Investment market 2020, as of early December

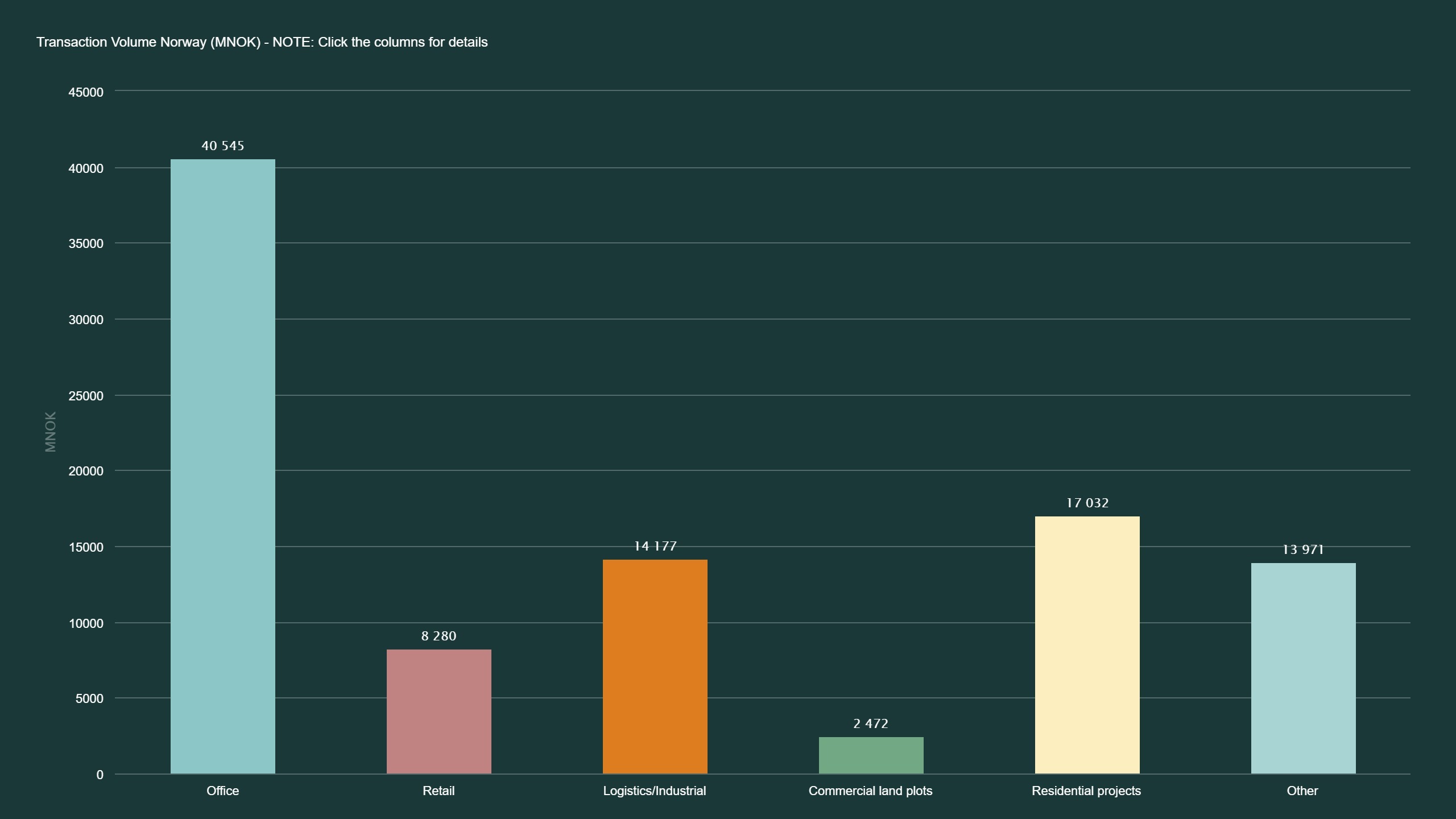

The Norwegian transaction market is heading for a record-high volume this year, as many investors seek more property both due to robust forecasts and a record-low interest rate level. As the uncertainty of the first five months gave way to firmer indicators for GDP, rates, margins and other factors, the market as a whole has moved with an impressive speed. Prime office yield has been reduced to an impressive 3.3% level. Office, logistics, alternatives, and residential land plots are segments which outperform both in terms of value and volume compared to past years.

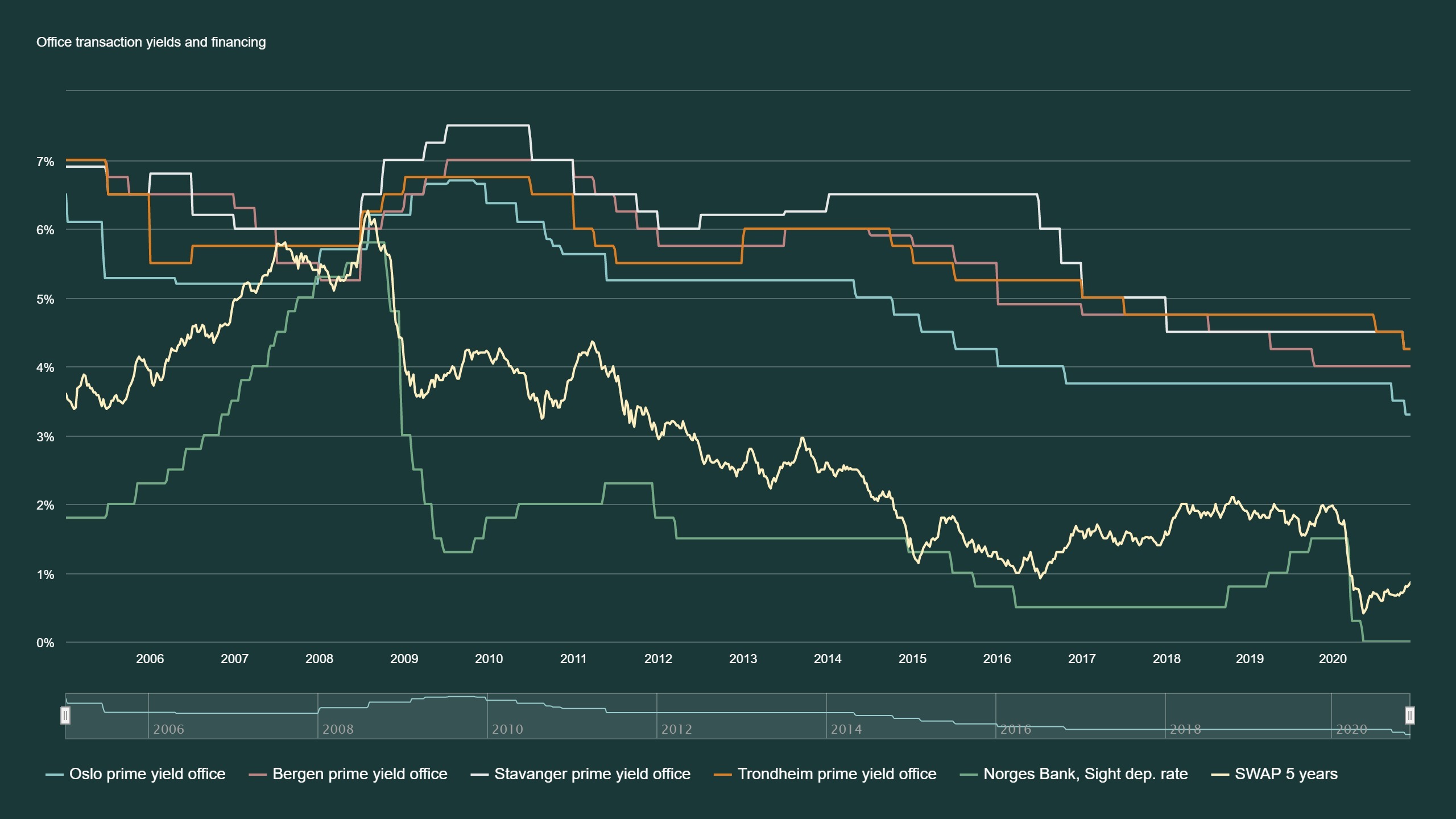

Despite an abrupt halt in transactions in March, activity significantly improved towards the summer. As we approach year end, market activity is strong, fuelled by appealing yield spreads due to reduced financing costs, as Norway was one of the few countries in Europe that had room for further interest rate reductions. Investors’ risk perception is also reduced, at least for now, and Akershus Eiendom expects the year-end volume to exceed NOK 110 billion (surpassing 2019, at NOK 105 billion).

Norwegian Market Performance: key figures

- Total YTD volume of NOK 92 billion; September, October and November have all overperformed significantly compared to previous years.

- Large deals are characterising the market in 2020; 22 deals above bNOK 1 have been observed so far in 2020, whereas the total in 2019 was 19 for the full year. Five of the 2020 transactions are above 2.5 bNOK, compared to six for the full year 2019.

- Prime yields for office have fallen with 30-50 basis points for several segments and geographical areas.

Yields move down – for some segments

The observed transactions have supported the reduction in our prime yield estimate for Oslo CBD office from 3.75% to a record low 3.30% as of November. The drop in yields for the CBD is only surpassed by two groups: logistics and social infrastructure properties with very long leases. The CBDs of the secondary cities are also affected by the drop in yields, although this has so far only been seen in actual transactions in Bergen. It appears that non-CBD offices in both Oslo and other cities have not yet seen a similar drop in yields, unless there are government tenants. This highlights the perceived higher risk profile of the economy in general, and the increased importance of the tenant solidity.

The major change since June is the consensus of lower yields for office and social infrastructure properties. We can add that logistics was the first to see yields declining, but this has probably also continued into the fourth quarter.

The decline in office yield seen in Norway is unusual in Europe for 2020, and the main reason is, obviously, the falling Norwegian interest rates. While EU rates have stayed low where they were in early 2020, Norwegian 10-year SWAP rates declined with 100 basis points in Q1 and have barely risen with 20 point since March. This means some of the low-return effects felt on European investors in 2017-19 have now been affecting the Norwegian markets, motivating more investors to lower their expected return levels for property.

An unexpected transaction boom in 2020

As of late November, the transaction volume is estimated at approximately NOK 92 billion, including assets under offer – 20% higher than the same period last year. The positive sentiment in June escalated after the summer, and as December is usually the busiest month of the year, the total volume can be expected to surpass 110 bNOK of property value.

The volume is driven both by small and medium-sized deals, plus a surprisingly high number of large transactions. The growth is, however, spread out over several segments and geographical areas.

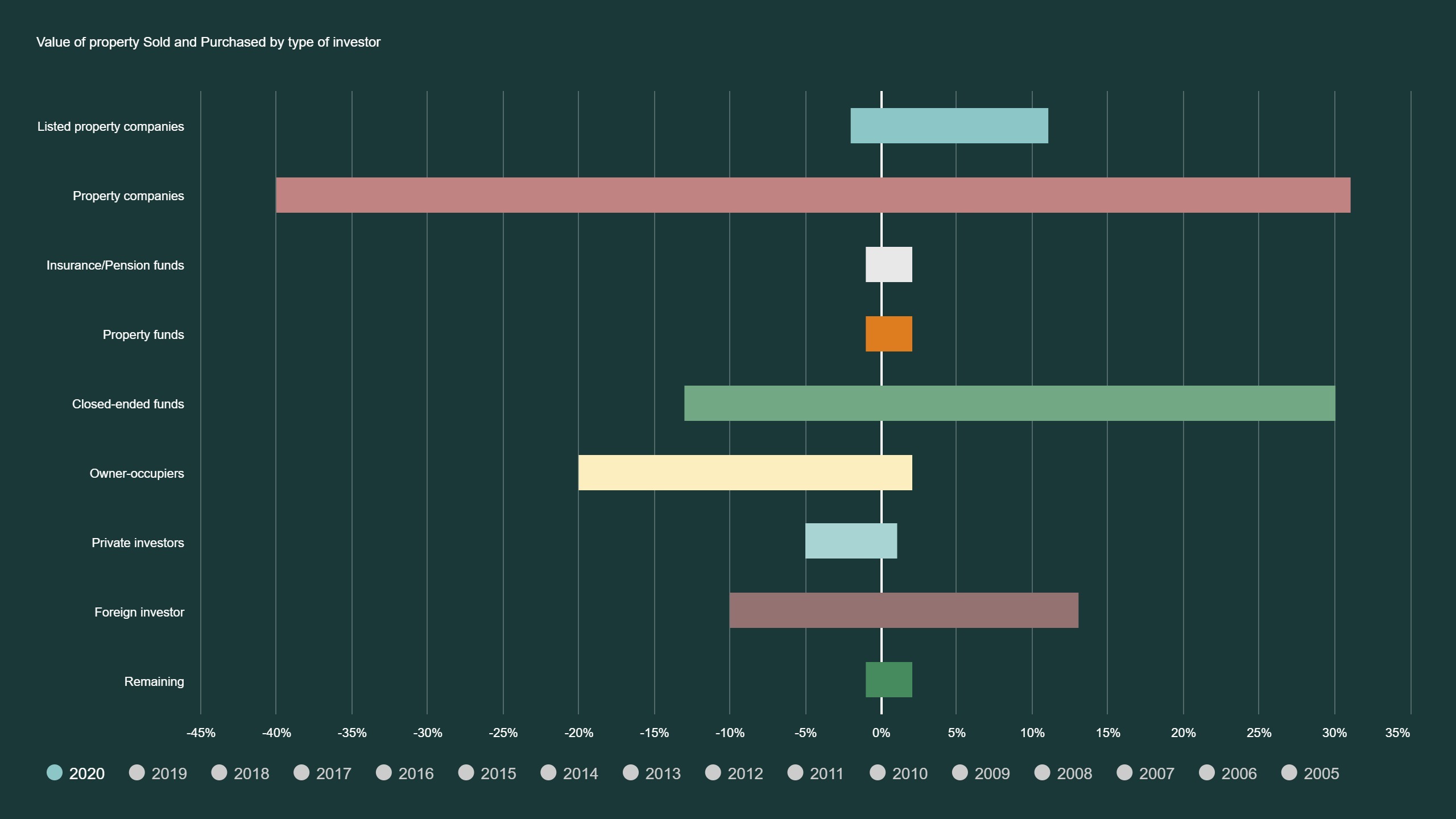

The Norwegian market now differs significantly from the general mood in the international commercial real estate markets, where transaction volumes are currently lower this year than in 2019. We believe that the main reason for this is the reduction in interest rates, which brought Norwegian returns on a variety of investments and asset classes down to almost the same levels as Europe in general, also allowing for lower hedging costs. Thus, real estate now attracts interest from a wide variety of investors. Most are domestic and need to expand their asset allocation towards real estate, but we also see renewed interest from international investors. We believe this latter effect happens partly due to the positive medium-term macroeconomic forecasts, where Norway is not affected as much by the pandemic, relatively speaking. The reasons given for this, are usually the solid financial situation for the government and significant stimulus packages, plus the economy’s low dependence on vacation travel, as many more Norwegians take vacations abroad compared to the number of foreigners coming into the country, in a normal year.

Some high-profile office property transactions in central Oslo have happened since our last update in September. These are Tjuvholmen Allé 1-5 at close to 2bNOK, H. Heyerdahls gate 1 at above 1 bNOK, and Kongens gate 21 “Telegrafen” at above 2 bNOK. All of these are fully let, and the two latter are older, refurbished properties. Add to this the major land plot transaction next to Aker Brygge in the Prime area, with 26,000 zoned m2 office at a price of 65,000 NOK/m2, and the Oslo CBD office market has had its best year since before 2007, and probably ever.

The buyer of both the land plot and of the H.Heyerdahls gate 1 is Ferd, a high-profile family office. The activity of such buyers has increased strongly in 2020, and this is likely to fuel more interest from other national and local investors with background and money from consumer goods, maritime shipping, or other industries. Also, the syndicate/closed-ended fund investment banks and their retail investors will be encouraged by this observed activity. The confidence of the market is very solid.

So far in 2020, domestic buyer segments are most active, but the public bids from Swedish companies SBB and Castellum for Entra is an example of continued international interest, which might for the moment be concentrated on larger deals.

Office

The expected downwards pressure on office rent levels does not appear to happen at levels expected in early Q2, however, some lease agreements are being signed on lower levels compared to pre-Covid. In terms of transaction volume, the office share is relatively stable compared to previous years with 40%. In addition to CBD assets, regional assets with public sector counterparts are experiencing strong demand.

The largest single asset transaction in Norway took place in Q4 when the listed Norwegian Property acquired the Telenor HQ on Fornebu. With a deal value of BNOK 5.45, it is the largest single asset deal since the DNB HQ in Barcode was sold in Q1 2019.

Retail

The overall retail market is under pressure due to the effects of the pandemic. However, the changing shopping patterns are redistributing retail turnover. The long-term effects are still unknown, but the most notable change is the investor interest for big-box assets, especially with grocery- and DIY (home building stores) counterparts; both have over-performed in store turnover in 2020, due to consumers’ choices when limited from traveling or dining at restaurants.. Some shopping centres have also entered into exclusivity, though on discounted pricing. This is not new, as shopping centres were already under pressure before Covid-19.

Logistics

Several large logistics transactions have taken place, including the 3bn transaction of COOP’s main distribution centre on Gardermoen. The deal size surpassed NOK 3 billion, and the cap rate is below 4%. Other prime logistics assets have also entered exclusivity, both on Langhus, Berger and Vestby. In line with the trend observed over the last years, logistics assets are increasing in popularity, and possible yield compression is expected for prime assets over the years to come. Logistics now appear to be on track for 15-20% of the total volume, significantly higher than average, and a lot more than last year’s 6%.

Alternatives and residential

After a brief slowdown in early Q2, the residential market has been strong in 2020, following up the record activity in 2019. Landmark transactions such as the NRK land plot at Marienlyst, and the divestment of Veidekke Eiendom and Neptune Properties have contributed to a significant residential project volume also in 2020; it might even surpass last year’s record share of the total volume, which was 17%. Rallying residential prices and political pressure to speed up zoning processes are likely to further fuel the market in the near future.

2019 was a major year for social infrastructure, with several large kindergarten portfolios changing hands. This has continued in 2020, with SBB’s purchase of the kindergarten operator Læringsverkstedet’s sale- and-leaseback. The Krona portfolio in Kongsberg is another example of a regional asset with public counterpart achieving sharp pricing.

Oslo market performance

- The Oslo market accounts for more than half of the YTD volume in Norway, mainly driven by large office deals in the CBD.

- As there have been no clear signals of a significant decline in rents, or office demand, the confidence of owners is solid; this benefits Oslo more than other European large cities.

- Many assets have now appreciated in value, and owners can be expected to sell some of them to secure profits.

Outlook

- We expect investment volume of NOK 110-120 billion for the full year 2020, not counting any change in the status for Entra.

- Yields are expected to be stable for 2021 after a solid decrease this year.

- Transaction volume for 2021 is expected to remain high, as more private and institutional investors will continue to re-balance their portfolios to include more real estate, as other assets offer low returns; also as a function of more pension savings.