Market Views, CRE | Favourable Market Conditions in the Last-Mile Segment

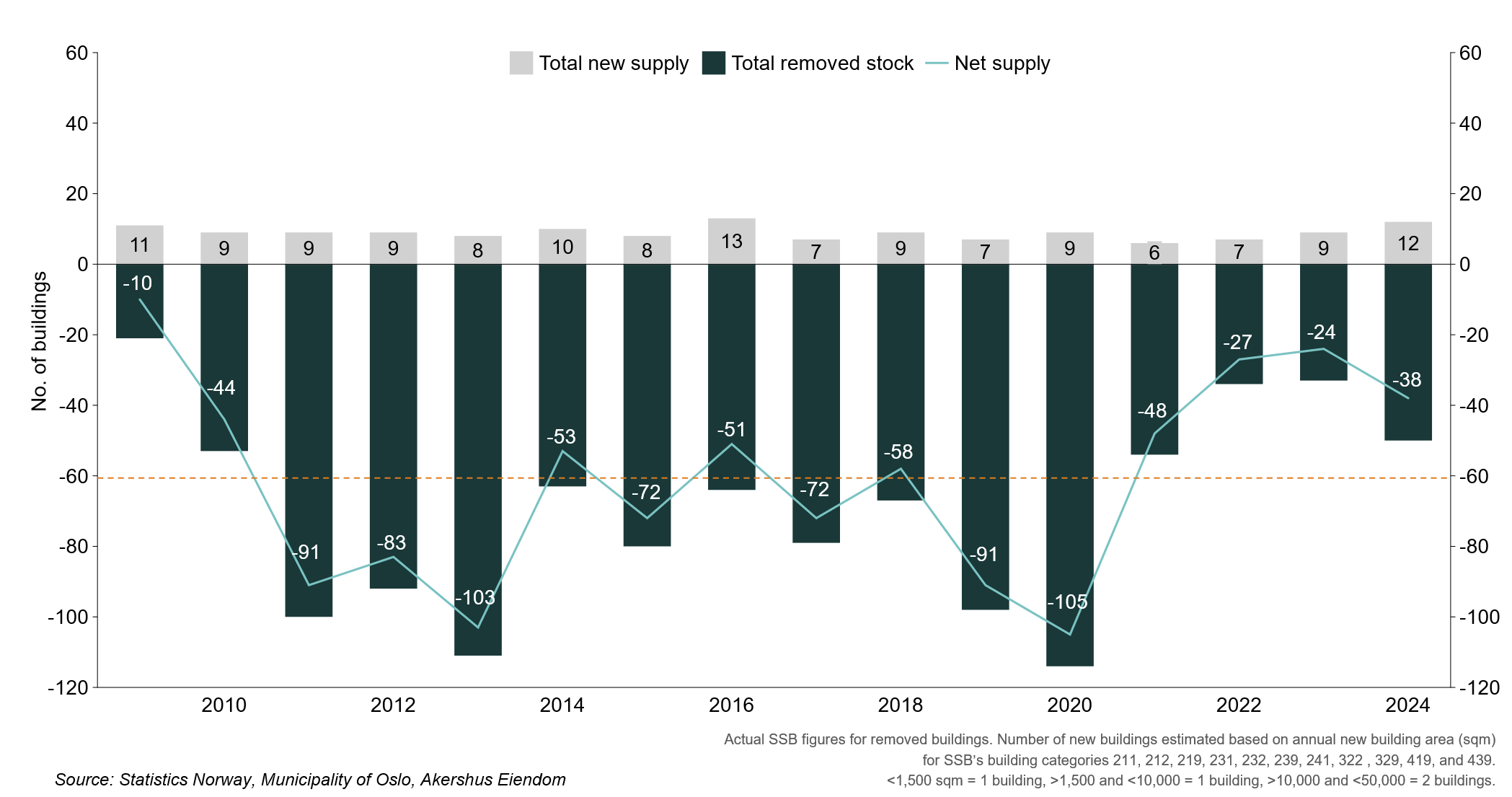

Limited new supply combined with the ongoing removal of logistics space from the market, largely due to conversions to alternative uses, is contributing to a tight supply side. Simultaneously, demand for centrally located premises remains strong, a trend we expect to continue. This is likely to drive rental growth for prime logistics properties in Oslo.

Summary

- Leasing activity in the logistics property market has gradually picked up over the past year, although occupiers have remained somewhat cautious. Interest rate cuts, however, have boosted sentiment, and we have recorded an increase in enquiries from companies seeking new premises.

-

As demand improves, we observe that supply in the most central parks remains constrained. Although vacancy has edged up slightly in recent years, it remains low. In addition, an increasing share of warehouse and logistics space in Oslo is being converted to residential and other uses.

-

Stronger occupier sentiment, combined with a tight supply side, is likely to put upward pressure on rents for warehouse and logistics space in Oslo going forward.

Constrained Supply

Although logistics vacancy has edged up in recent years, it remains low in Oslo, particularly among prime assets. Going forward, we expect vacancy rates to further decline in logistics hubs close to the city centre, where demand is strongest. This is largely due to the limited pipeline of new developments that meet the demand for modern, centrally located warehouse facilities, combined with the ongoing conversion of logistics space in Oslo municipality, primarily into residential use. This trend is expected to continue, driven by urbanisation and city development.

Figure 1. Net addition of warehouse, light industrial and logistics space for last-mile purposes in Oslo

Rising Demand

Leasing activity in the logistics market has gradually improved over the past year, although occupiers have remained somewhat cautious. However, interest rate cuts in both June and September have boosted sentiment, and we are now observing increased enquiries from companies seeking new premises. Notably strong activity has been recorded in Groruddalen and Alnabru. This last-mile area consists largely of mixed-use and older stock, but the location makes it attractive to small and mid-sized occupiers seeking proximity to both the city centre and their customer base. Akershus Eiendom has signed approximately 25,000 square meters in this area over the past year.

There is also strong appetite for new developments. The “flight-to-quality” trend, which has been a key driver in the office market in recent years, is now also evident in the logistics segment. The most attractive products, typically newer buildings with strong environmental credentials in central locations, are experiencing significant demand. A similar trend is observed across Europe, where new developments meeting high sustainability standards have set new benchmarks for rents and contributed to solid rental growth.

Several major lease expiries in the coming years are expected to fuel activity further and initiate new development projects to meet occupier demand. Given the scarcity of development opportunities in Oslo’s most central logistics hubs, some occupiers may prioritise quality over location and establish operations outside of Oslo. Gardermoen, with its abundant land availability and strong development potential, could become a winner among more demanding occupiers.

In addition to improved occupier sentiment and several major expiries, other factors point towards rising demand for warehouse and logistics space. Heightened geopolitical risk, increased trade barriers, and growth in industries such as pharmaceuticals and defence are expected to drive further demand for production and storage facilities. Similar patterns are already evident in European markets. According to JLL’s last market report, demand is being stimulated by the development of artificial intelligence as well as Asian e-commerce platforms increasingly shifting focus from the US to Europe in response to high tariffs against China.

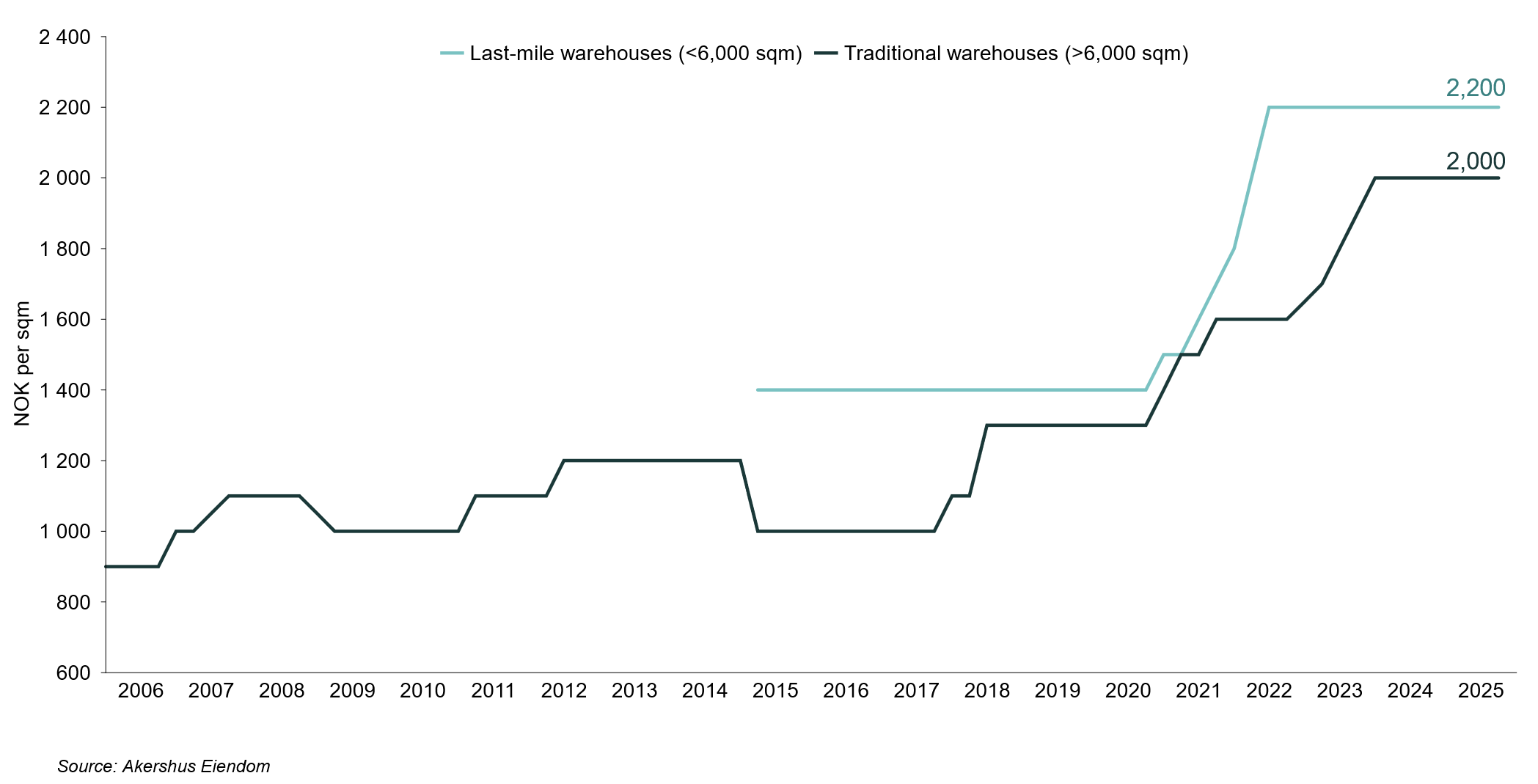

Rental Levels Stabilised at Elevated Levels

Despite increased uncertainty, more cautious occupiers and a modest rise in vacancy, rents have stabilised at high levels in Oslo. According to our observations, prime rents remain at NOK 2,000 per square meter for larger units at Alnabru and NOK 2,200 per square meter for smaller, centrally located last-mile properties.

Figure 2. Likely upward pressure on rental levels in Oslo

Conclusion

Looking ahead, a constrained supply side in Oslo, combined with expectations of sustained occupier demand, is likely to drive further rental growth for prime logistics assets. The market remains selective, however, with older buildings in less attractive locations not experiencing the same upward pressure.