Market Views, CRE | Strategic opportunities within the existing building stock

High construction costs are likely to continue to limit the supply of new office developments in the coming years. At the same time, demand for high-quality office space remains strong, reinforcing the shortage of prime products. This creates opportunities within the existing building stock, where upgrading outdated office properties may offer attractive alternatives for increasingly demanding tenants with leases approaching expiry in the years ahead.

Summary

- Limited new office development, combined with sustained demand for the highest-quality products, is creating opportunities within the existing building stock for meeting the needs of increasingly demanding tenants.

- Upgrading an office building to a significantly higher standard can generate solid rental premiums across all office submarkets in Oslo. However, in some areas, even a higher rent level will not be sufficient to make a project financially attractive due to low baseline rents.

- Our analysis of the Oslo office market shows that location is the key determinant of project profitability. Refurbishing office buildings in the city centre offers favourable financial conditions, characterised by short payback periods and attractive returns.

Low supply of new office buildings

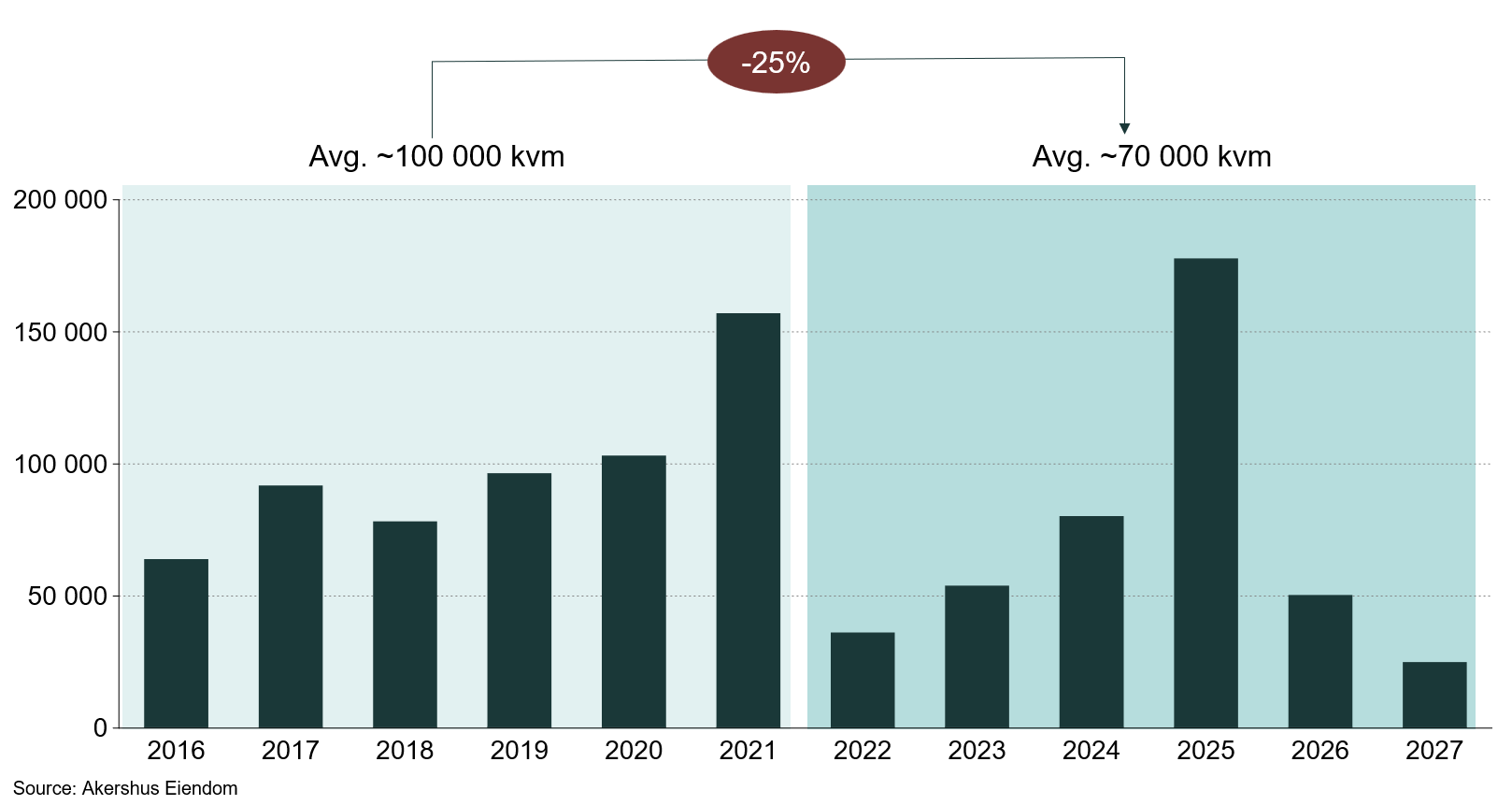

JLL data show that total office construction across Europe peaked in 2020 and has since dropped 24 per cent. A similar trend is evident in Oslo, where the average volume of new office space built between 2022 and 2027 is projected to be 25 per cent lower than in the 2016-2021 period. This is largely driven by elevated construction and financing costs, as discussed in the macro section of this analysis, which continue to weaken the profitability of new-build projects. These cost pressures are likely to persist in the short term, further limiting new office supply in the years ahead.

Figure 1: New office development, Oslo

Top-tier office spaces continue to let well

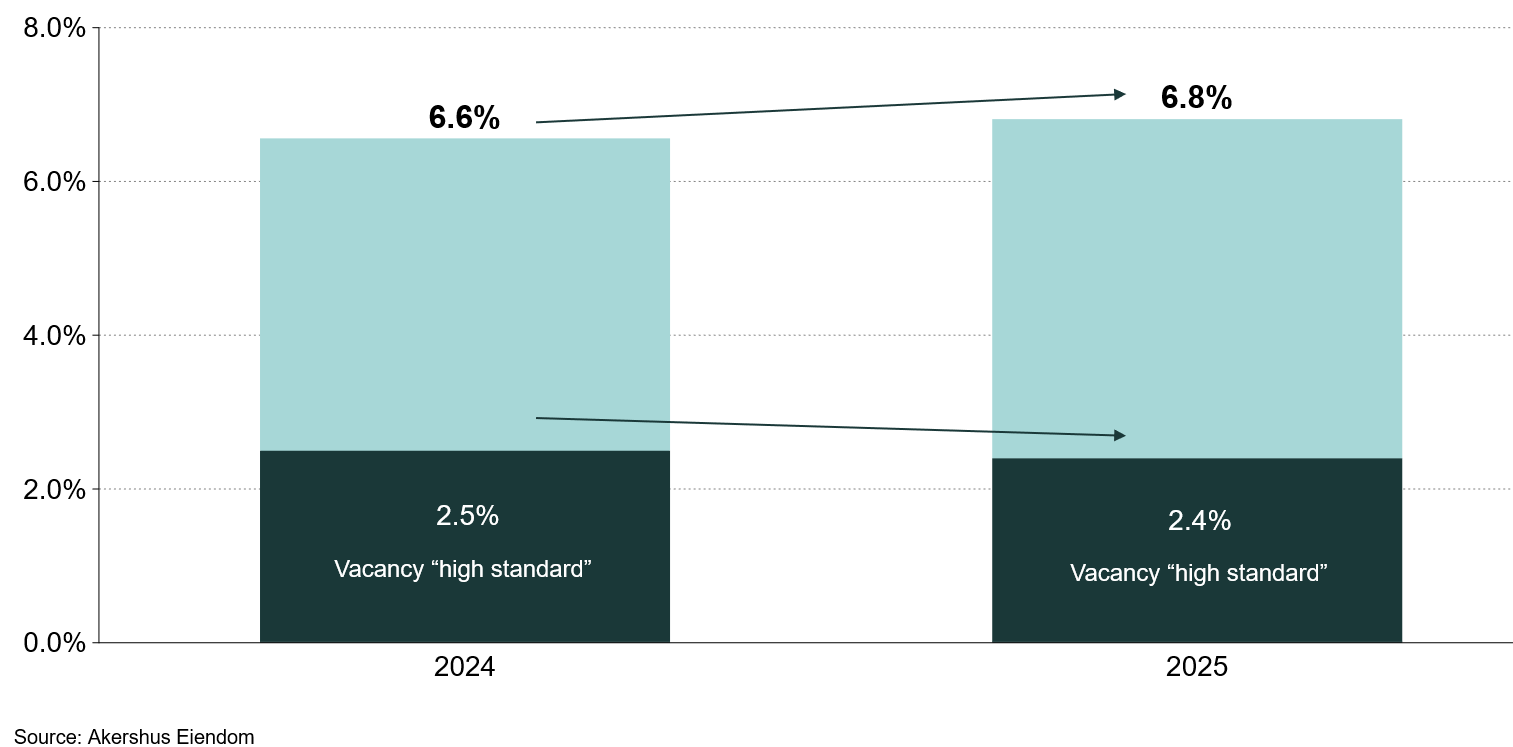

Even though new office supply is limited, demand for top-tier office space remains solid. In recent years, tenants have raised their expectations, with a clear shift towards full-service buildings offering high energy efficiency, which is a trend reflected in today’s office vacancy patterns. While overall office vacancy in Oslo has increased over the past year due to weaker demand, vacancy among space classified as “high standard” has declined over the past 12 months. This indicates that, although aggregate office demand is down, demand for the best products remains robust. Together with elevated cost levels, this has helped keep prime rents stable at high levels, despite weaker take-up and a more generous supply side. In addition, we continue to observe a steady shift towards central location among tenants, a trend we expect to persist going forward.

The same pattern is evident in the transaction market, where we are seeing increasing competition for high-quality assets in processes both globally and in Norway. Investors are becoming more cautious about ending up with vacant office buildings that no longer meet tenant expectations. As a result, modern assets with a strong ESG profile in central locations continue to attract solid investor interest.

Figure 2: Office vacancy, Oslo

Going forward, we expect a polarisation in the office market, with tenants continuing to gravitate towards the highest-quality buildings. Meeting this rising demand for top-tier office space will require new development, and with new-build activity slowing, opportunities are emerging within the existing building stock. Market dynamics suggest that landlords who initiate retrofit projects early can secure a clear first-mover advantage. Competition from new developments remains limited for now, and several large lease expiries are approaching over the coming years. This creates a window in which modernised buildings can capture demand ahead of an expected increase in new supply towards 2030.

Although retrofit costs are significant, many office buildings currently considered “good standard” will need more substantial upgrades to remain competitive. For buildings facing rising vacancy, the timing for such investments may be favourable, as the risks associated with delaying action tend to increase over time. However, as discussed in this analysis, the cost environment also poses challenges for the profitability of many office projects.

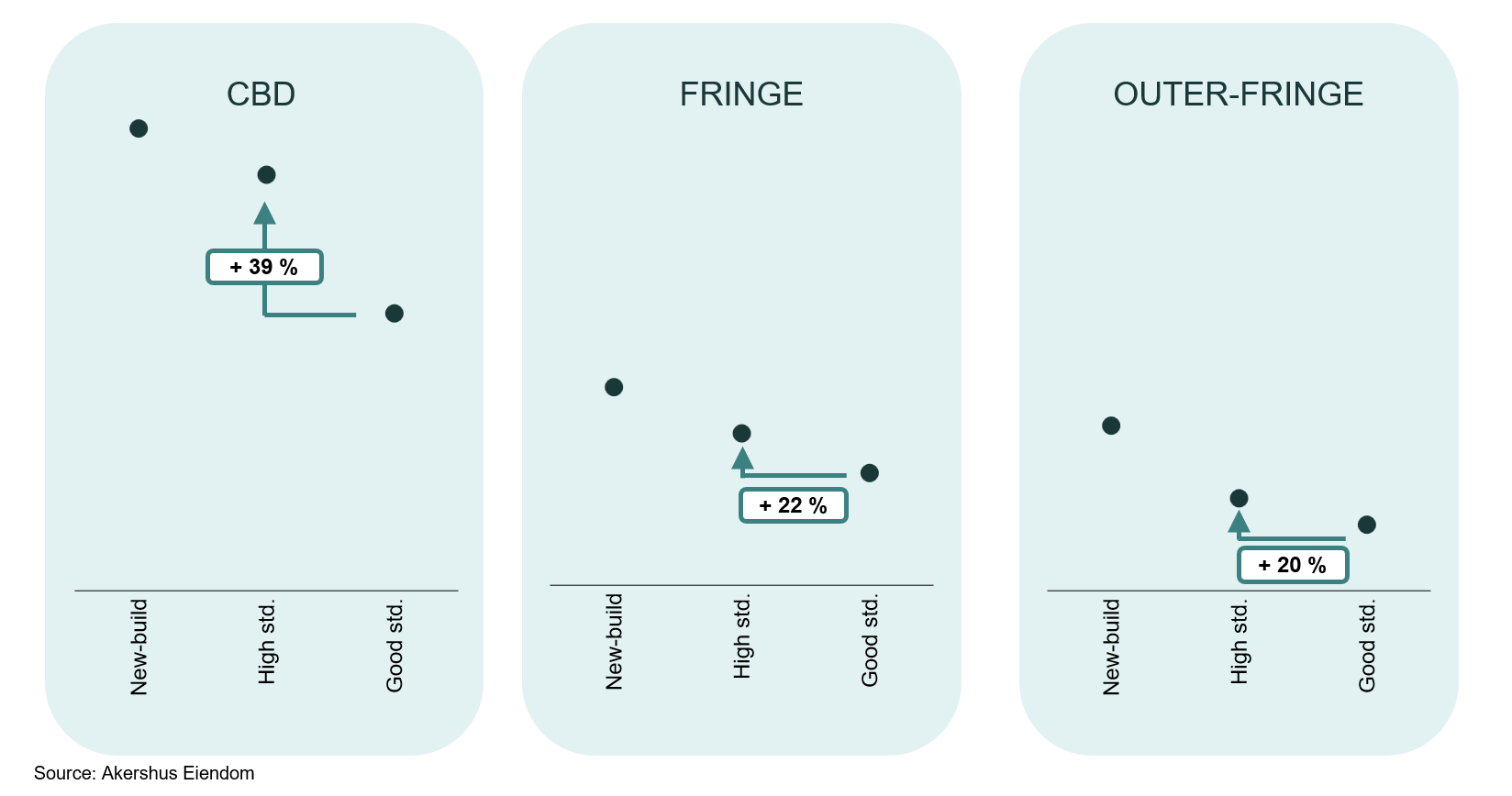

High rental premiums from upgrading

Observasjoner i markedet viser at oppgradering av utdaterte kontorbygg kan gi gårdeier betydelige leiepremier. I denne analysen har vi tatt utgangspunkt i en oppgradering som kreves for å løfte et kontorbygg fra det vi definerer som «god standard» til «høy standard» i ulike kontorområder i Oslo. Det betyr at vi har ekskludert de mest omfattende kontorprosjektene, som krever leiepriser på nivå med nybygg.

The results indicate that such upgrades can unlock solid rental premiums across all office submarkets, including outer fringe areas. However, when considering the payback period, the time required to recover the initial investment, differences are significant, ranging from around 10 years in the most central locations to as much as 50 years in more outer-fringe locations. In other words, location is the key determinant of upgrade profitability. The variation is primarily driven by two factors: the baseline rent levels in each submarket and the magnitude of the achievable rental premium. This underlines why strategic submarket selection and targeted asset picking are crucial to maximising returns from upgrades. In areas where refurbishment of existing office buildings does not appear financially viable, we observe several stakeholders exploring alternative uses, such as residential or data centre conversion.

In recent years, several large refurbishment projects have been initiated to meet the needs of major tenants with increasingly demanding requirements and lease expiries in the coming years. After substantial upgrades, these projects have achieved high, and in many cases entirely new, rent levels for their respective sub-markets. A common feature among these projects is their central location, while there are currently fewer comparable examples in the outer- fringe areas of the city.

Figure 3: Rental premium CBD, fringe and outer-fringe

Strong return outlook in central locations

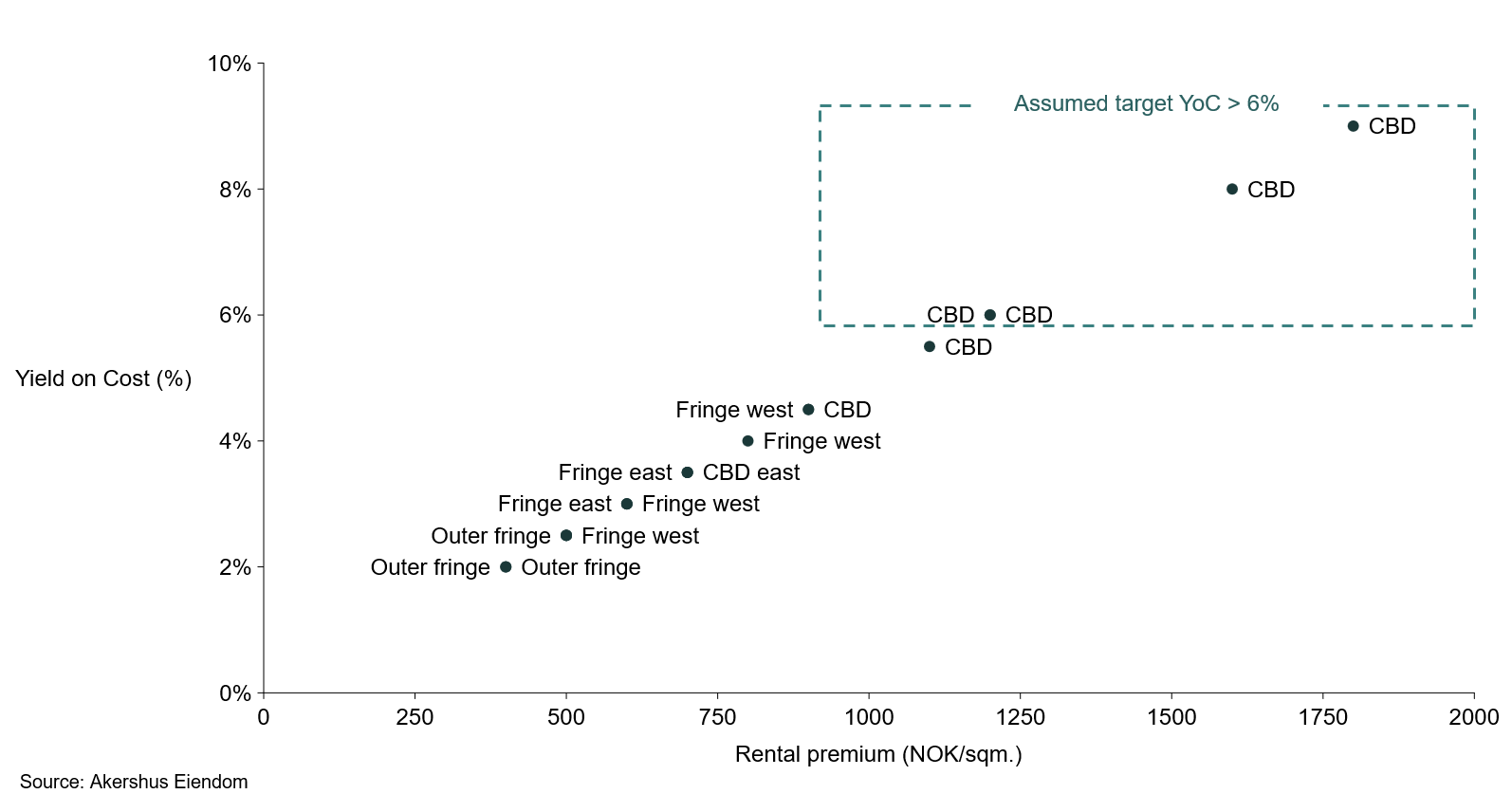

The analysis further shows that the financial return potential varies significantly across submarkets. Several central areas achieve a yield on cost of more than 6 per cent, offering an attractive risk premium and spread relative to a prime yield of around 4.5 per cent. This spread reflects uncertainty related to the construction process, tenant fit-outs and market volatility.

As in other European cities, it is the central areas with the highest rental premiums that offer the strongest financial returns. In Vika–Aker Brygge and Bjørvika, solid demand and already-established high rent levels support stable premium uplifts, and our calculations indicate a yield on cost of around 9 and 8 per cent respectively. This makes the city centre an area with a broad foundation for value creation through office asset upgrades.

In the fringe areas, return potential is generally weaker. Lower nominal rents and a more generous supply side make it more difficult to achieve sufficient rental premiums following an upgrade. In addition, the risk premium for fringe-located assets should sit higher than for central buildings, further reinforcing the differences in return levels between the submarkets.

Figure 4: Rental premium and yield-on-cost, Oslo

The analysis has not, however, accounted for other value drivers associated with an upgrade such as lower operating costs, reduced vacancy risk and increased capital value, which may result in actual financial returns being somewhat higher than indicated by a purely theoretical assessment.

Conclusion

Limited new office development, combined with continued strong demand for the highest-quality products, is creating opportunities within the existing building stock. Upgrading an office asset can unlock significantly higher rents; however, location ultimately determines profitability, with the city centre currently offering the most favourable financial conditions for retrofit projects.

About the analysis

This analysis is based on a comprehensive international study of the office market in selected major European cities conducted by JLL earlier this year. Using JLL’s methodology as a foundation, we have adapted the framework to the local market in Oslo. The analysis is grounded in conservative methodological choices to ensure realistic estimates, while highlighting strategic opportunities for real estate investors in the Norwegian market. We have applied our market rent assumptions for each Oslo submarket and used an upgrade cost level of NOK 20,000 per square metre.