Market Views, ESG | Will Omnibus Ease Momentum for Green Office Space?

In 2024, we observed a marked increase in demand for green buildings, with the EU’s new corporate sustainability reporting directive (CSRD) serving as a clear catalyst. Now, with the introduction of the Omnibus package, the EU’s proposal to ease some of the newly adopted requirements, we might see ripple effects in the real estate market, albeit to a lesser extent than initially anticipated.

Summary

- In 2024, we observed a notable shift in the demand for green buildings, driven by larger corporations preparing for EU’s new sustainability reporting requirements (CSRD).

- EU’s proposal to simplify its recently implemented sustainability reporting directive – the Omnibus package – may potentially affect demand for green buildings. However, our analysis suggests the impact will be less significant than initially anticipated.

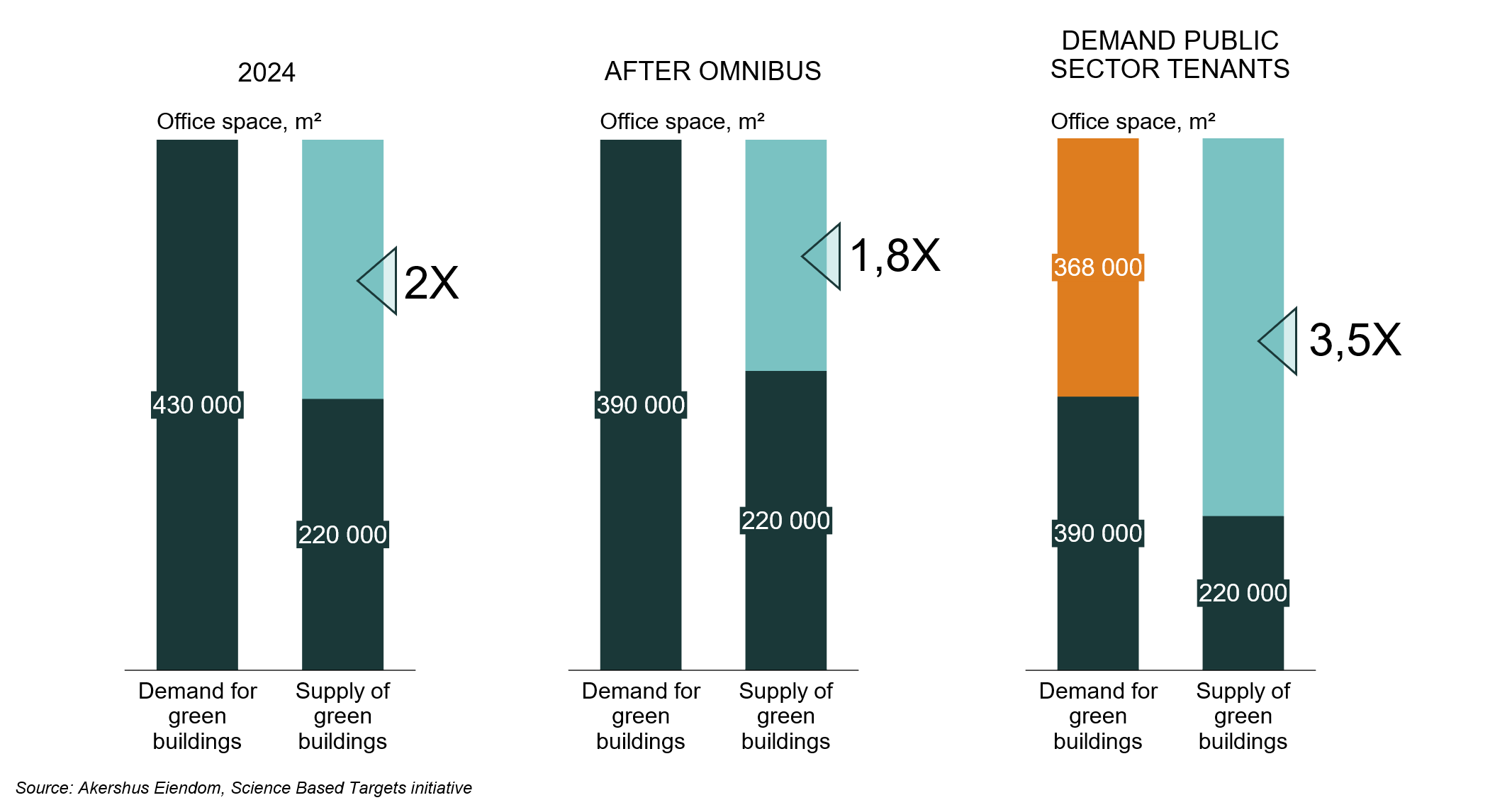

- Adjusted for the Omnibus package, our data indicates that demand for green buildings towards 2030 still exceeds the supply of taxonomy-aligned office space by 80 percent, down from 100 percent previously.

- If public sector office tenants in Oslo also begin demanding taxonomy-compliant buildings, demand could rise to as much as 3.5 times the expected supply.

A More Rational Approach to the Green Transition

A strong environmental profile is becoming a hygiene factor in many leasing and investment decisions across the property sector. Investors with access to the lowest cost of capital now place higher demands on a building’s environmental performance than they did just two years ago. At the same time, the high-payingtenants expect high standards, increasingly including high environmental standards. Banks are also continuing their targeted push to increase the share of green loans in their lending portfolios.

None of these trends appear to have been significantly affected six months after announcement of EU’s Omnibus proposal and Trump’s “anti-woke” rhetoric in the United States.

There are likely two main reasons for this:

- Omnibus represents a two-year temporary pause in reporting obligations, not a full retraction, and the real estate sector operates on long investment horizons.

- The green transition remains a strategic priority for many companies, even though the era of corporate declarations of ambitious “Net Zero by 2030” goals appear to be winding down. ESG initiatives today are expected to be tangible, verifiable, and impactful – and commercial real estate remains one of the most cost-effective and measurable pathways to meaningful environmental transformation.

The Omnibus Package’s Limited Impact on Demand for Green space

As Wiersholm outlines in part two of the analysis, sustainability reporting requirements would be eased if the Omnibus amendments are adopted. In particular, the employee threshold for CSRD reporting would rise from 250 to 1,000. This could lead some companies falling outside the reporting requirement to defer larger ESG initiatives. At the same time, many of these firms have already invested time and resources into sustainability reporting and embedded environmental commitments at the board and executive levels. Whether this will affect concrete, measurable measures, such as the decision to occupy more environmentally friendly premises, remains to be seen.

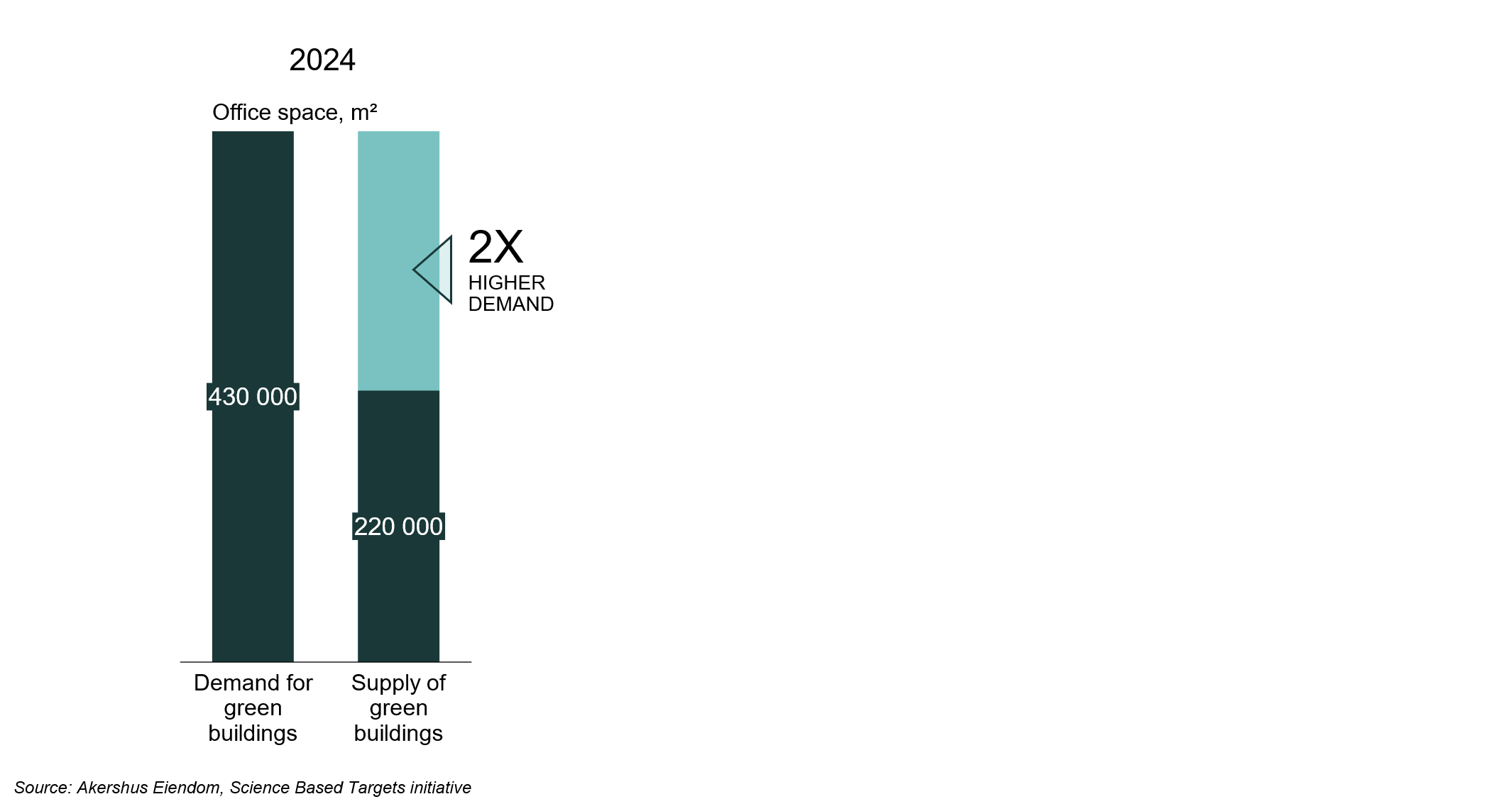

In April last year, Akershus Eiendom conducted an analysis of anticipated demand for green office space over the coming years. The study focused on the 100 largest private companies in Oslo with lease expirations through 2030. The findings showed that expected demand for green office space is approximately twice the estimated supply over the same period.

Figure 1: Expected Demand for “Green Buildings” in 2024

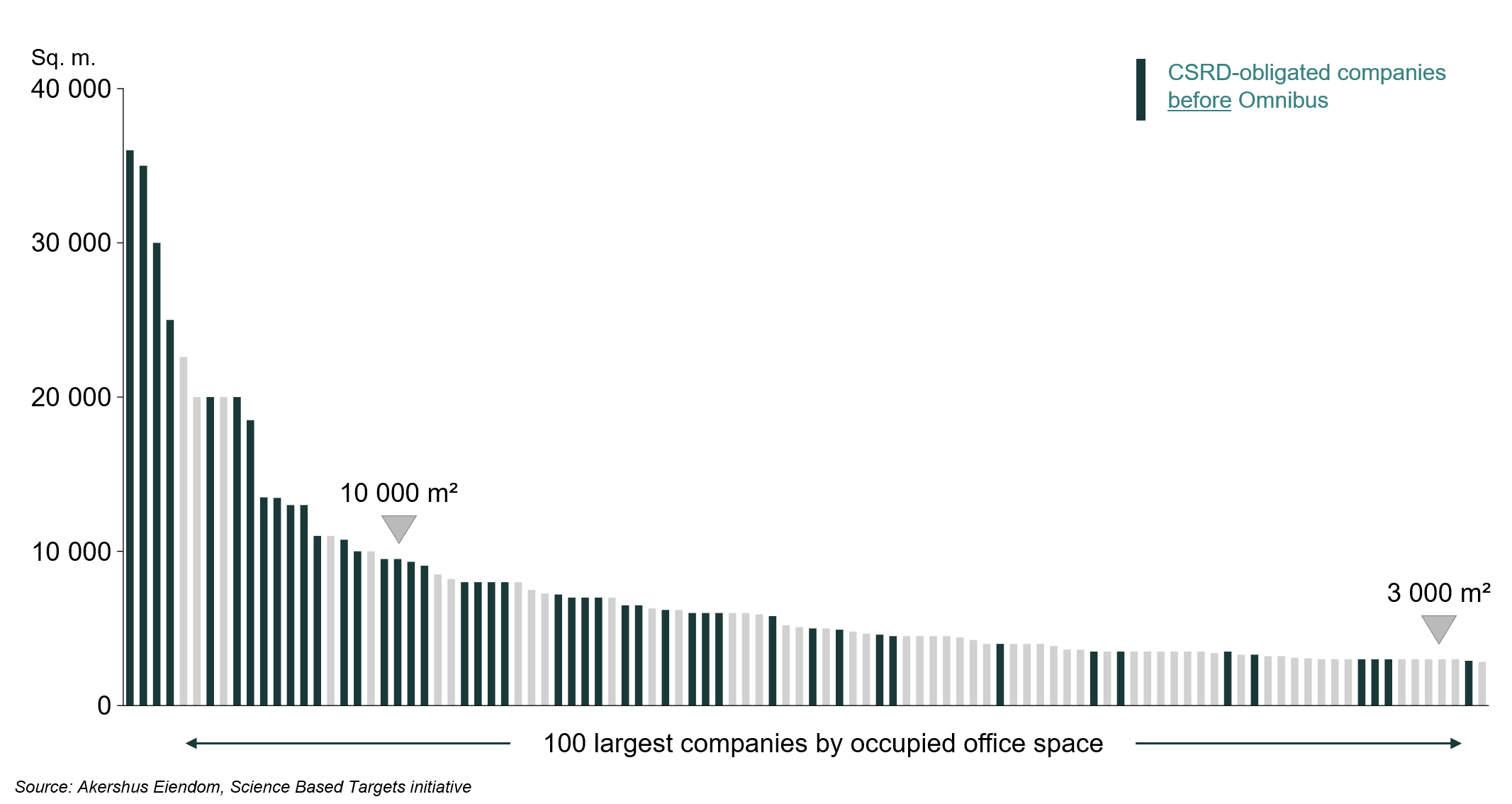

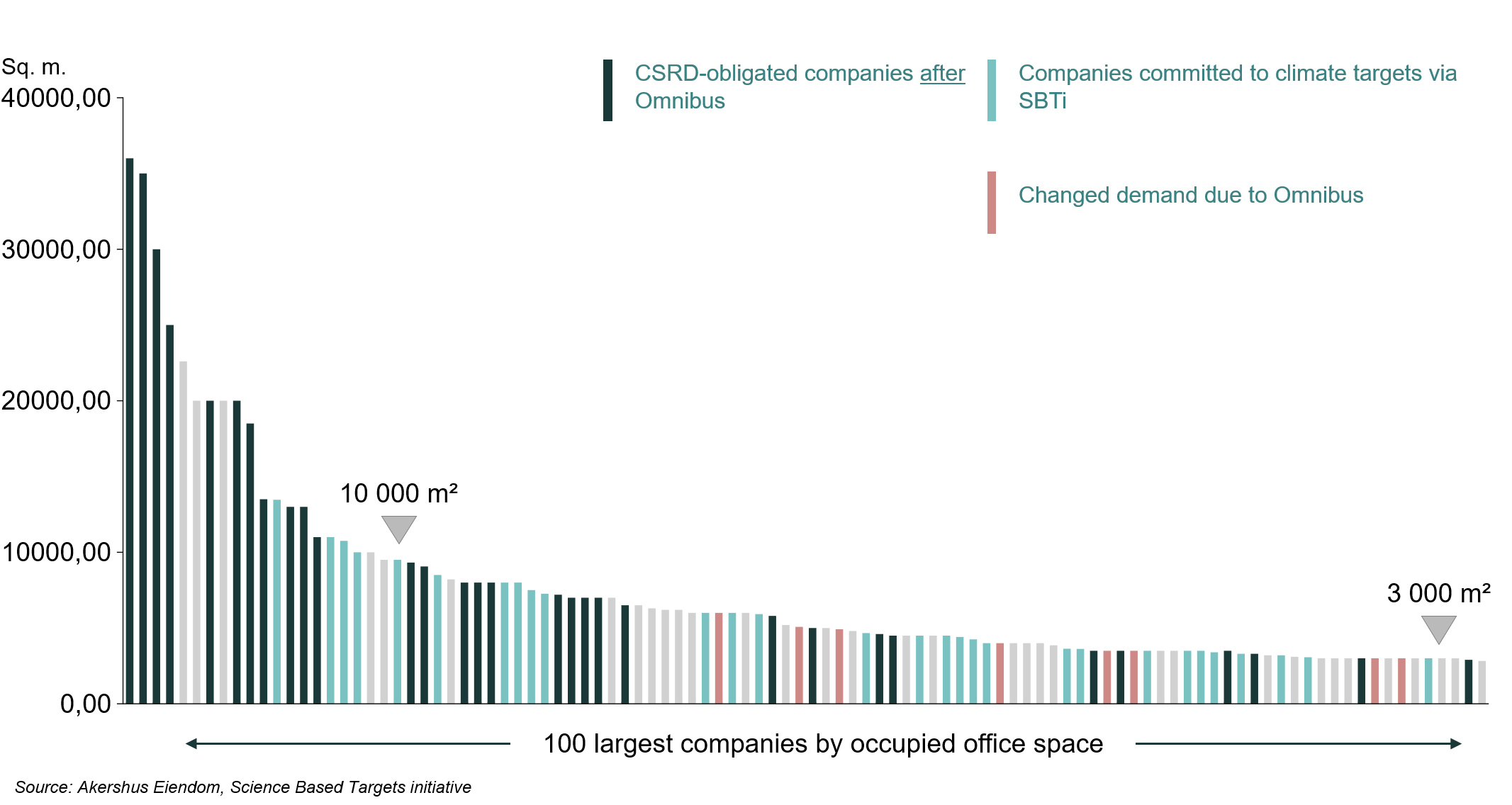

With EU’s Omnibus package as a backdrop, we have revisited this analysis. Prior to Omnibus, 50 of the 100 largest private companies in Oslo, by office space, were expected to fall within the CSRD reporting scope. If the proposal is adopted, that number will most likely drop to 30 companies in the short term.

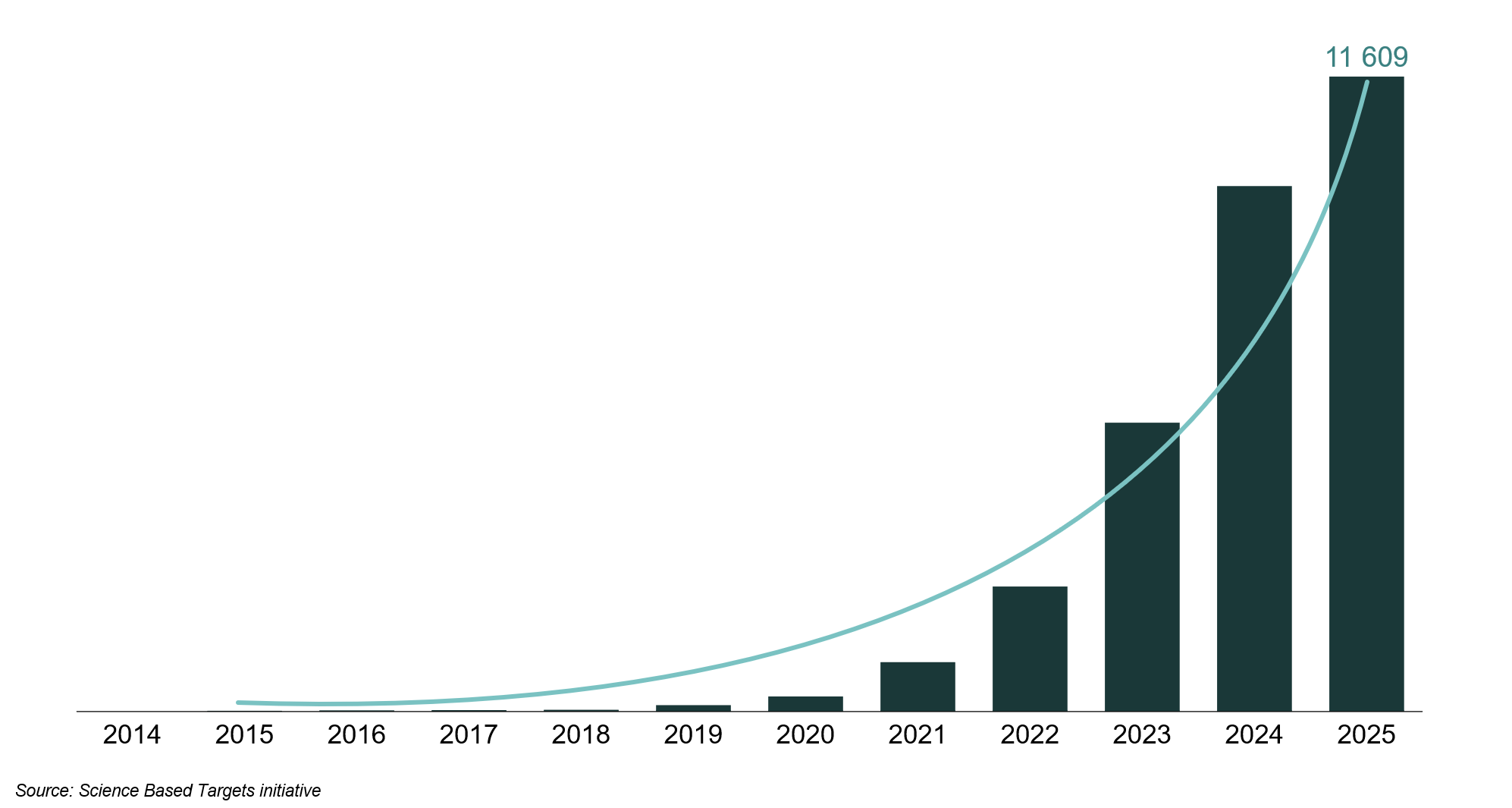

At the same time, we are seeing a pronounced increase in the number of companies voluntarily committing to climate targets through initiatives such as the Science Based Targets initiative (SBTi). Over the past three years, this cohort has grown by nearly 70 percent annually. Today, more than 11,600 companies worldwide have set SBTi targets, of which 5,840 are European, and 151 are Norwegian. Among the Norwegian participants are major corporates like Telenor, Storebrand and BDO, as well as real estate firms such as Braathen Eiendom, Entra and Olav Thon Gruppen.

Many organisations have adopted these targets in anticipation of future ESG reporting obligations. Although the reporting requirement for certain companies may now be postponed and simplified, boards and executive teams have nevertheless gained heightened awareness of, and in some cases committed to, more comprehensive environmental strategies and goals. This is particularly true for concrete, measurable measures such as energy efficiency. On this basis, we expect demand for green office space to remain robust, even if the Omnibus proposal is enacted in its current form.

Figure 2: Cumulative Number of Companies Globally Committing to Sustainability Targets via SBTi

Our data indicate that only eight of the 100 largest companies in our analysis have reduced demand for green office space compared to pre-omnibus data. Compared with last year’s findings, the projected demand for green buildings falls by 10 percent to 1.8 times the possible available supply towards 2030. The reduction is less than we initially anticipated.

Figure 3: 50 of the 100 largest companies by office area in Oslo were slated to report under CSRD before the Omnibus proposal

Figure 4: After Omnibus, 20 fewer companies will be required to report under CSRD, although many of these have voluntarily committed to their own ambitious environmental targets

Twice the Demand When Including Public Sector Tenants

Public sector office tenants, of which most advised by Statsbygg, have indicated they will impose stricter environmental requirements in future procurement. This implies increased demand for green office space from the public sector as well. When including public sector organisations in the analysis, total demand rises by 360 000 m², doubling total demand. In this scenario, expected demand would be 3.5 times the estimated supply over the same period.

Figure 5: Expected Demand for Green Buildings

Conclusion

Despite recent newspaper headlines suggesting that the Omnibus package will completely reverse corporate environmental ambitions, our analysis reveals only limited impact for the Oslo office market. The overarching market dynamic trending toward greener buildings, remains intact.

Omnibus may provide a temporary “breather” for some companies and prompt adjustments to the overambitious targets. However, commercial real estate stands out as a uniquely effective tool: a building’s environmental features deliver quantifiable and cost-saving benefits to tenants, potentially keeping demand for green space up. Which in turn are critical to the sustainability objectives of both property investors and financing institutions.

Read Wiersholm's article here: Market Views, ESG | Wiersholm: The Omnibus Proposal - Simplified Rules for Sustainability Reporting