European Retail Update

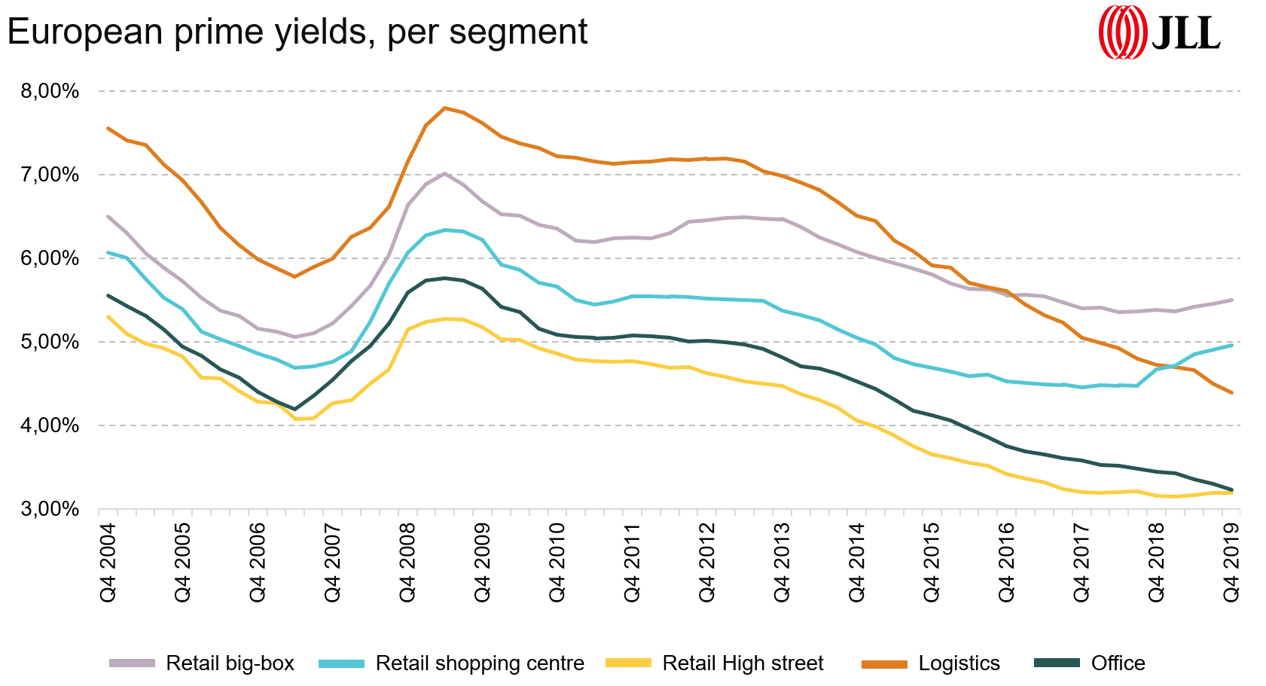

The retail property market is feeling the burden of the problems among retail chains in general and shopping center tenants in particular. Shopping center yields have risen across Europe with 50 bps in one year, while yields for other segments are unchanged or have declined. Sustainability trends, and the shift of consumer spending from goods to services, will be key drivers for the coming retail property changes and re-development.

The retail market has been burdened with a lot of store closings and bankruptcies over the last couple of years. Mass market brands have fared the worst, and retail chains which contain these brands have suffered the most. Luxury brands, however, have seen stable or rising sales, fueled by tourism and general growth in the segment.

The prime rents in European high street locations and shopping centers have been essentially flat throughout 2019, after rising by 20% and 10%, respectively, in the years 2014-2018. There are some variations throughout Europe, but mostly, the trends are similar in most countries. The growth in online sales, often blamed for the stagnating retail rents, has been close to 10% in 2019. This growth rate is predicted to fall to 5% over the next four years, offering a reprieve for the retail property industry.

The prime yields have gone through a more profound change over the past 12 months. Average prime shopping center yields for Europe (excluding Russia) has increased by almost 50 bp over the year, equivalent to a decline of 10% of capital values. This reflects that the retailers’ problems have impacted the retail property market with full force, and the effect can also be seen in property owners’ stock prices. Other property segments, however, have stable or falling yields, so the diversified property owners do not see financial strains.

Sustainability trends

The focus on sustainability is expected to make a profound impact on the retail industry. Waste and CO2-emissions in production and distribution are emerging issues, and consumer trends for more experience and entertainment rather than goods purchases are likely to be supported by this development – for experiences are environmentally friendly.

One early part of this major trend is the growth in renting or re-selling clothes, mainly through online applications and websites. The early players in this area, such as ‘tise and Fjong in Norway, see tremendous growth, and might take a cut of the regular fashion retailers’ market. There are some signals that these will need physical space as the volumes grow to a level where the trade of the clothes between consumers themselves can be facilitated through retail space – controlled by the software needed to manage the logistics in this. This area obviously has a lot of room for innovation, but as consumers’ preferences are shifting, a critical mass of customers seems to have arisen for these concepts.

The sustainability issues may even contribute to a slowdown in online sales, as the return policies and subsequent waste issues (a significant share of returned goods are not resold but end up in landfills) will lead to the internet becoming a more expensive channel for purchases. Omnichannel options and more use of “clicks-to-bricks” are an obvious solution to this, as the CO2 costs of today’s online sales become more of a focus even for the consumer.