacancy levels in Oslo

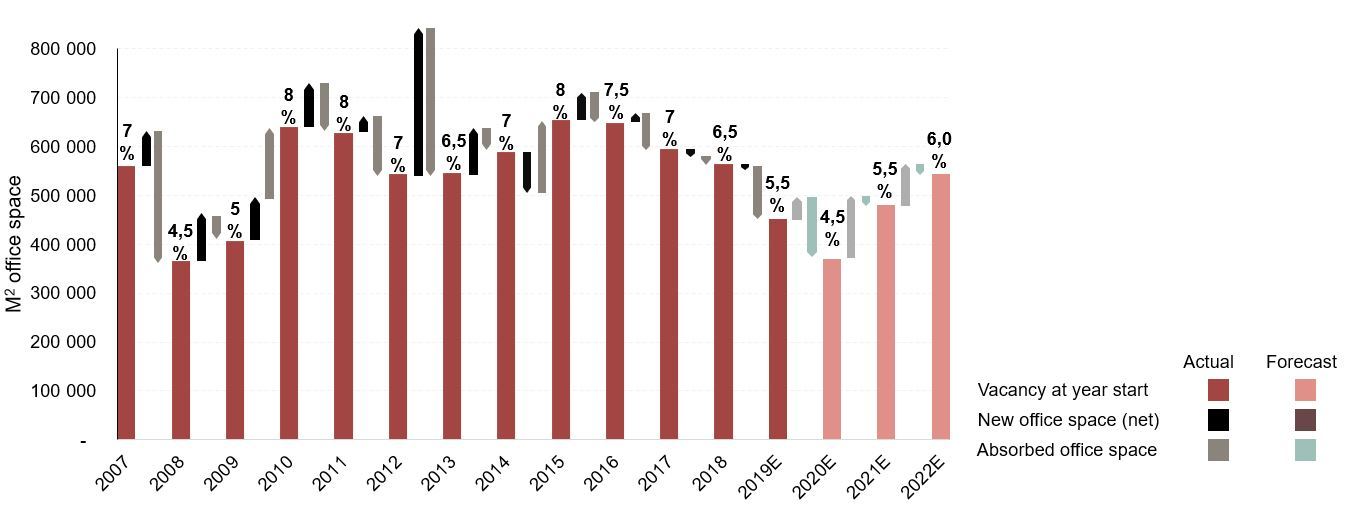

Vacancy levels in Oslo have steadily declined over the past four years and are per Q3 2019 below 5% for Oslo as a whole. With little speculative construction started in 2014-2017, there is a very low net supply of office space until the end of 2019, supported by a high volume of office space being converted to other uses, mostly residential. For 2020, more new space will be completed, and probably also in 2021. The take-up level has been strong and is believed to stay strong going forward. Thus, the vacancy level is expected to decrease until mid-2020 and thereafter increase slowly.

Oslo office vacancy measured as floor space available per July 2019 and within 3 months was 4.9%, or approximately 420,000 sq. m., while the vacancy in CBD per July 2019 was 3.7%.

For more information and data on vacancy levels in Oslo, click here.