Kontor rundt Slottsparken: De rimeligste lokalene stiger mest i pris

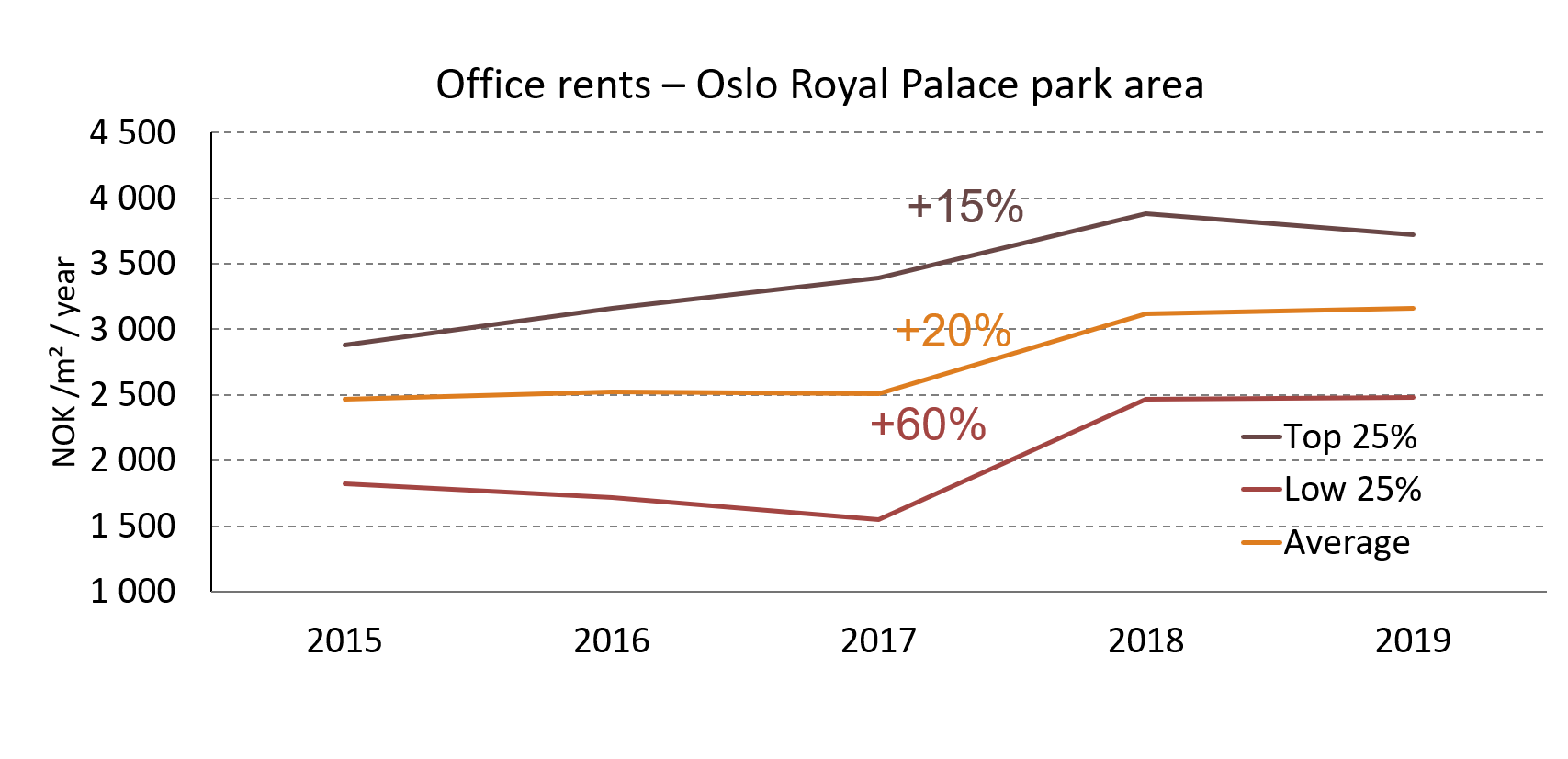

After several years of rent levels changing very little, the area surrounding the Royal Palace have now made a significant leap to a higher level. Between 2015 and 2017, only the top 25% of signed leases proved rental growth. Over the last two years, the “bulk majority” have followed, manifesting a new normal for the area.

Throughout 2019, the debate regarding the solid rental growth observed in the city centre has to a large extent focused on the Kvadraturen area. However, several other areas have “stabilised” on higher levels, reflecting the record low vacancy in the CBD. One of the areas that stands out is the area surrounding the Royal Palace. With its sense of prominence and heritage, plus the proximity to the large open park, the area offers something few other areas can match.

2018 was a particularly strong year for the area. The lowest 25 % of leases signed increased by approximately 60 % compared to 2017, whereas the middle 50 % increased by 20 %. Interestingly, the rents have stabilised at these levels, yet with a small growth also for 2019. The top 25 % of leases signed have increased significantly year-by-year since 2015, before a slight dip has been observed in 2019.

The short version of the story is this: the average rent has increased a lot more than the high-standard rent, as the market has virtually eliminated low-rent lease contracts. The low-quality space is now also rented at high levels – or, more correctly, almost all the low-quality space has been upgraded and now commands higher rent.

One important explanation behind this rental market development is increased tenant demands and corresponding high-quality refurbishment projects. The quality of most office space is now higher, particularly for the higher end of the scale. Yet, the data illustrates a new normal for the area where the majority of leases now are signed significantly above NOK 3,000 per sq. m. The same story is evident in other areas of the city centre, and the conclusion is rather obvious: tenants who signed leases in the city centre 5 years ago will have to accept higher rent levels to remain in the city centre, or move to the fringe areas. However, this is not all one-sided: the downside for landlords is the increasing costs for refurbishment which follow this trend.

Akershus Eiendom estimates a 5-10% rental growth for the area surrounding the Royal Palace in 2020, as for the rest of the Oslo city centre. The actual development may vary significantly between micro-areas.

Source for data: Arealstatistikk AS