Nedre Slottsgate has dethroned Karl Johans gate as the street with the highest rents

Recent signings in the luxury segment display a new and interesting pattern in the Oslo high-street market where the next-door brand drives rent rather than footfall.

After Søylen Eiendom acquired Steen & Strøm Magasin in 2011, Nedre Slottsgate, between Karl Johans gate and Prinsens gate, has been transformed into the leading luxury street in Oslo with several luxury and high-end brands entering the market since then.

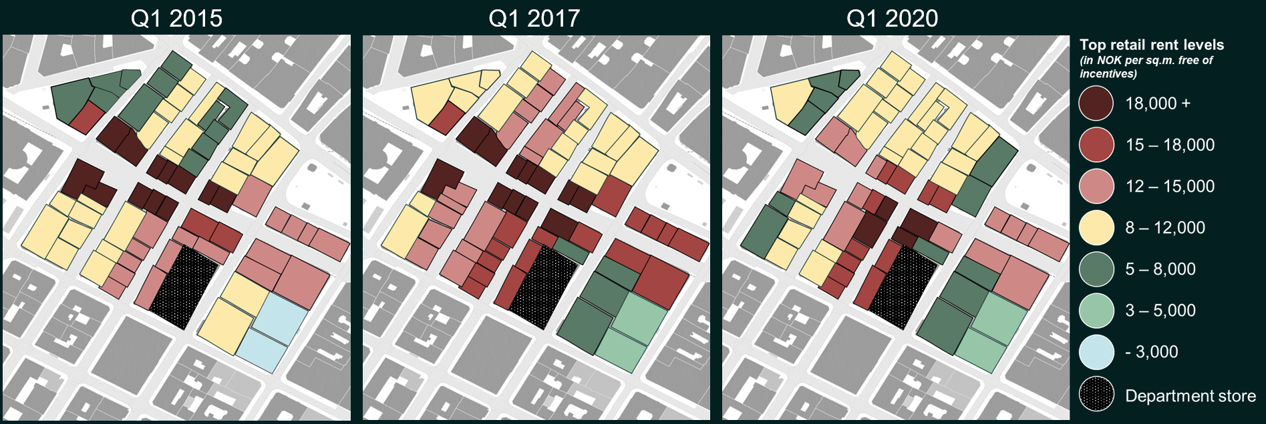

Back in 2015, four luxury brands were established in the street and several more brands were in pipeline. The first brands to open a store got first-mover advantage with lower rents and were anchoring the street and making it more attractive for the next luxury retailer. At this time, the highest footfall, which was and still are achieved in Karl Johans gate, generated the highest rents.

In 2017, the number of luxury brands present in this part of the Oslo shopping area had increased substantially, with both new brands entering the Norwegian market as well as existing brands relocating like Louis Vuitton that decided to move their store from Akersgata to Nedre Slottsgate. At this point, Nedre Slottsgate experienced the highest rental growth among the main retail streets in Europe. However, the highest rents were still achieved in Karl Johans gate.

Today, this part of Nedre Slottsgate is more or less fully occupied by prime luxury and high-end brands. Recent signings in the luxury segment display a new and interesting pattern where Nedre Slottsgate has dethroned Karl Johans gate as the location with the highest rents. The next-door brand drives rent rather than footfall, and brands are now willing to pay a higher rent for a Nedre Slottsgate location. As of today, several luxury brands are not yet present in Oslo, and according to Annette Lund in Promenaden Management, they will continue to open new luxury and high-end stores and they have a great line-up of new brands entering the market in the coming years. The question is, where will the next luxury brand locate when Oslo’s luxury street has no vacant space? And will the rent level in this part of Nedre Slottsgate continue to experience an upward pressure from prominent luxury tenants, both existing tenants up for renegotiation and new brands entering the market, wanting this specific address?

Please see the development in ERV since Q1 2015 below.