Retail Market Update Q1 2021

With 2020 behind us, it is interesting to see how the pandemic has affected the Norwegian retail market. Covid-19 has undoubtedly affected our consumption patterns, but what are short-term effects, and what will the new normal look like?

Retail Sales

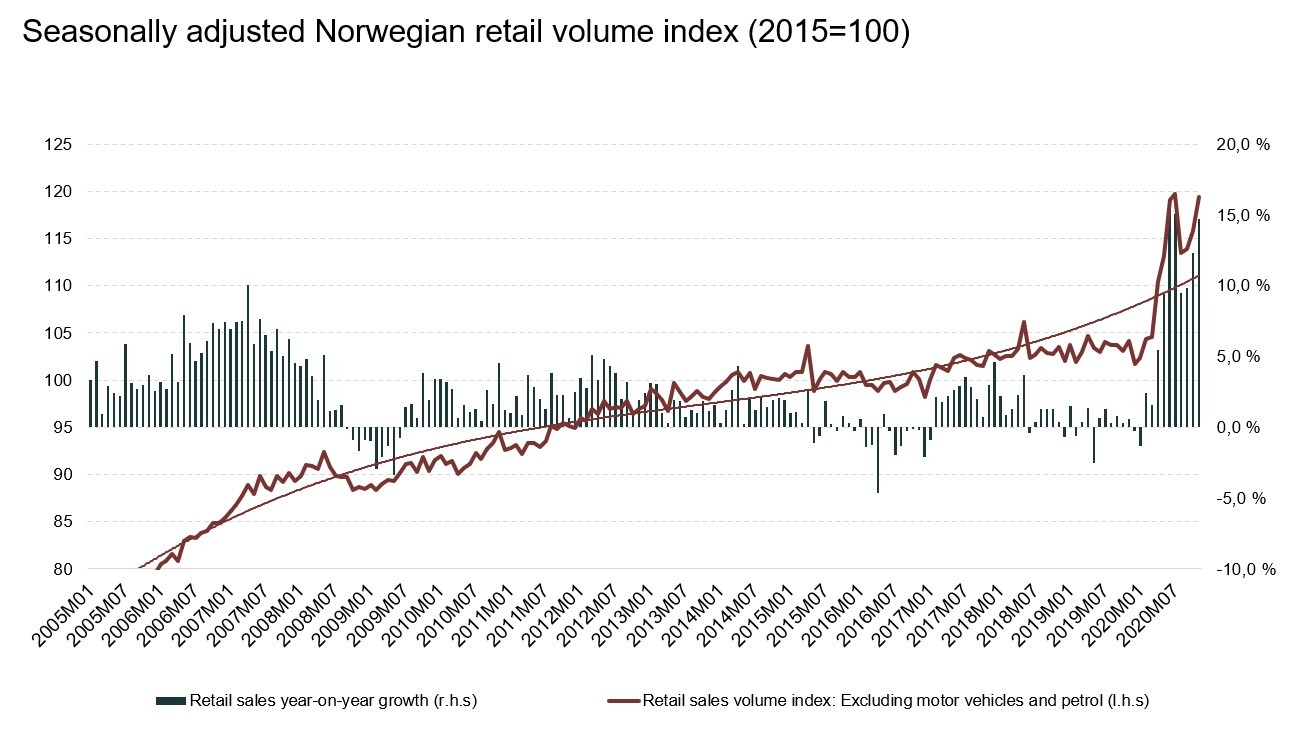

Retail sales and goods consumption have continued the positive development throughout 2020, and retail sales were 12.9% higher in November 2020 compared to November last year. During 2020, the Norwegian consumers have changed their consumption pattern in the direction of spending less on services, and more on goods. This trend can be explained by restrictions and regulations introduced to limit infections. According to DNB Insight, a team established in March 2020 to analyse the direct and indirect effect of Covid-19, DNB’s customers (more than 1.4 million private customers) increased goods spending by 8% while they reduced their spending on services by 23%.

DNB’s customers increased retail spending towards the end of 2020, and on average they spent NOK 20,000 in the period between 1 November and 24 December, an increase of 15% compared to the same period last year. However, due to the pandemic, a considerable share of the Christmas shopping was moved to November this year. Both physical and online shopping have experienced a solid increase during this years’ Christmas shopping, but due to the ongoing pandemic the online channel has experienced the largest increase with a total increase of 56%. In addition, the consumers have been out shopping fewer times, but have spent more money when shopping.

Norwegian shopping centres’ turnover decreased by 1.1% during the first half of 2020. However, local shopping centres and regional centres have both experienced growth compared to 2019, while city centre locations have experienced a significant drop in revenue. Shopping centres located close to residential areas, and car-based shopping centres have experienced a solid number of visitors and growth in turnover. As Oslo city centre is almost car-free, and the consumers are advised not to travel by public transportation unless strictly necessary, the number of visitors are naturally down.

The Retail Leasing Market

The low activity in the retail leasing market has continued in 2020, mainly due to the pandemic. The uncertainty related to when the pandemic will end has created a vacuum, in which retailers are postponing expansion decisions.

However, some areas in central Oslo, including Bjørvika and Valkyrien (Majorstuen), have experienced a solid number of new contracts signed even during the pandemic. According to Carl Erik Krefting in Carucel Eiendom, they have signed 17 new contracts in Bjørvika between April and mid-December. The new shopping destination at Majorstuen, Valkyrien, opened in April 2020 with several fashion and F&B concepts, and has experienced a positive response from customers since opening. Towards the end of 2020, Moniker decided to open its third store at the shopping centre, Moniker Man. In addition, Promenaden Management have signed three new contracts in the Promenaden Fashion District, all at solid levels.

Based on recent signings, the rent level development in both the Karl Johans gate area and Majorstuen are considered stable. Bjørvika, the new hot-spot in Oslo, has experienced a positive development in rent levels and the rent levels are expected to continue to grow going forward.

High-street Retail

According to Annette Lund, CEO and Portfolio Director at Promenaden Management, they experienced a double-digit growth in the first months of 2020, followed by a dramatic decline in both visitors and turnover following the initial lockdown in March. The performance over the summer months was solid as the Norwegian consumers decided to spend their vacations at home and were willing and able to spend money. Due to the second lockdown and the lack of domestic and international tourism in Oslo, the second half of 2020 was weaker than expected.

As a response to lockdown, social distancing and increased use of home office, the Promenaden Fashion District has seen a dramatic drop in footfall traffic during 2020. However, turnover has not experienced the same drop, which indicates that the shopping basket is larger, and that the consumer spends money when visiting city centre locations, rather than just window shopping. The winner has been luxury goods, while F&B and fashion has seen a decline in turnover.

Expansion Activity

If we look at the retail expansion activity, which is important to predict future development in the real estate industry, this came to a complete stop 12 March. Confidence grew after Easter and towards the summer, and many retailers were looking forward to August where expansion activity was expected to pick up again. However, Hurtigruten, a cruise/ferry route along the coast of Norway and students returning to university and hosted their parties experienced larger outbreaks of COVID-19. When these seemingly innocent events resulted in such dramatic impacts on the society, retailers and F&B operators were frightened, and expansion halted to an almost complete stop. For the F&B operators this was strengthened during “lockdown 2.0” in November when restaurants in Oslo were not allowed to sell alcohol.

Going Forward

Consumption patterns have changed due to the regulations introduced to limit the spread of COVID-19. However, going forward, we expect the consumer to return to spending more on services and less on goods, which is in line with the long-term trend seen prior to the pandemic. The increase in retail sales in 2020 can largely be explained by the reduction in international travel, improving the Norwegian consumer’s economy and increasing overall domestic spending. Once international travel restrictions are lifted, more money from Norwegian consumers is expected to be spent abroad.

Growth in e-commerce is not a new trend, but this is a channel that has experienced exceptional growth throughout 2020. When we leave the pandemic behind us, we expect the growth in e-commerce to return to its former pace, as many consumers will return to physical stores. However, the pandemic has led to a larger customer group to shop online; online grocery shops being the clear winner. Prior to the pandemic, the e-commerce channel was mainly used by younger generations. In 2020, unsurprisingly, this channel has witnessed a strong growth also among the older generations. Some of the online grocery customers will return to physical stores, however, some will remain online shoppers also after the pandemic, enjoying the convenience of home delivery and time saved from visits to crowded stores during rush hours. In addition, several retailers now offer delivery directly to people’s front door at no extra cost, making the online experience even more smooth.

City centre locations are expected to experience an increase in number of visitors once people return to their offices, travel by public transportation, and feel safe in crowded areas again. Tourists will also return. However, home office and more flexible working solutions are here to stay, and the total number of employees at the office is expected to be lower than before.

Prior to the pandemic, the F&B sector experienced the strongest improvement in the Norwegian retail market, but has suffered during 2020 due to alcohol serving restrictions and social distancing. This sector is expected to see a solid boost in the number of guests and turnover when we are back to normal as the consumer is eager to socialise and get out of the house. In the longer run, the sector is expected to return to pre-lockdown levels. Fingers crossed that they will survive until then. Fashion was already struggling prior to the pandemic and has continued to struggle through this period. The fashion retail segment will need to adapt to the new retail landscape in order to survive going forward.

The expansion activity in 2021 is determined by when the virus infection rate slows down and the government eases restrictions. Until then we will see renewals of existing contracts, some activity in development projects, and minor new entries. However, when the market stabilises, we believe that expansion will return back to normal levels. Retailers and F&B operators that have survived, restructured and adapted their organisations to suit the new reality, will use their strength to expand and increase their market cap.