Market Views, CRE | Outlook for 2026 - What will drive the leasing market going forward?

A weaker labour market and increased uncertainty about the future are expected to continue shaping the office leasing market. In an increasingly unpredictable environment, we see both landlords and occupiers reassessing their approach to office space. Against this backdrop, we have identified five key drivers that we expect will shape the office market in 2026.

Current market conditions

Activity in the office leasing market has slowed over the past two years. A high degree of uncertainty related to the economy and AI has made occupiers more cautious in their office decisions, resulting in a reduction in overall space requirements. This has contributed to rising office vacancy. At the start of 2026, our data shows total office vacancy at 6.8 per cent, up from 6.0 per cent at the beginning of 2024.

Despite this, headline rents have remained stable at elevated levels over the past year, while the most attractive products, new developments or comprehensively refurbished buildings, have in fact experienced upward rental pressure. This is largely explained by the fact that rental levels have increasingly become cost-driven.

Looking ahead, we expect uncertainty surrounding economic growth and employment, as outlined in the macro analysis , to continue influencing the Oslo office market. In a more unpredictable environment, both landlords and occupiers are adjusting their approach to office space. In this context, shifting priorities among both landlords and occupiers are expected to define leasing dynamics in 2026.

1: Cost focus

The most evident driver today is an increased focus on costs. This is driven by a sharp rise in construction and fit-out costs, high financing costs and greater uncertainty about the future. Similar trends are observed globally. According to a recently published global analysis by JLL, as many as 72 per cent of industry leaders state that cost reduction is their top priority going forward. In the short term, cost levels are expected to remain elevated, and we anticipate that cost focus will continue to characterise the real estate market in 2026.

We observe that landlords are currently less willing to undertake capital-intensive investments unless they are strictly necessary and instead prioritise maintenance measures that contribute to cost reduction. Our latest ESG-analysis confirms that reducing operating costs is now the single most important driver for green investments among investors in the Norwegian market.

Occupiers are increasingly demanding, seeking high-quality offices in attractive locations while at the same time aiming to keep costs under control. Choosing modern office buildings with a strong ESG profile can be justified by lower service charges compared to older, less efficient buildings. In addition, we observe increased space efficiency, partly as a means of supporting higher rent levels per square metre.

2: Efficiency

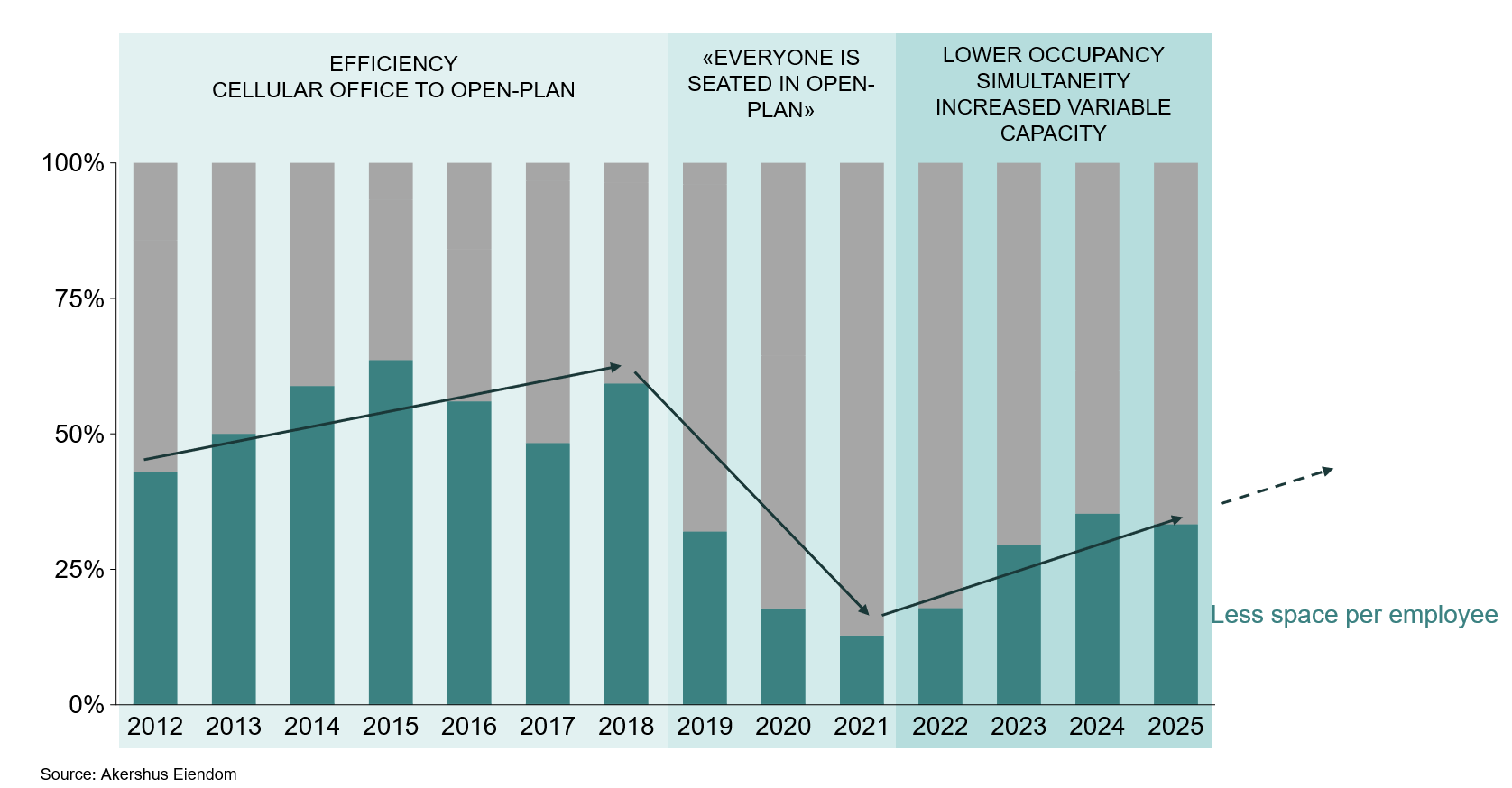

This is confirmed by our annual space requirement survey, which shows that an increasing number of companies are reducing space per employee, driven by cost focus and changing working patterns. Up until 2018, development was largely characterised by the transition from cellular offices to open-plan layouts, enabling more efficient use of space. As this transition has largely been completed, further efficiency gains are increasingly achieved through higher levels of variable capacity. Our experience from recently signed leases indicates that many occupiers now assume a simultaneity rate of approximately 70 per cent. This implies that companies plan for fewer workstations than total headcount. Solutions such as free seating and activity-based workplace concepts are increasingly adopted to better align office space with actual use.

Figure 1: Space requirement survey, Akershus Eiendom

Reduced total space allows occupiers to select more efficient buildings and better locations within a lower overall occupancy cost. At the same time, free seating and activity-based workplace concepts provide greater flexibility in space utilisation, enabling changes in headcount to be absorbed without the need for adjustments to the leased area. Looking ahead, we expect increased use of technology and AI to further enhance this flexibility, including through more efficient utilisation and management of office space.

3: Flexibility

Increased uncertainty surrounding future staffing levels has made flexibility an increasingly important element of lease structures. Occupiers are showing growing demand for flexibility in both lease term and space size. This includes the ability to adjust space requirements over time and to limit long-term commitments in a more unpredictable market environment.

According to JLL, workforce forecasting is becoming increasingly challenging, partly due to AI-driven changes in job roles and more volatile project cycles. This heightens the need for more elastic portfolio strategies, where both physical space and operational capacity can be adjusted on an ongoing basis. In such a market, flexibility in lease structures becomes a key prerequisite for managing uncertainty, while also helping to reduce the need for subletting and supporting a more balanced leasing market.

4: AI

The development of AI is progressing at an unprecedented pace, and over the past year much of the discussion has focused on its implications for employment and future office demand. There has been less emphasis on the role AI can play in improving efficiency and optimising the real estate sector. We expect AI to have a significant impact on the commercial real estate market throughout 2026 and beyond.

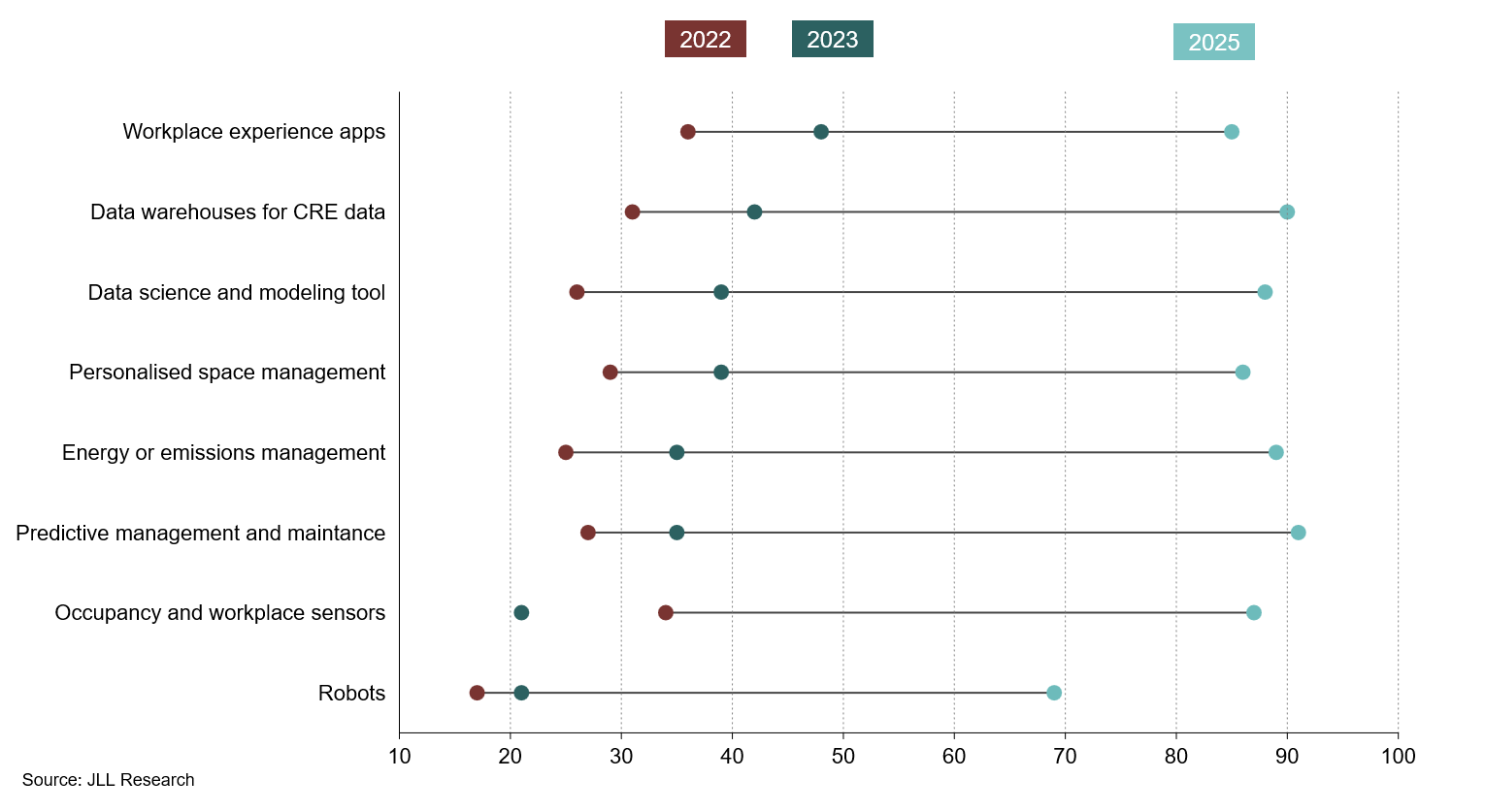

According to a recent analysis by JLL, interest in AI within the real estate sector has accelerated rapidly, with most industry participants now adopting various AI tools. Technologies related to workplace optimisation now show adoption rates above 80 per cent, including tools for predictive control and maintenance, data management, and platforms for energy and emissions management. This indicates that operational efficiency, including cost reduction, currently represents the primary focus of AI investment.

Figure 2: Adoption rates of AI tools, JLL Research

5: Location

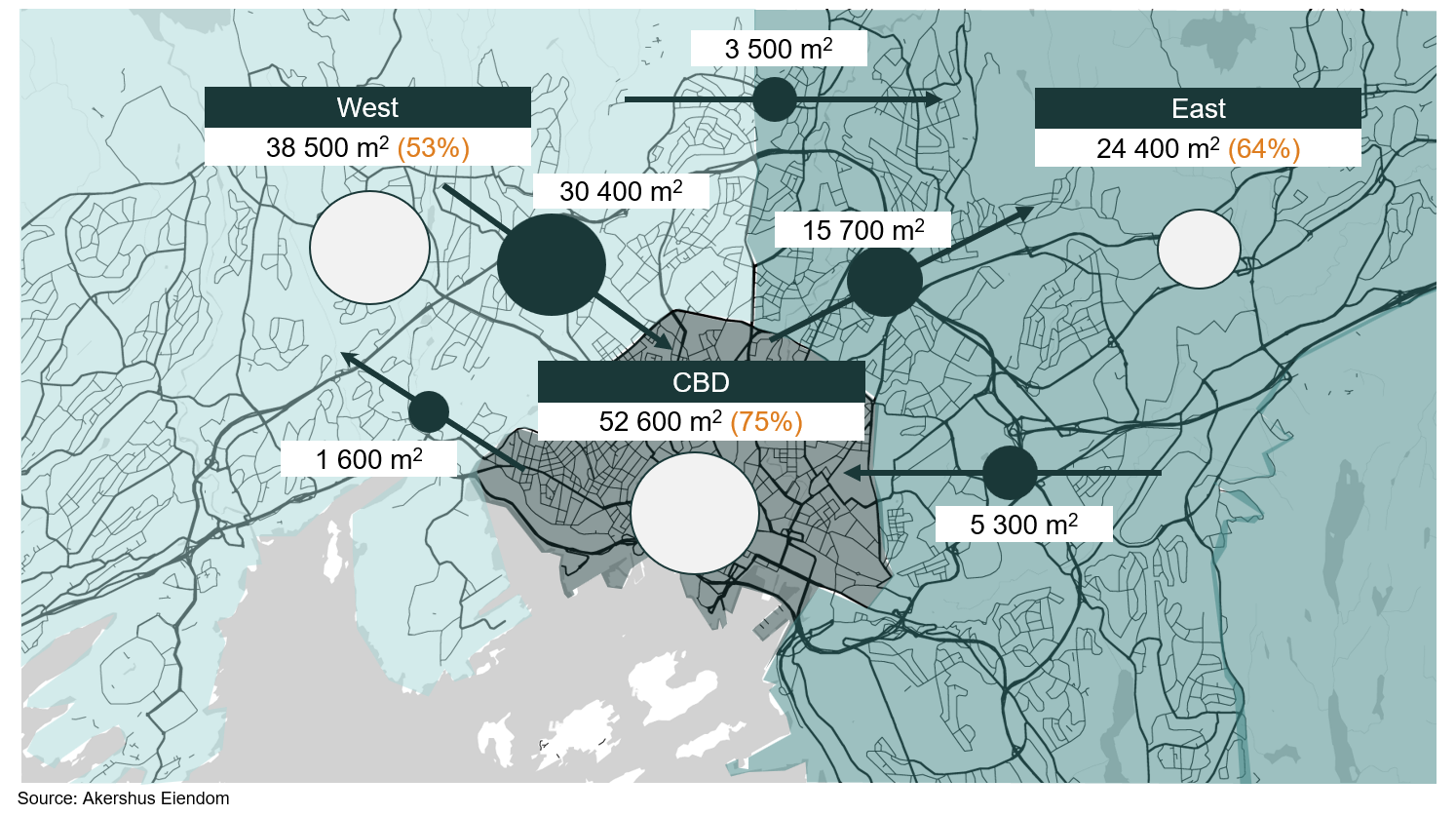

Location remains a key decision factor for occupiers, and our annual relocation pattern analysis shows that pressure towards the city centre persists. Approximately 75 per cent of companies relocating from existing premises in the city centre choose new premises that are also centrally located. This is significantly higher than what we observe in peripheral locations. The share of internal relocations within Oslo city centre is, however, slightly lower this year than in previous years, which can largely be explained by the relocation of government occupiers in 2025 due to location policies and cost considerations.

Over time, relocation patterns show that the city centre continues to attract a substantial share of inbound relocations. Sustained demand for central locations is largely explained by accessibility and employee preferences. International research from JLL shows that work-life balance is in fact prioritised above salary. Our experience further indicates that central locations contribute to higher levels of physical office attendance, helping to explain why many companies continue to prioritise the city centre when relocating. This can, however, pose challenges for companies moving from peripheral locations into the city centre, particularly where total leased area has been reduced as part of the relocation.

Figure 3: Relocation pattern analysis based on leases signed in 2025 (excluding renegotiations)