Market Views, Macro | High Costs and Moderate Demand

Elevated construction and financing costs have exerted pressure on profitability in building and refurbishment projects, and these cost challenges are likely to persist in the short term. At the same time, growth in the Norwegian economy is expected to remain moderate over the coming years, which will constrain demand for office space.

Summary

- Although construction costs have reached very high levels, they are expected to continue rising, albeit at a more moderate pace going forward.

- If Norges Bank’s projections hold true, financing costs will also remain elevated, with only one interest rate cut per year over the next three years.

- Meanwhile, only modest growth in the Norwegian economy is likely to keep demand for office space selective in the period ahead, shaping which property projects will be worth pursuing in the coming years.

Construction Costs Continue to Rise

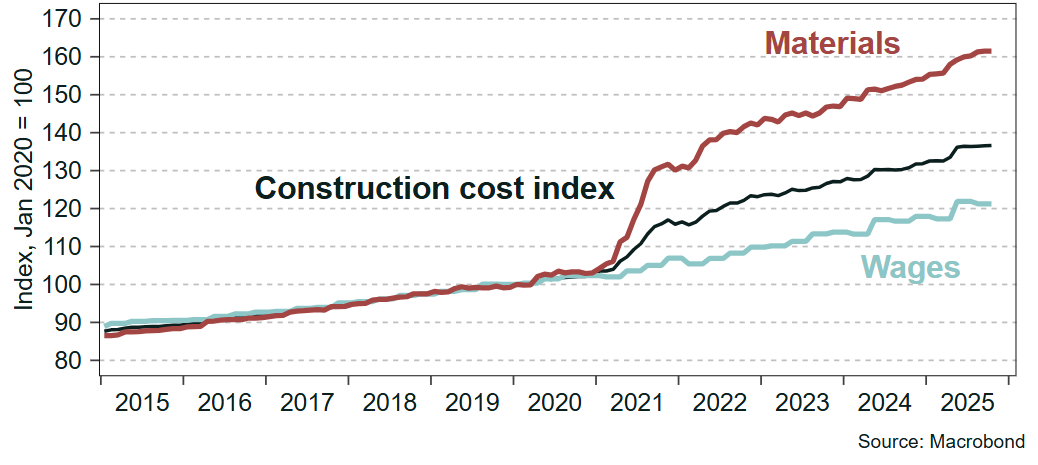

Construction costs have increased significantly and are still climbing. This year, costs have risen by around four per cent, according to Statistics Norway’s construction cost index for apartment blocks.

Figure 1: Construction cost index

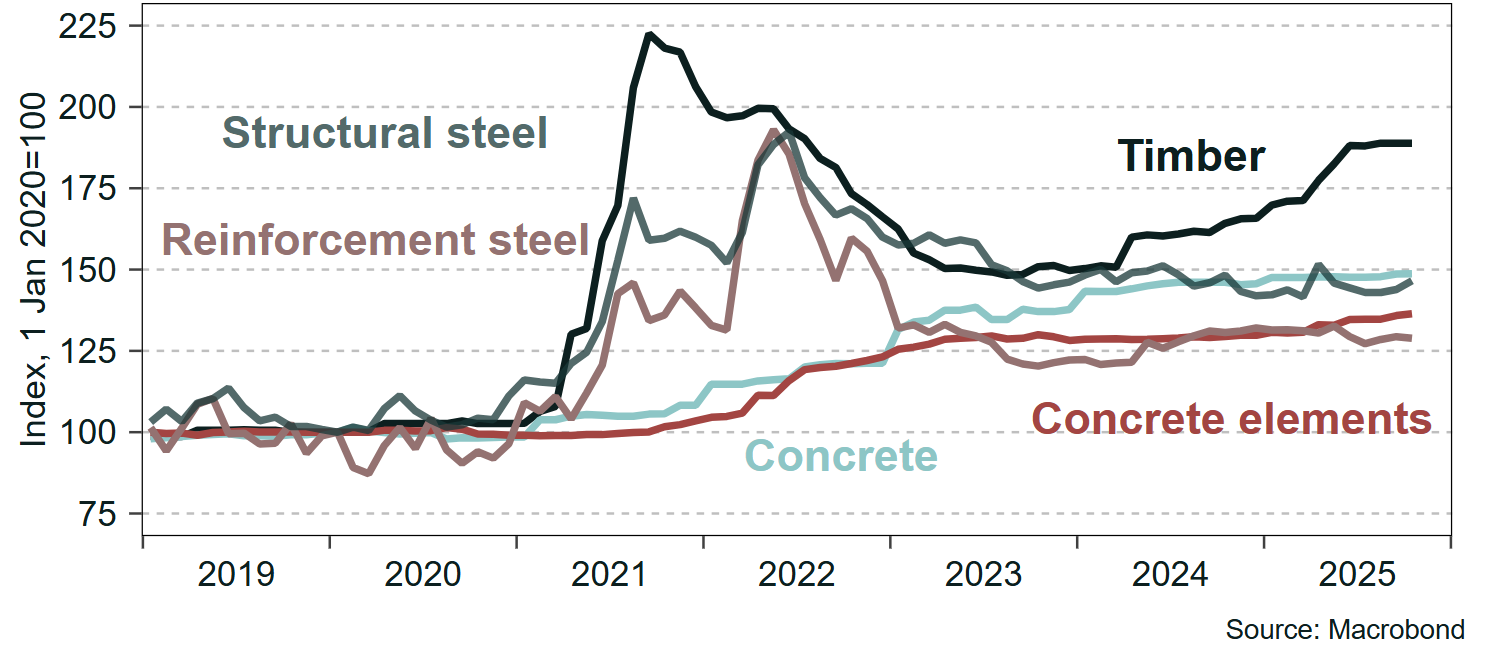

Despite the sharp price surge triggered by war and the pandemic, material costs have continued to rise in recent years. Over the past two years, timber has been the main driver of higher material prices, due to both domestic and global factors. Sanctions against Russia and Belarus have removed large volumes from the market. In addition, bark beetle infestations in North America and Central Europe have further restricted supply. Meanwhile, global demand for timber has remained strong. Combined with a weak Norwegian krone, this has boosted exports of Norwegian timber, resulting in significant upward pressure on raw material costs domestically. Higher transport costs and strong wage growth in the sector have also contributed to rising timber prices. However, since the summer, timber prices have stabilised as supply and demand have become more balanced. Looking ahead, building material chains expect timber prices to develop more moderately. For other material categories, price growth has been relatively modest over the past two years, and as timber price inflation eases, overall material cost growth is likely to return to more normal rates.

Figure 2: Construction cost index, materials

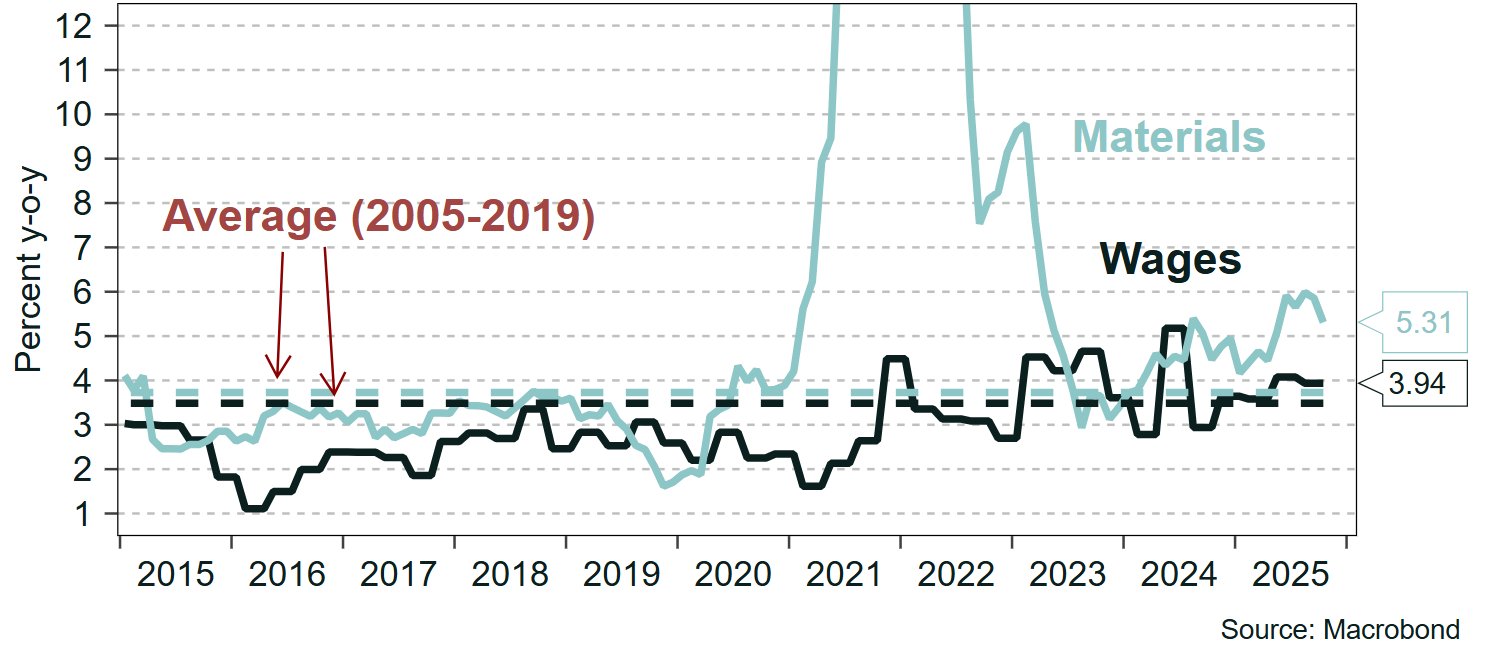

Despite low activity in the construction industry, wage growth in this sector has been pushed up over the past two years by strong settlements in Norwegian manufacturing, due to the wage-setting system in Norway. Recently, however, wage growth in construction has moderated somewhat, according to Statistics Norway. For next year and beyond, both Norges Bank and the social partners expect wage growth in the Norwegian economy to slow and approach more normal levels. We therefore anticipate a continued deceleration in wage growth within construction.

Figure 3: Growth in building costs

Although construction costs have risen sharply, they are not expected to decline in the near term. However, there are prospects for slower growth going forward.

Persistently High Financing Costs

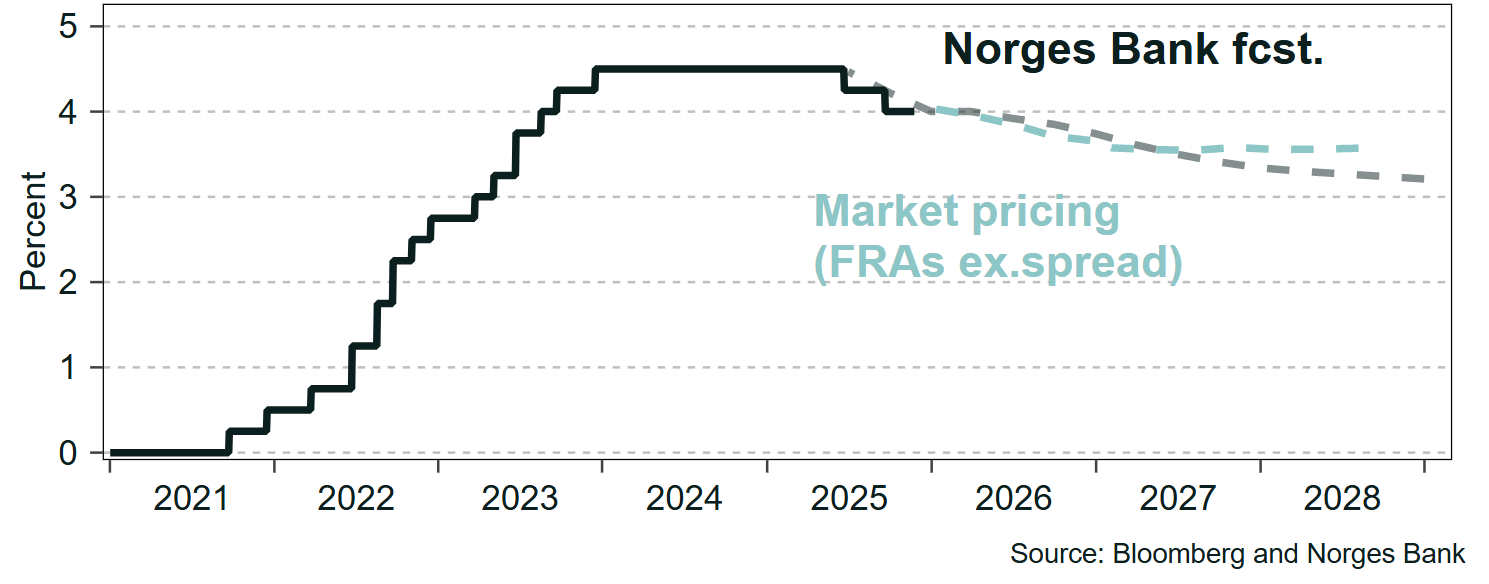

In addition to rising construction costs, interest rates are expected to remain high for some time, at least if Norges Bank’s projections are correct. The central bank’s September forecast suggests that the policy rate will be cut only once per year over the next three years. This outlook is based on limited downside risk to Norwegian economic growth, with both employment and GDP expected to expand at a moderate pace in the coming years. Market pricing reflects a high probability that Norges Bank’s rate path will materialise. If anything, market expectations point to slightly less easing than the central bank anticipates. Consequently, financing costs are likely to remain elevated in the near term.

Figure 4: Policy rate expectations

- Norges Bank vs. market pricing (FRA)

Moderate Growth in the Norwegian Economy

GDP growth has picked up somewhat this year but is expected to slow ahead due to weaker international demand and reduced activity on the Norwegian continental shelf. Nationwide, employment growth has remained robust so far, but there are significant differences across sectors and regions. Economic activity has been particularly strong in Western Norway, while growth has been weaker in Eastern Norway. In the Oslo region, employment has stagnated over the past year.

In the Greater Oslo office market, we have observed an increasing focus on cost control among companies. Tenants have become more cautious in their demand for office space and more selective regarding the type of premises they choose. A continued high-cost environment and only moderate economic growth will likely mean that companies remain somewhat reserved in the period ahead.

Conclusion

Further increases in construction costs and persistently high financing costs are expected to continue putting pressure on project profitability. At the same time, moderate growth in the Norwegian economy will likely keep demand for office space selective. Taken together, these factors will shape which property projects are worth pursuing in the coming years - a topic we explore further in the real estate section of this analysis.

Read the corporate real estate section of the analysis here: Market Views, CRE | Strategic opportunities within… | Akershus Eiendom