Market Views, CRE | Hotels Emerging as an Attractive Asset Class

We are currently experiencing solid interest in hotel real estate. Unlike other property segments, hotel assets did not see the same level of value appreciation during the pandemic. However, strong recovery in key performance indicators and positive future outlooks have contributed to making the hotel segment increasingly attractive today.

Summary

- Hotel properties did not experience the same value growth as other segments during the pandemic. However, the sector recovered much faster than initially expected, and the outlook for both hotels and the broader travel industry remains positive. As a result, hotels are now viewed as an attractive investment.

- This has contributed to strong investor interest and increased global transaction volumes for hotel assets, with particularly robust growth in Europe, where several large-scale deals have driven activity.

- Looking ahead, we expect to see a higher number of hotel transactions, a broader pool of buyers, and sustained interest in both urban hotels and destination resorts.

Limited Value Growth During the Pandemic

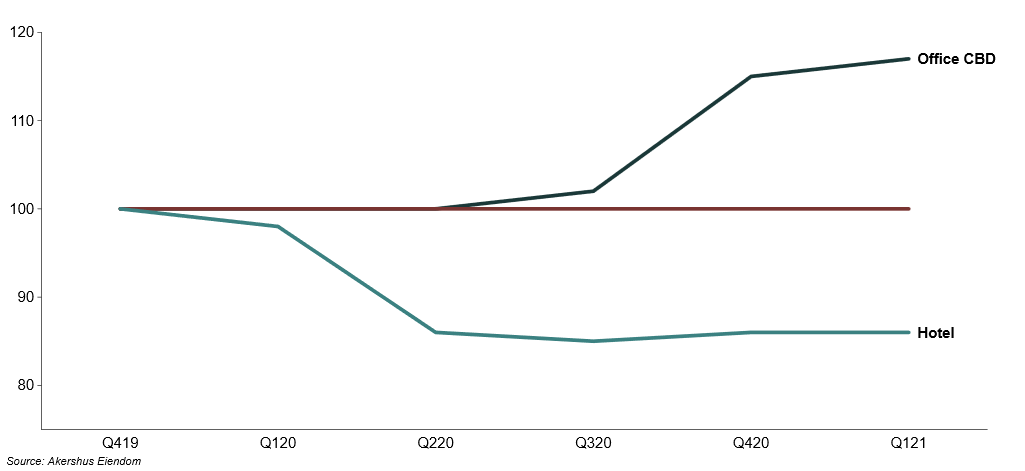

Hotel properties did not experience the same value growth as other real estate segments during the pandemic. Rapidly falling interest rates drove significant value appreciation in most segments, but for hotels, high uncertainty and a sharp drop in revenue offset this effect, resulting in value declines of 10–20 percent through much of the pandemic years.

Figure 1: Value Index through 2021

As interest rates began to rise, hotel assets were already offering relatively high yields, providing a buffer compared to other segments. This has helped rekindle investor interest after historically low activity during the pandemic.

Strong Underlying Fundamentals

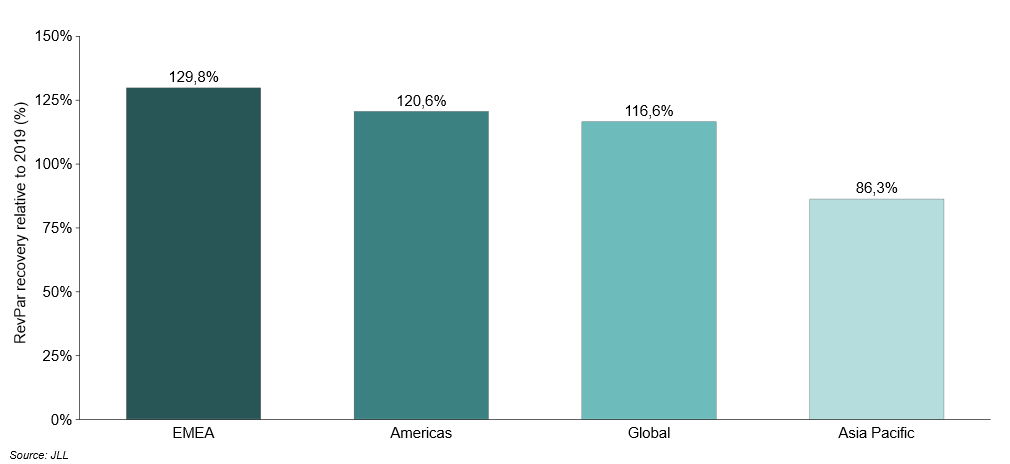

Global travel has rebounded much faster than initially expected. Both in Norway and internationally, the hotel sector has seen a strong post-pandemic recovery. This mirrors patterns seen after previous global shocks, such as 9/11 and the financial crisis, where demand for hotel stays proved resilient.

Figure 2: RevPAR Recovery by Region

As described in the macroeconomic section of this report, Norwegian hotel stays have recovered significantly, with several trends indicating continued growth in the domestic market.

While demand has returned, increased financing and construction costs have limited the supply of new hotel rooms in most markets—a trend likely to persist. This supports the potential for further value creation in the hotel sector.

These solid fundamentals are expected to continue fueling strong investor interest in hotel properties.

The Nordics Stand Out

In recent years, shifts in travel patterns have enabled Northern Europe to gain market share from more traditional destinations. Favorable currency exchange rates, scenic nature experiences, a cooler climate, and a strong sense of safety have made the Nordic region particularly attractive—both now and moving forward. According to JLL, demand in the Nordic countries significantly exceeds supply compared to other European markets. This has opened the eyes of a broader group of investors to Nordic hotel real estate, a market traditionally dominated by domestic buyers.

Increased Global Transaction Activity

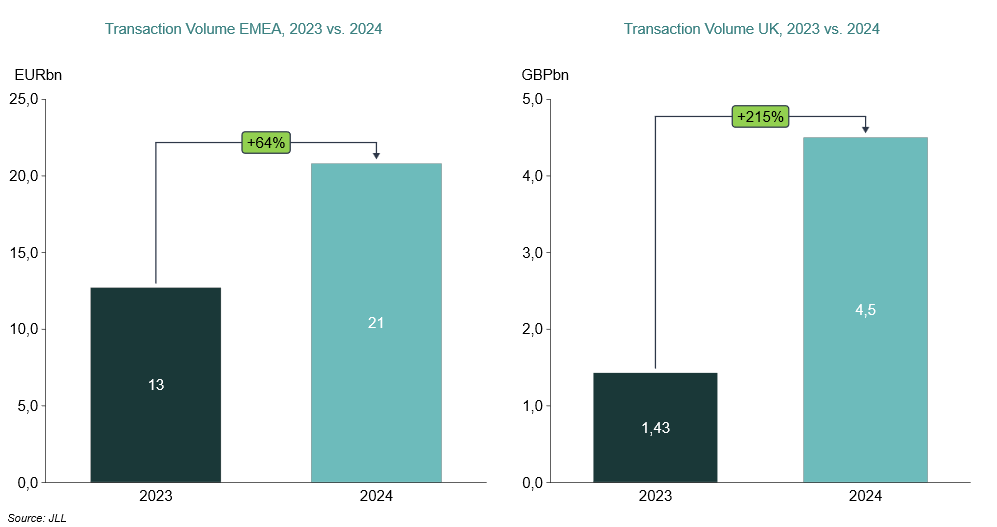

The robust recovery and positive outlook for the sector have translated into increased transaction activity. Globally, hotel transaction volumes rose by a modest 7 percent in 2024 compared to 2023. However, JLL expects this positive trend to continue, forecasting an increase of 15–25 percent in 2025. In JLL’s annual investor sentiment survey, a record-high 80 percent of respondents indicated they plan to maintain or increase their hotel investments in the coming year. Additionally, 78 percent stated they expect to invest in urban markets and large cities with solid prospects—reflecting a broader investment trend toward perceived safety.

That said, regional differences remain substantial. Europe saw particularly strong growth in 2024, with transaction volumes increasing by 64 percent. In the UK, growth was even more pronounced, with a 215 percent increase compared to 2023.

Figure 3: Transaction Volume in EMEA and the UK

This sharp increase is largely due to several major portfolio and M&A transactions. One example is ADIA’s sale of a 33-hotel portfolio in the UK to KKR and Baupost for £897 million—the largest real estate transaction across all segments in the UK last year. A similar trend is seen in the Nordic region, where CapMan Hotels II’s acquisition of Midstar Fastigheter marked the largest hotel transaction ever in the Nordics, comprising a portfolio of 28 hotel properties in Sweden, Denmark, and Norway.

Strong Interest in the Norwegian Market

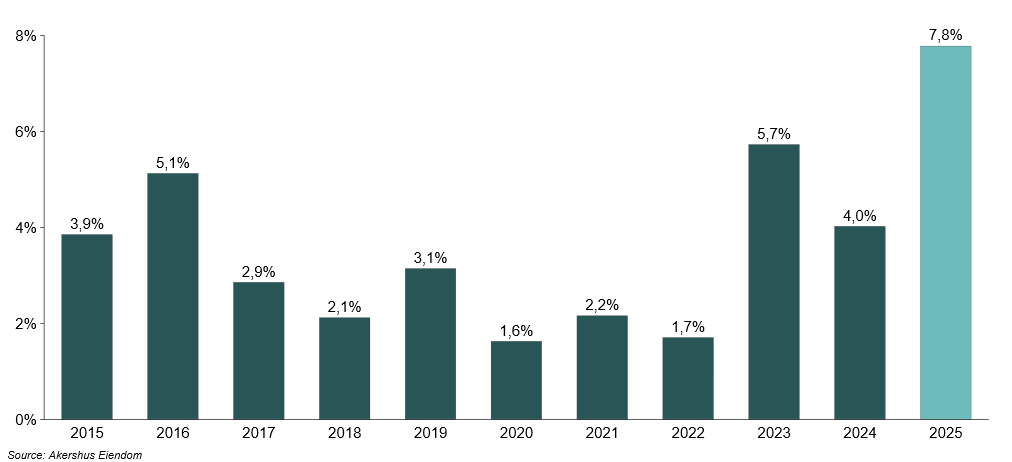

Historically, hotel assets have made up a small share of total real estate transactions in Norway, averaging just under 4 percent over the past decade. So far this year, that share has doubled—mainly due to the Midstar portfolio transaction. We have observed consistent investor interest in hotel real estate, although a lack of quality assets has kept transaction volumes low.

Figure 4: Hotel Share of Total Transaction Volume

The Norwegian transaction market has also been dominated by domestic buyers, who accounted for nearly 85 percent of transactions over the past decade. This trend is mirrored across the other Nordic countries, where the hotel investment market has traditionally seen high shares of domestic and pan-Nordic investors. However, this may change going forward, as several factors—outlined earlier in this report—make Norway and the broader Nordic region increasingly attractive.

Excluding the Midstar portfolio, recent hotel transactions have primarily involved centrally located assets in major cities. This trend is consistent globally, and we expect sustained interest in such assets. In addition, hotels in key tourist destinations—such as Tromsø, which has seen remarkable growth in recent years—stand out, and we anticipate strong investor interest in similar destinations going forward.

Conclusion

Strong underlying fundamentals and continued positive outlooks have driven increased demand for hotel real estate—both in Norway and globally. Looking ahead, we expect to see more hotel transactions, a broader pool of investors, and sustained interest in both urban and destination hotels.