Market Views, CRE | The Office Market is Stabilising

There has been lower activity in the office market over the past year. Signing volumes have fallen from record highs to around the historical average, and tenants have been more cautious in their office decisions in a volatile and uncertain market. Going forward, employment growth will likely be supported by interest rate cuts, and we expect this to contribute to a stabilisation of the office leasing market.

Summary

- After a period of unusually high activity in the office leasing market in 2022 and 2023, the market has slowed, and take-up is now around the historical average.

- This aligns well with the findings from this year’s Space Requirements Survey, which shows that tenants, as was the case last year, are somewhat more cautious in their office decisions and that demand has stabilised.

- Office vacancy has remained largely unchanged over the past year, just below historical averages, while rents have stabilised at high levels.

- Looking ahead, we expect a continued stabilisation of the office leasing market, with vacancy remaining unchanged and rental growth limited to CPI.

Activity has slowed down

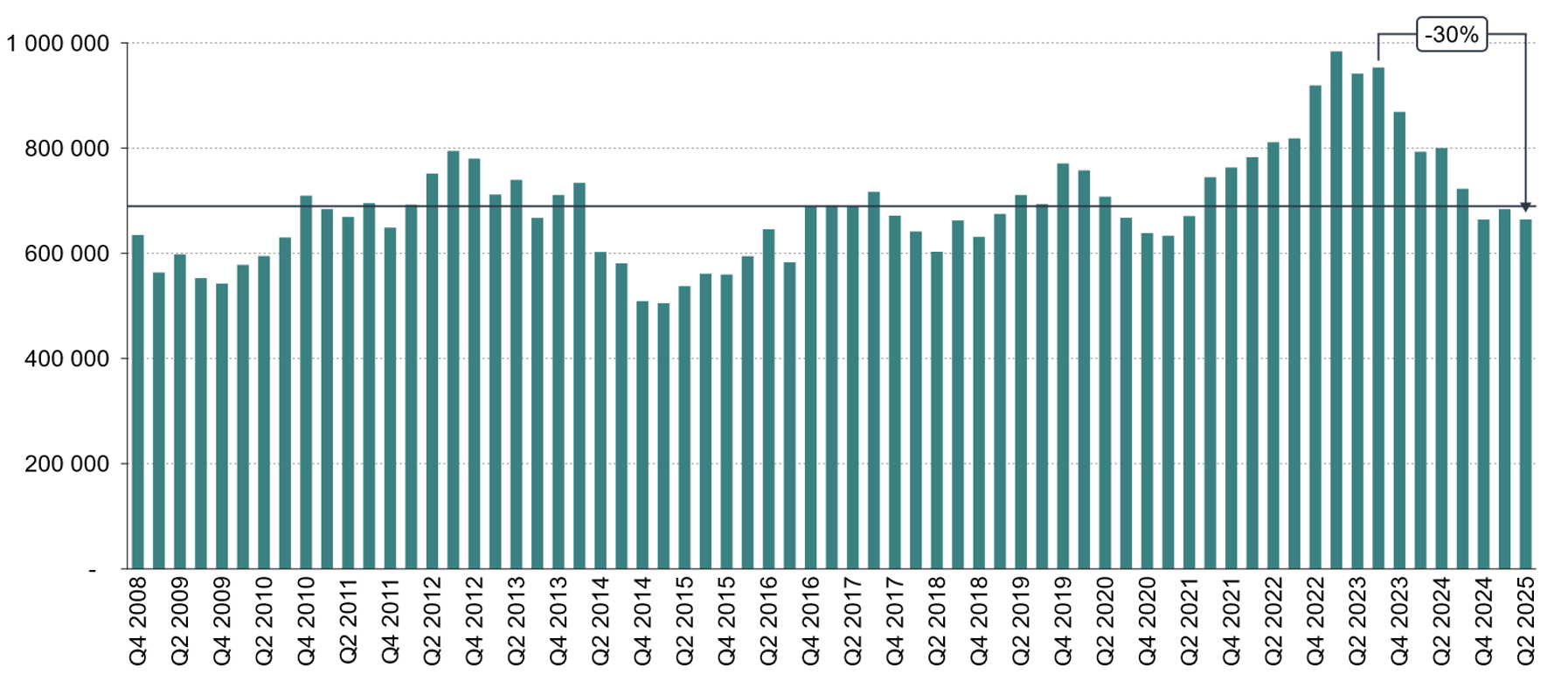

After a period of unusually high activity in the office leasing market, the market has slowed, and signing volumes are now significantly lower than in 2022 and 2023. However, compared to historical levels, signing volumes over the past year are only marginally below the historical average.

Figure 1: Take-up Oslo

As described in a previous analysis (in norwegian), one likely reason for the lower volume over the past year is the limited number of lease expirations in 2026, which affects signing volumes 1–2 years in advance. This is particularly true for the largest tenants, and our observations show an unusually low number of leases (including renewals) of 10,000 square meters or more over the past year. Another likely reason is a slower labor market in Oslo over the past year. This is confirmed by our annual space requirements survey, where we measure the pulse of the leasing market by examining the demand for space among companies that have either recently signed a new lease or are actively looking for new offices.

Demand for space is easing

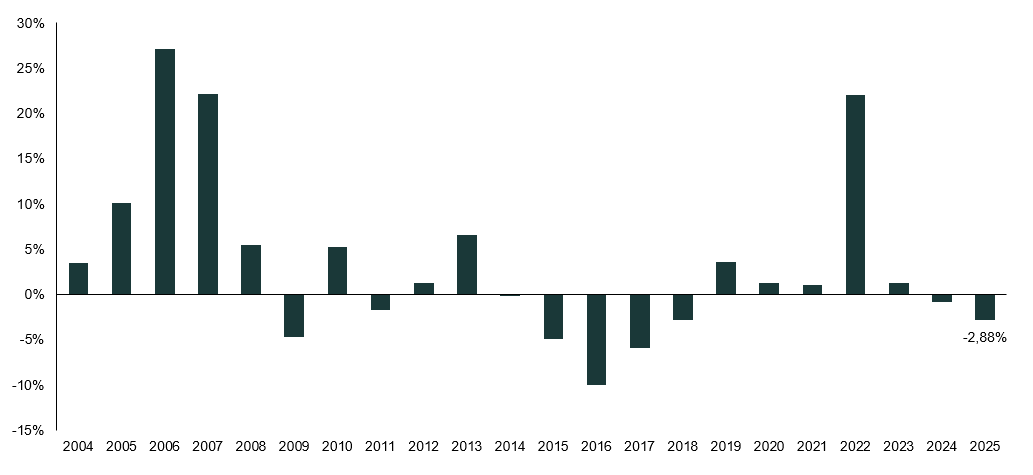

This year’s office space demand survey shows that office users on average are seeking around 3 percent less space than what they currently occupy. This is lower than what we have observed in recent years, when tenants on average were looking for more space than they already had. The results reflect a more cautious market, where tenants are more careful in their office decisions.

Figure 2 – Office Space Demand Survey – total

The survey shows, as in previous years, that it is primarily the largest companies with a long tenure at their current location that are driving down space requirements. These are companies that often have the ability to further optimise efficiency and therefore can take less space.

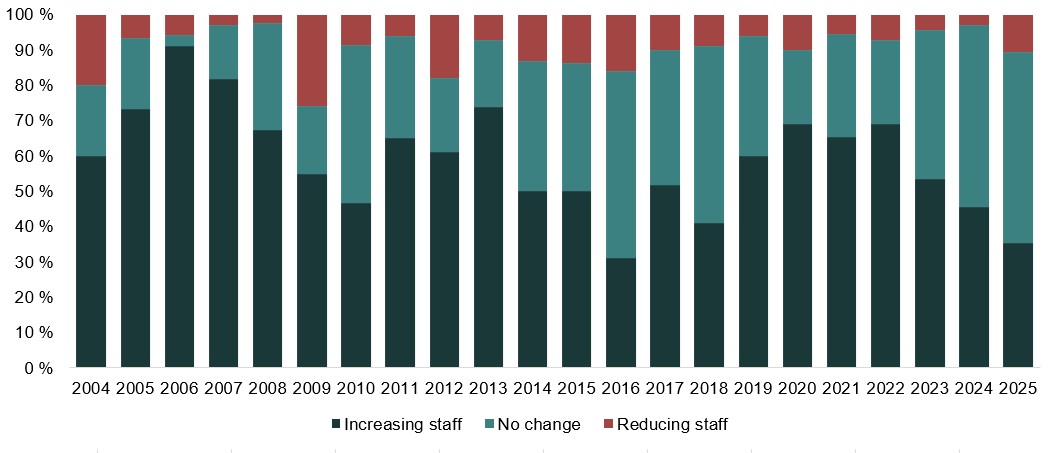

A key finding in this year’s survey is that more companies report that they are planning staff reductions. Just over 10 percent of the companies we have been in contact with state that they intend to reduce headcount going forward. This is a significant increase compared with the previous four years, when very few reported the same. Furthermore, this year’s survey shows that a clear majority of 54 percent expect the number of employees to remain unchanged, well above the ten-year average of 37 percent. This aligns with the fact that employment growth and the labor market have normalised following the post-pandemic recovery. Taken together, the results indicate a more cautious sentiment in the labor market.

Figure 3: Office Space Demand Survey – share of companies planning to increase/reduce staff

Stable development in rents and office vacancy

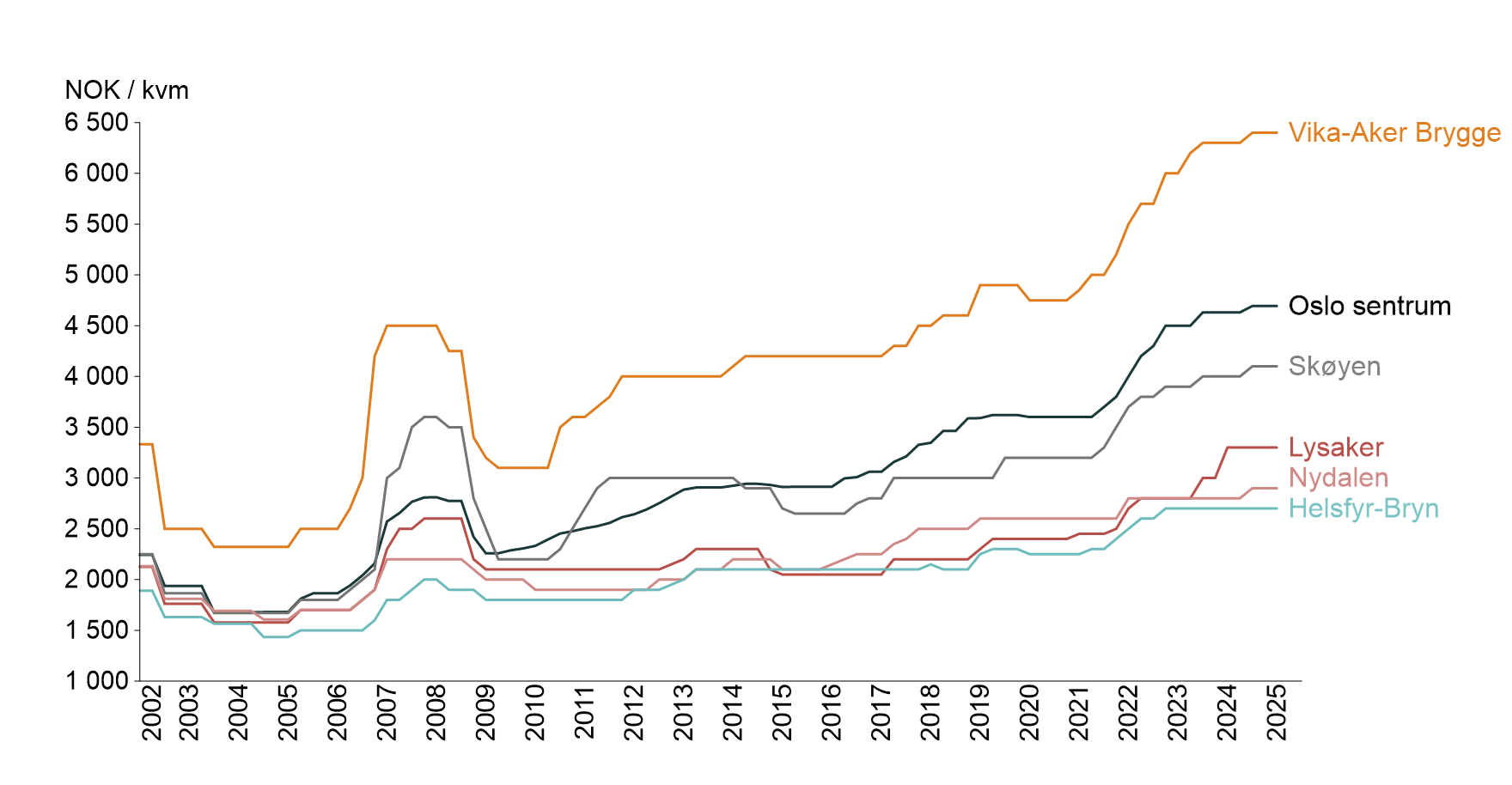

Despite a slower leasing market over the past year, office rents in Oslo have stabilised at a high level. In particular, prime assets like prestige offices with central locations, high quality, and a strong ESG profile have experienced further growth, driven by selective but solid demand. In addition, high fit-out and refurbishment costs have helped keep rental levels elevated.

Figure 4: Rental price development

Office vacancy in Oslo has gradually increased in recent years, but over the past year it has leveled off at current levels. Overall office vacancy now stands at 6.5 percent, while the city center is at 5.7 percent. For the city center, there has been a slight increase over the past year, partly due to OBOS relocating to Construction City and the addition of their former premises in the center. Despite this increase, vacancy in the city center remains low, and the supply of high-quality space is limited.

Figure 5: Development office vacancy

The stability in the market is the result of a combination of several factors. On the demand side, interest in the top segment remains strong, while on the supply side, very little new space is expected to come onto the market in the short term. Although activity levels are more subdued, both rents and vacancy have remained stable over the past year.

Stable development in the leasing market ahead

Looking ahead, we expect a stable development in the office market with signing volumes returning to normal levels, vacancy remaining unchanged, and rental growth limited to CPI, driven by prospects of a more normalised labor market. Several major lease expirations in the coming years, along with a number of larger companies currently searching for new premises, could contribute to increased activity and eventually trigger new office developments.