Moving east: The 2020 Oslo office relocation survey

The annual survey of Oslo office users' overall geographical relocation patterns shows a picture similar to the results over the past few years. The eastern part of Oslo attracts new tenants from the west and the CBD, most of these public sector offices. The west, while not offering as many new buildings, sees a healthy new volume of tenants moving from the CBD.

The annual survey of relocation patterns

To map tenants’ relocation patterns across Oslo (including Lysaker and Fornebu), Akershus Eiendom annually collects and analyse a representative sample of recently signed lease contracts.

This year’s sample for our relocation analysis consists of 97 tenants occupying 155,000 m2 (excluding renegotiated contracts and extensions). This is fewer than in the 2019 survey, but on par with earlier surveys. The most notable relocation examples include Direktoratet for Økonomistyring (a government office) moving from Karl Johans gate 37 (CBD) to Lørenfaret 1 (east), Nent Group from Akersgata 73 (CBD) to Karvesvingen 7 (east) and Nortura from Lørenfaret 37 (east) to Schweigaards gate 15 (CBD), to mention a few of the largest.

Highlights of the 2020 survey

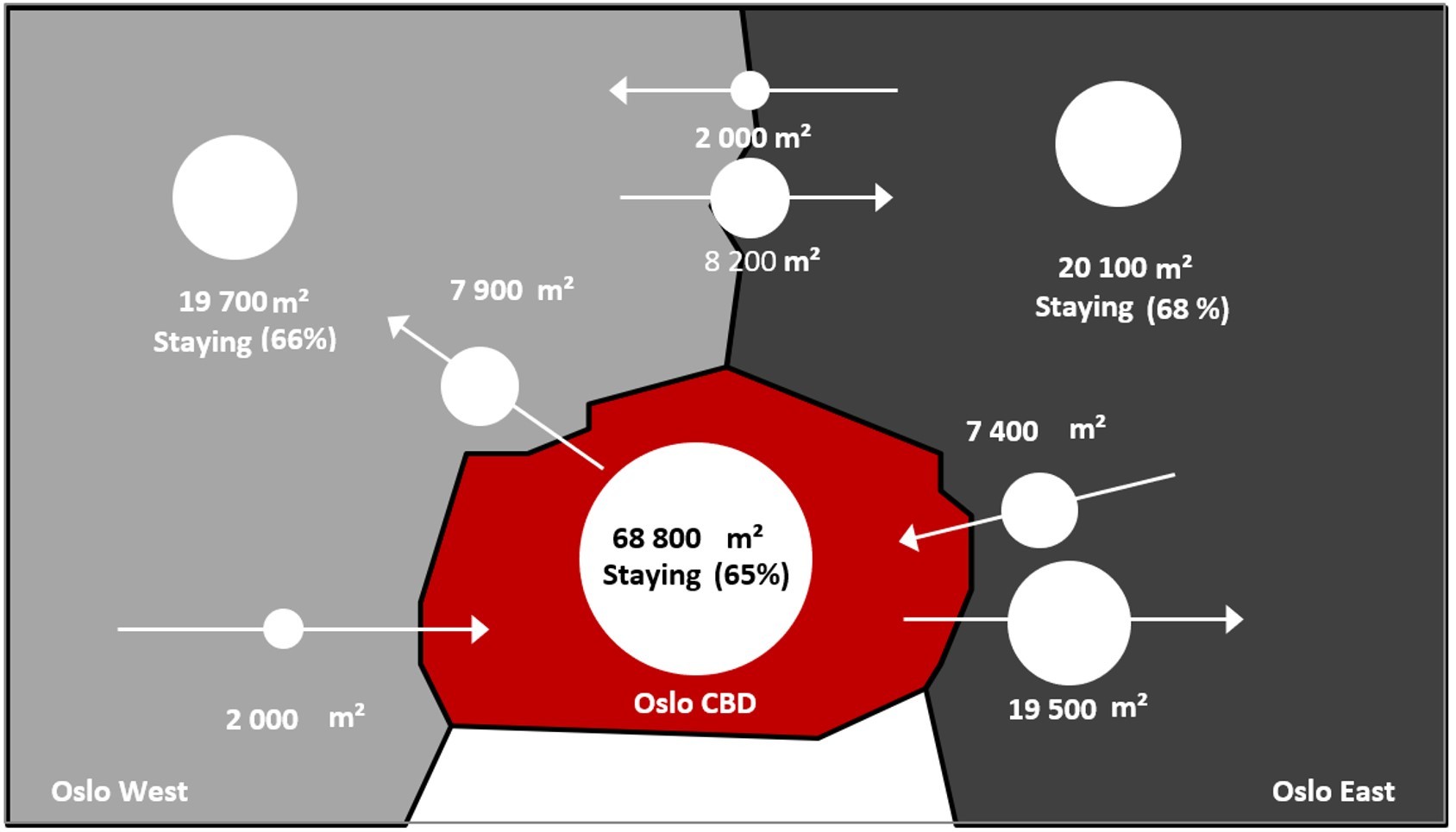

- Somewhat fewer companies chose to stay in their area in 2020 compared to the average of 2015-2019, with a retention rate shy of 70%.

- Net outflow from the CBD was at -18,300 m2.

- There was a net inflow of 18,300 m2 to the east.

- For the west, inflow and outflow were about the same, net positive from the CBD and net negative towards the east.

70% of all tenants in the sample ended up moving within either the east, the CBD, or the west. This is 4%-points lower than the average of 2015-2019. Out of 46 tenants with a size at or above 1,000 m2, only 12 chose to move to another general area; out of 21 which had more than 2,000 m2, seven were in this category, so the average size of those changing area was relatively large.

The CBD usually sees a high share of tenants staying in the same area; this year, 72% of all relocations from the area choose to stay within it. Two of the five largest ones that moved out, were public agencies moving to the northeast; two others were private companies moving to the west.

66% of the floor space changing location in the west choose to stay within the same area, while 27% consisted of companies relocating to the east. Several other, larger companies chose to stay within the area, but renegotiated their existing contract and are therefore not included in the statistics. NorgesGruppen is a major such tenant, and there are others of the same size, but most of these re-negotiations are not made public.

The flow of tenants moving to the east during 2020 was solid, also relative to previous years. This can be explained by the high supply in the eastern fringe, with several new buildings under completion.

Historical comparison

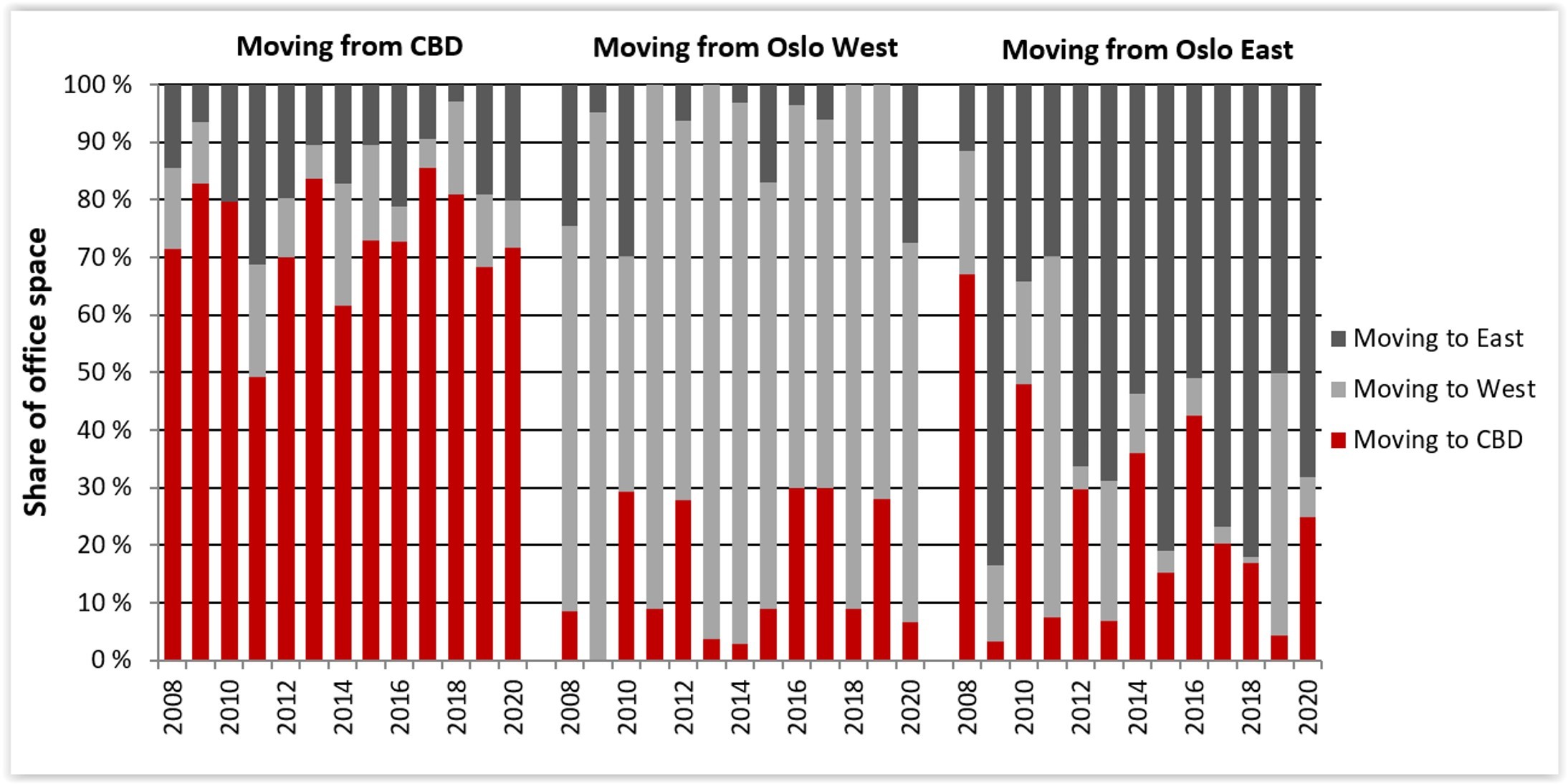

The figure below shows the full historical results of our relocation survey.

CBD had a slightly lower retention rate at 68% compared to the recent five-year average at 76%.

East experienced a slightly higher retention rate at 68% than the latest five-year average at 66%.

We observed a significantly lower retention rate at 51% for the companies in the west compared to the recent five-year average of 69%; however, the NIVA (National Institute of water research) temporary move of 6,700 m2 from Ullevål to Økern (which will be reversed in two years) was a large share of the movement out of the general area.

Historically, we have seen a low share of companies moving from CBD to the west. However, we do observe a significant percentage of companies moving this way during 2020, which at 22% is the second-highest share observed, consisting of at least five firms above 750 m2 office size. We know for a fact that rent difference between CBD and Skøyen/Lysaker was a factor for some of these tenants.

The movement of government and municipal agencies and offices from CBD to eastern areas has been a major trend over the past ten years. As of this year, it is hard to see how this trend can continue as there are few such tenants left in the CBD.