Why high-street retail rents are experiencing downward pressure

From being a market with zero vacancy; limited supply of quality retail space and high demand from new international tenants with higher willingness to pay high rents, pushed retail rents to record high levels. The Oslo high-street market has changed due to strong competition and restructuring. Today, the high-street market experiences increasing vacancy and downward pressure on rent.

A few years ago, the Oslo high-street market experienced strong retailer demand, especially from international luxury brands and other high-profile brands with lack of presence in Norway. The Norwegian economy was strong and stable, with high purchasing power and Oslo was the fastest growing capital in Europe. In addition, the Oslo retail market was at this point underdeveloped compared to Stockholm and Copenhagen, making it an interesting new market to enter for new retail tenants. This together with the lack of available quality retail space pushed the prime rent to record-high levels. High-end retailers clustered between Steen & Strøm Department Store and the Parliament, making Nedre Slottsgate the street with the highest retail rental growth in Europe. Nordic mass-market brands continued to be present in Karl Johans gate. Click here to read our article “Nedre Slottsgate overgår Europa” (only in Norwegian) from Q2 2016.

As the years have passed, several luxury brands have opened stores and have become a natural part of the retail landscape in Oslo, resulting in lower demand from the luxury segment. In addition, fast-fashion experiences increased competition from e-commerce and changing consumer preferences with like higher focus on sustainability. Clothing and shoes are more frequently bought through online platforms. According to the latest retail report from Virke, the Norwegian clothing industry experiences solid growth, but the consumer uses other channels than the physical store when buying clothes, leaving clothing stores with a growth of only 1% between 2012 and 2017. Clothing and shoes are by far the sectors with the highest footprint in the shopping streets of Oslo.

As the retail scene is changing with e-commerce being the most significant change, retailers have been forced to restructure their business. How much of the total distribution shall be e-commerce, own retail or through whole-sale is an important question and many don’t know yet. In Europe it’s forecasted that approx. 30-35% of retail will be e-commerce. In the UK where the cost of distribution and logistics is lower as much as 40-45% is forecasted. For Norway with a much higher cost level and complex geography and infrastructure the forecast is below European average. The change into an omni-channel distribution has caused retailers costs to increase and margins to shrink.

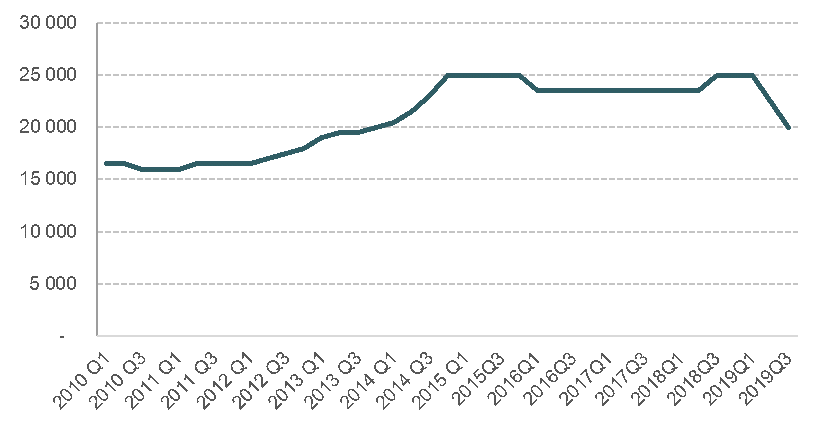

Increased bankruptcies and store closings within the clothing and shoes sectors; the above-mentioned restructuring and increased costs have resulted in record low expansion activity – leaving attractive high-street premises vacant. As a result, the traditional high-street tenant is no longer willing or able to pay high rents, resulting in a downward pressure on prime rents throughout 2018. Prime high-street rents are now below NOK 20,000 per sq. m.

However, it is important to note that the luxury segment continues to experience solid growth in turnover and luxury bags, watchmakers and jewellers are the main winners in the Oslo shopping market.

The graph below shows the development in the high-street prime rent in Oslo (NOK per sq. m).